Advertisement|Remove ads.

Gemini XRP Mastercard Launch Pushes Exchange App Past Robinhood, Coinbase – Tyler Winklevoss Says ‘The Flippening Is Accelerating’

The launch of the Gemini XRP Mastercard has pushed the Gemini app ahead of Robinhood (HOOD) and Coinbase (COIN) in Apple’s App Store rankings.

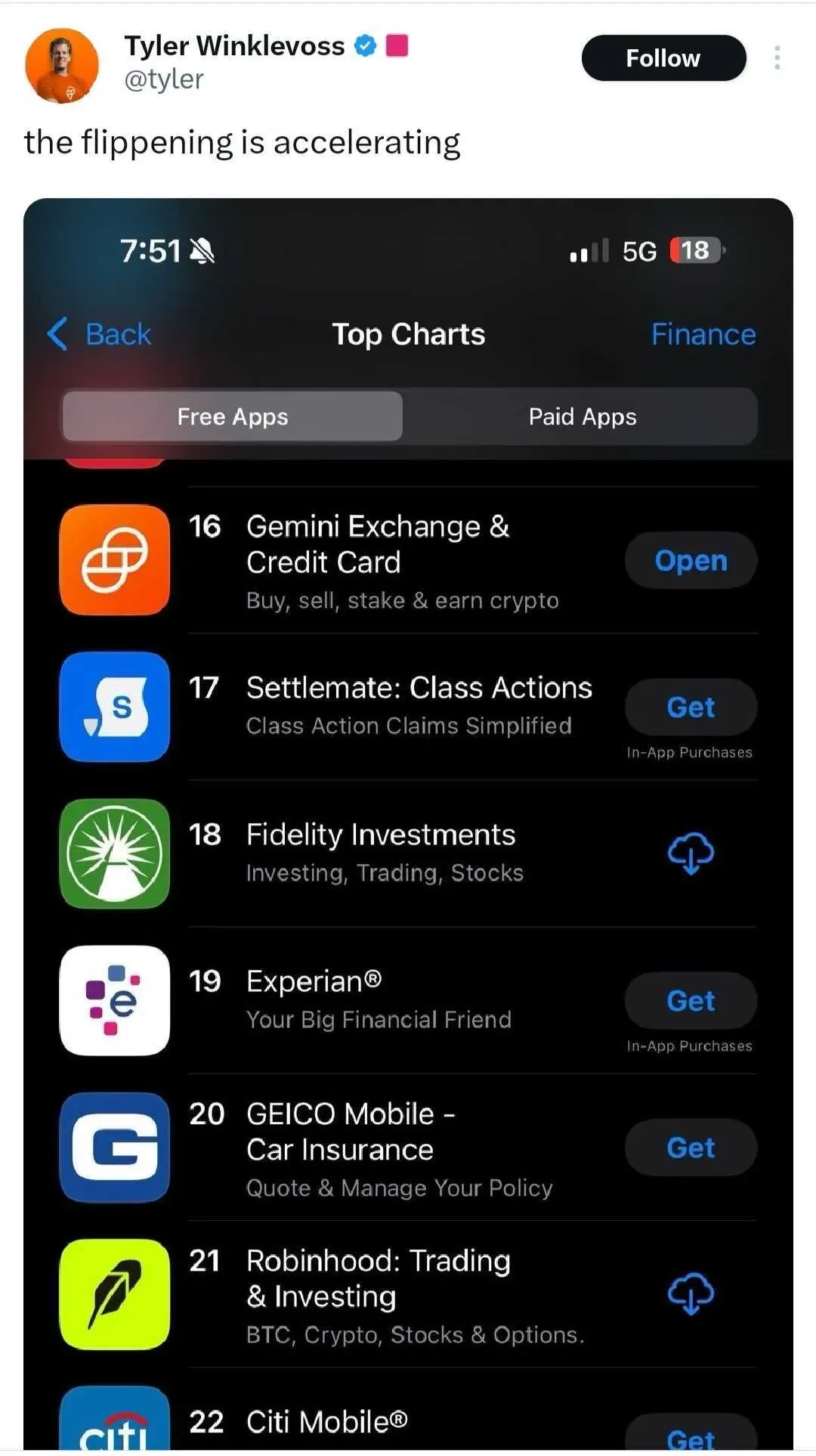

“The flippening dark mode,” Tyler Winklevoss wrote on X after Gemini Exchange & Credit Card climbed to No. 20, overtaking Coinbase at No. 25, Amex at No. 24, and Citi Mobile at No. 21.

“The flippening is accelerating,” he added shortly after, as Gemini advanced to No. 16, while Robinhood slipped to No. 21. The Gemini Exchange & Credit Card app currently ranks No.11 on the Top Free Finance Apps chart in Apple’s App Store.

Despite the buzz around Gemini’s XRP Mastercard, XRP’s price continued to trend lower in early morning trade. The altcoin slipped more than 1.5% in the last 24 hours, trading at around $2.90. On Stocktwits, retail sentiment around the cryptocurrency trended within ‘bearish’ territory over the past day.

Like Coinbase and Robinhood, Gemini is aiming for Wall Street. The exchange confidentially filed for an IPO with the SEC in July to list its Class A common stock. The launch of the Gemini XRP Mastercard and the app’s recent jump in App Store rankings could serve as a useful signal of retail momentum at a time when Gemini is preparing to sell its growth story to public investors.

Shares of Coinbase, which went public in April 2021, have gained nearly 20% this year. Coinbase’s stock was trading flat in pre-market trade on Tuesday, with retail sentiment on Stocktwits trending in ‘bearish’ territory over the past day. Meanwhile, Robinhood’s shares have gained 180% this year. The stock edged 0.7% lower in pre-market trade, amid weakness in the broader market, with retail sentiment falling to ‘bearish’ from the ‘neutral’ zone over the past day.

An increasing number of crypto-linked companies have reportedly been mulling over going public after President Donald Trump’s second term in office has resulted in a friendlier regulatory stance from the authorities.

Peter Thiel-backed crypto exchange Bullish (BLSH) and stablecoin issuer Circle Internet are the two most recent entrants. Bullish’s stock was down 1.2% in pre-market trade, with retail sentiment on Stockwits also in ‘bearish’ territory. The shares have lost more than 30% of their value since getting listed earlier this month. Circle’s stock, on the other hand, has nearly doubled in value since its IPO in June. The shares edged 0.3% higher in pre-market trade, with retail sentiment on Stocktwits improved to ‘bearish’ from ‘extremely bearish’ territory over the past day.

Read also: Binance Sets Final 500 Million USDT Quota For Plasma Yield Product

For updates and corrections, email newsroom[at]stocktwits[dot]com.

/filters:format(webp)https://st-everywhere-cms-prod.s3.us-east-1.amazonaws.com/large_stock_rising_resized_f17852d7aa.jpg)

/filters:format(webp)https://st-everywhere-cms-prod.s3.us-east-1.amazonaws.com/unnamed_jpg_9dff551b50.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_Getty_Images_2194650023_jpg_2af2244b5a.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/Aashika_Suresh_Profile_Picture_jpg_2acd6f446c.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_Getty_Images_2227669423_jpg_f410427536.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_cathie_wood_OG_2_jpg_c5be4c4636.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/Getty_Images_2233055049_jpg_0a316df698.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/jaiveer_jpg_280ad67f36.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_Getty_Images_2228864541_jpg_d94770c5a8.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/vivekkrishnanphotography_58_jpg_0e45f66a62.webp)