Advertisement|Remove ads.

Is Bitcoin Repeating 2022 Playbook? One Whale Says The Comparison Is ‘Absolutely Unprofessional’

- A well-known Bitcoin whale said that comparisons between Bitcoin's current cycle and the 2022 cycle are misleading.

- He said that 2022 was defined by aggressive monetary tightening and forced leveraging, which pushed Bitcoin from its 2021 peak to a decline.

- He argued that the current environment is much more supportive of easing inflation and improving liquidity conditions, potentially supporting Bitcoin over the long term.

A prominent Bitcoin whale has dismissed comparisons between Bitcoin's current price action and the 2022 crash, calling them misleading.

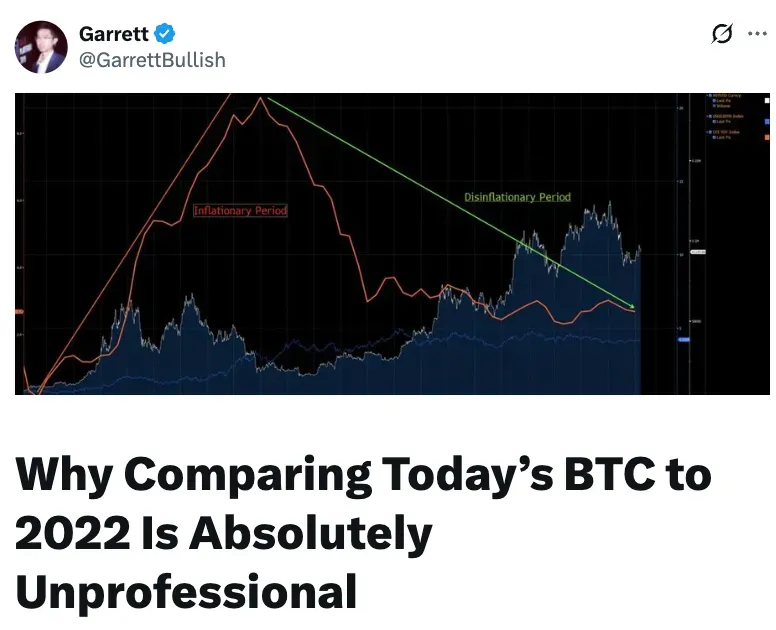

Garrett Jin, a popular Bitcoin whale and the founder of the now-defunct crypto exchange platform, BitForex, said on X in an article named ‘Why Comparing Today’s BTC to 2022 Is Absolutely Unprofessional’ that short-term similarities in Bitcoin charts ignore bigger differences in inflation, liquidity, and investor composition. He asserted that we should not compare the current Bitcoin cycle to that of 2022.

Bitcoin (BTC) was trading at $90,794, down by 2.6% over the past 24 hours. On Stocktwits, retail sentiment around Bitcoin dropped from ‘bullish’ to ‘bearish’ territory, as chatter remained at ‘normal’ levels over the past day.

Monetary Tightening And Bitcoin’s 2022 Downturn

In 2022, Bitcoin traded in a sharply tightening macro environment. Bitcoin faced “excessive liquidity during COVID” and rising inflation, triggered by the Ukraine war.” The U.S. Fed’s risk-free rates had risen sharply, reaching around 4.5% by late 2022.

Risk appetite fell across global markets, and capital moved toward cash and government bonds. He said that at the time, the capital’s primary objective was “risk avoidance.” During that period, Bitcoin (BTC) peaked near $69,000 in late 2021 before falling below $20,000 in mid-2022 as selling and leverage unwind intensified.

According to his post, this phase was a “distribution top,” formed during a tightening cycle when investors prioritized capital preservation over risk-taking.

The whale argued that the current macro-environment is the opposite of 2022. Inflation and risk-free rates are easing, liquidity is gradually returning, and capital conditions are shifting back toward “risk-on.” He added that Bitcoin has historically performed better under disinflationary periods, showing stronger BTC returns when inflation trends lower.

The post also pointed to AI-driven productivity gains as a factor that could support long-term disinflation, which the whale said would be constructive for Bitcoin over time.

Read also: Bitcoin Holds Near $91K Ahead Of Fed’s $3.8 Billion Liquidity Injection

For updates and corrections, email newsroom[at]stocktwits[dot]com.

/filters:format(webp)https://news.stocktwits-cdn.com/large_Trump_88435a6487.webp)

/filters:format(webp)https://st-everywhere-cms-prod.s3.us-east-1.amazonaws.com/Rounak_Author_Image_7607005b05.png)

/filters:format(webp)https://st-everywhere-cms-prod.s3.us-east-1.amazonaws.com/large_tilray_logo_resized_c5047aab55.jpg)

/filters:format(webp)https://st-everywhere-cms-prod.s3.us-east-1.amazonaws.com/unnamed_jpg_9dff551b50.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/Getty_Images_2197860201_jpg_c4f2083335.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/Aashika_Suresh_Profile_Picture_jpg_2acd6f446c.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_Tom_Lee_BMNR_64157a5786.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/Anushka_Basu_make_me_smile_in_the_picture_b92832aa_af59_4141_aacc_4180d2241ba8_1_2_png_1086e0ed8c.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_tech_stocks_jpg_78bcc9c52f.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_MSTR_caaa0be909.webp)