Advertisement|Remove ads.

Ethena Token’s Reported $100M Raise Fails To Lift ENA Token Amid Crypto Market Decline – Retail Remains Bearish

Ethena’s (ENA) token price fell more than 10% on Monday amid a broader cryptocurrency market decline, despite a Bloomberg report that the blockchain project secured $100 million in funding to develop a new token for traditional financial institutions.

According to Bloomberg, the fundraising round, completed in December, attracted major investors, including Franklin Templeton and F-Prime Capital, the venture capital arm affiliated with Fidelity Investments.

The report, citing sources familiar with the deal, said a foundation supporting Ethena sold ENA tokens at an average price of just under $0.40 each.

Ethena’s ENA token had surged to around $1.30 in mid-December but has since lost nearly 70% of its value, according to CoinGecko data.

The Ethena platform operates two cryptocurrencies. Their native token, ENA, is a governance token granting holders voting rights, and the other token, USDe, is a “synthetic dollar” currently offering a 9% yield.

In a January blog post, Ethena Labs founder Guy Young announced plans to introduce a third token, the iUSDe, designed for institutional investors.

The new cryptocurrency will include transfer restrictions to comply with traditional financial regulations, allowing firms to gain exposure without direct involvement in crypto markets.

Ethena’s primary focus for the first quarter is to integrate iUSDe with financial distribution partners, Young said at the time.

The launch comes as former U.S. President Donald Trump signed an executive order in January to support the U.S. dollar, including measures to promote the growth of regulated stablecoins.

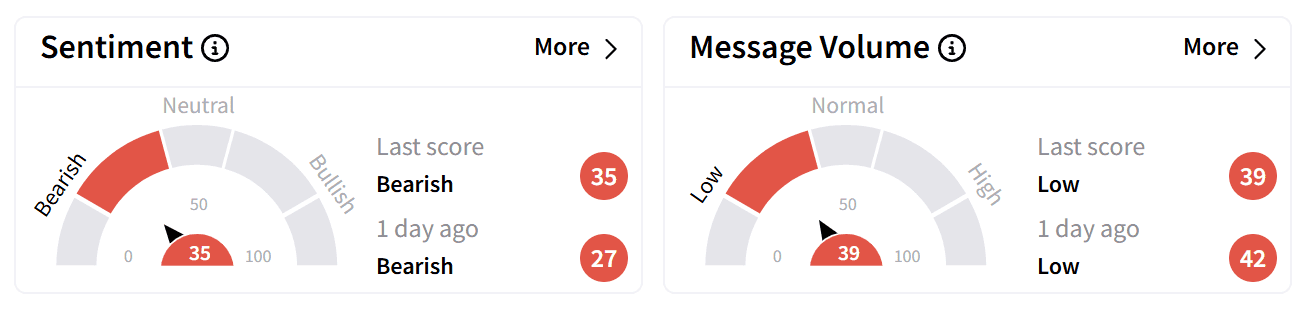

On Stocktwits, retail sentiment around the ENA token edged higher but remained in ‘bearish’ territory.’

Some users speculated that ENA could soon break above the $0.50 mark, while others suggested a potential connection between Ethena and America’s $500 billion AI infrastructure project, Stargate, announced by Trump earlier this year.

Beyond securing institutional backing, Ethena has also established political ties. In December, World Liberty Financial – a crypto project promoted by Trump and his sons – announced a strategic partnership with Ethena Labs.

Ethena Labs declined to comment on the token sale. However, major crypto-focused venture capital firms, including Dragonfly Capital Partners, Polychain Capital LP, and Pantera Capital Management LP, also participated in the funding round, according to Bloomberg’s report.

For updates and corrections, email newsroom[at]stocktwits[dot]com.

Read also: DOGE, SHIB, PEPE Drop As Solana-Lazarus Links Fuel Meme Coin Sell-Off, Dampening Retail Hype

/filters:format(webp)https://news.stocktwits-cdn.com/large_Nebius_jpg_291bb409c7.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/Aashika_Suresh_Profile_Picture_jpg_2acd6f446c.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_Getty_Images_2202349941_jpg_3f45878d03.webp)

/filters:format(webp)https://st-everywhere-cms-prod.s3.us-east-1.amazonaws.com/unnamed_jpg_9dff551b50.webp)

/filters:format(webp)https://st-everywhere-cms-prod.s3.us-east-1.amazonaws.com/large_marathon_holdings_resized_40790d98cc.jpg)

/filters:format(webp)https://news.stocktwits-cdn.com/jaiveer_jpg_280ad67f36.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_trump_jpg_fc59d30bbe.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_nio_es8_jpg_6097d170b7.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_Getty_Images_76024286_jpg_1a0537b0fc.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/shivani_photo_jpg_dd6e01afa4.webp)