Advertisement|Remove ads.

Coinbase CEO Brian Armstrong Calls Current Crypto Slump The ‘Best Time To Get Ahead’

- Tamaino noted that crypto venture funds raised $36 billion in 2022 during the “crypto winter” that followed the FTX collapse and Terra-Luna implosion.

- According to him, the markets are facing a similar slump right now, with precious metals outpeforming Bitcoin and well-funded projects being forced to wind down.

- He stated that the environment is currently ideal for building new crypto products.

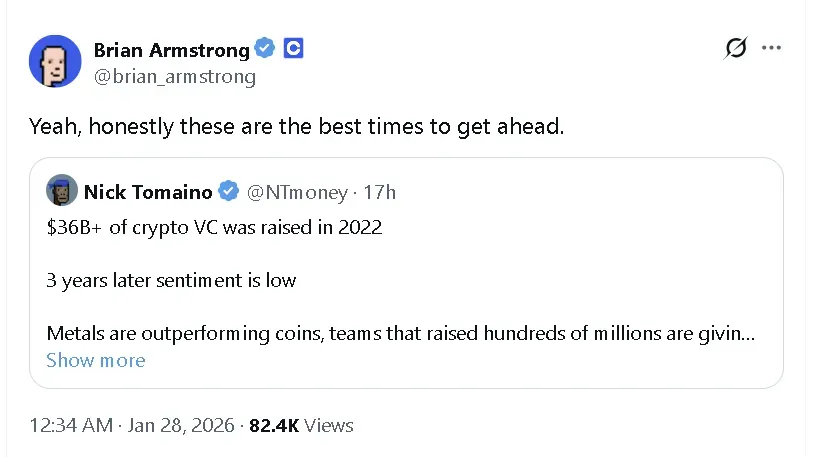

Coinbase (COIN) CEO Brian Armstrong said on Wednesday that crypto market slumps, like the current stagnation, are the “best times to get ahead,” with Bitcoin (BTC) struggling to get back above the $90,000 mark this week.

Armstrong was responding to a post from 1confirmation founder Nick Tomaino, who stated that the current pessimism in the crypto market is akin to periods before major innovation cycles. “Can’t think of a better time to build and invest if you believe in something,” wrote Tomaino.

Bitcoin’s price rose 1.2% in the last 24 hours to around $88,800, recuperating from a dip to $86,000 over the weekend. On Stocktwits, retail sentiment around the apex cryptocurrency fell to ‘extremely bearish’ from ‘bearish’ territory over the past day.

Meanwhile, COIN’s stock rose 0.59% in pre-market trade on Wednesday, with retail sentiment on Stocktwits in the ‘bullish’ zone, amid ‘high’ levels of chatter. This comes after Baird initiated coverage on Coinbase with a ‘Neutral’ rating and a price target of $240, as per the TheFly.

Crypto Sentiment At 2022 Lows

Tomaino pointed out that more than $36 billion was raised by crypto venture funds in 2022 when the market was in a so-called “crypto winter”. Bitcoin’s price peaked in November 2021, followed by a nearly 75% crash to $16,000 by late 2022 amid the FTX collapse and Terra-Luna implosion.

According to Tomaino, the crypto market is in a similar position in 2026 – investor sentiment has weakened in a similar fashion, and several well-funded teams have been forced to buck out of the race. He added that decentralized finance (DeFi) and non-fungible tokens (NFTs) have largely failed to deliver mainstream adoption at scale, while prediction markets such as Polymarket stand out as one of the few crypto-native applications to gain broader traction.

Tomaino was an early Coinbase user and employee after buying Bitcoin in 2012, when purchasing the asset required cash transfers and unregulated exchanges. The friction convinced him a simple, bank-linked platform would win, leading him to become one of Coinbase’s first hundred users after Armstrong launched the service.

For updates and corrections, email newsroom[at]stocktwits[dot]com.

/filters:format(webp)https://news.stocktwits-cdn.com/large_Getty_Images_2219715394_jpg_c787a7b591.webp)

/filters:format(webp)https://st-everywhere-cms-prod.s3.us-east-1.amazonaws.com/IMG_9209_1_d9c1acde92.jpeg)

/filters:format(webp)https://news.stocktwits-cdn.com/large_martin_shkreli_jpg_4da92d4843.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/IMG_8805_JPG_6768aaedc3.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_Getty_Images_2263898051_jpg_9e75888009.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_Getty_Images_2241292402_jpg_9661b0c852.webp)

/filters:format(webp)https://st-everywhere-cms-prod.s3.us-east-1.amazonaws.com/unnamed_jpg_9dff551b50.webp)

/filters:format(webp)https://st-everywhere-cms-prod.s3.us-east-1.amazonaws.com/large_stock_rising_resized_f17852d7aa.jpg)

/filters:format(webp)https://st-everywhere-cms-prod.s3.us-east-1.amazonaws.com/large_adam_smigielski_K5m_Pt_O_Nmp_HM_unsplash_f365ee93f4.jpg)

/filters:format(webp)https://news.stocktwits-cdn.com/jaiveer_jpg_280ad67f36.webp)