Advertisement|Remove ads.

CLARITY Act Draft Curbs Stablecoin Yield, Giving Banks A Potential Edge

- CLARITY draft limits stablecoin “passive yield,” allowing rewards only for specific user actions.

- Multiple draft versions are circulating, and Democrats are pushing to delay markup for more review time.

- Markets are watching closely: Polymarket odds imply strong passage chances, and analysts say it could shape crypto sentiment.

The revised version of the Digital Asset Market Clarity Act (CLARITY) could offer banks a competitive edge and alter the status of altcoins, as lawmakers move to restrict how stablecoin issuers can offer yield.

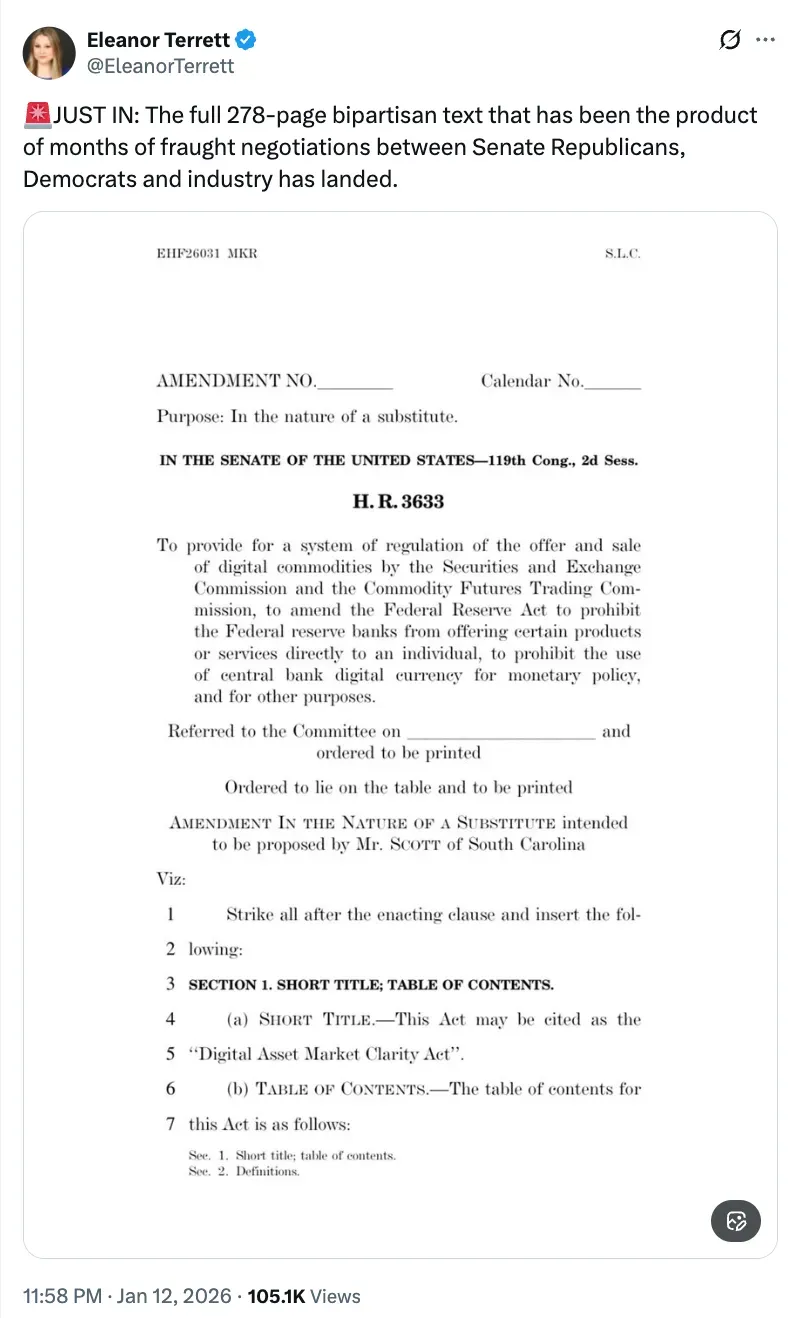

Eleanor Terrett revealed on X that, according to an excerpt circulated on Monday, lawmakers added language that narrows how stablecoin issuers can offer yield. The latest 278-page bipartisan draft includes language that would bar companies from paying interest simply for holding stablecoin balances.

Terrett said the text allows rewards only when they are tied to specific actions, such as opening an account, making transactions, staking, providing liquidity, posting collateral, or participating in network governance. The clause addresses how stablecoin issuers may structure rewards, including limits on paying yield solely for holding balances.

Stablecoin Yield Provisions Emerge As Flashpoint

She also said that an incomplete draft of the Senate Banking Committee’s market structure bill circulated ahead of the expected official release and omitted the stablecoin yield section. She added that the circulating version included ethics provisions and Section 601 language to protect software developers, which she described as a DeFi-TradFi compromise.

If the U.S. Senate Banking Committee approves the changes to the cryptocurrency market structure bill that affect how exchanges can provide rewards for dollar-pegged stablecoins, Coinbase (COIN) might decide to stop supporting that bill, sources within Coinbase said on Monday. These provisions, which have already been discussed in Congress, appear to include restrictions on the types of rewards and yields that can be offered to individuals holding cryptocurrency assets, such as USD Coin (USDC).

Coinbase (COIN) closed at $242.98 on Monday. In after-market trading hours, COIN was down 0.09%. On Stocktwits, retail sentiment around Coinbase dropped from ‘neutral’ to ‘bearish’ territory, as chatter remained at ‘high’ levels over the day.

Clarity Act Full Hearing On The Way

In a separate X post, Terrett said that the updated draft surfaced as Democratic senators on the Senate Banking Committee urged leadership to hold a full hearing before the scheduled markup in late January. Thus, arguing that the lawmakers were given too little time to review the bill’s text.

Analyst Ryan Rasmussen pointed to Polymarket pricing that implies traders see strong odds the bill is signed into law this year, with stablecoins and DeFi among the key sticking points. As lawmakers debate the timeline and final language, the stablecoin yield section is emerging as one of the clearest pressure points between bank and crypto-native issuers.

For updates and corrections, email newsroom[at]stocktwits[dot]com.

/filters:format(webp)https://news.stocktwits-cdn.com/large_Getty_Images_2230137825_jpg_d14459f501.webp)

/filters:format(webp)https://st-everywhere-cms-prod.s3.us-east-1.amazonaws.com/IMG_9209_1_d9c1acde92.jpeg)

/filters:format(webp)https://news.stocktwits-cdn.com/large_tom_lee_OG_2_jpg_9ae5c049c3.webp)

/filters:format(webp)https://st-everywhere-cms-prod.s3.us-east-1.amazonaws.com/Prabhjote_DP_67623a9828.jpg)

/filters:format(webp)https://news.stocktwits-cdn.com/large_Getty_Images_2213364715_jpg_59427544e3.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/IMG_4530_jpeg_a09abb56e6.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_Getty_Images_2213364581_jpg_86d1ff954e.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/IMG_8805_JPG_6768aaedc3.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_Data_center_jpg_5f0fa8e828.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_bitcoin_OG_oct23_jpg_588046d0a9.webp)