Advertisement|Remove ads.

MARA Stock Rises On Signs It May Tap Bitcoin Sale To Fund AI Push

- MARA’s stock ranked among the top trending tickers on Stocktwits in early morning trade.

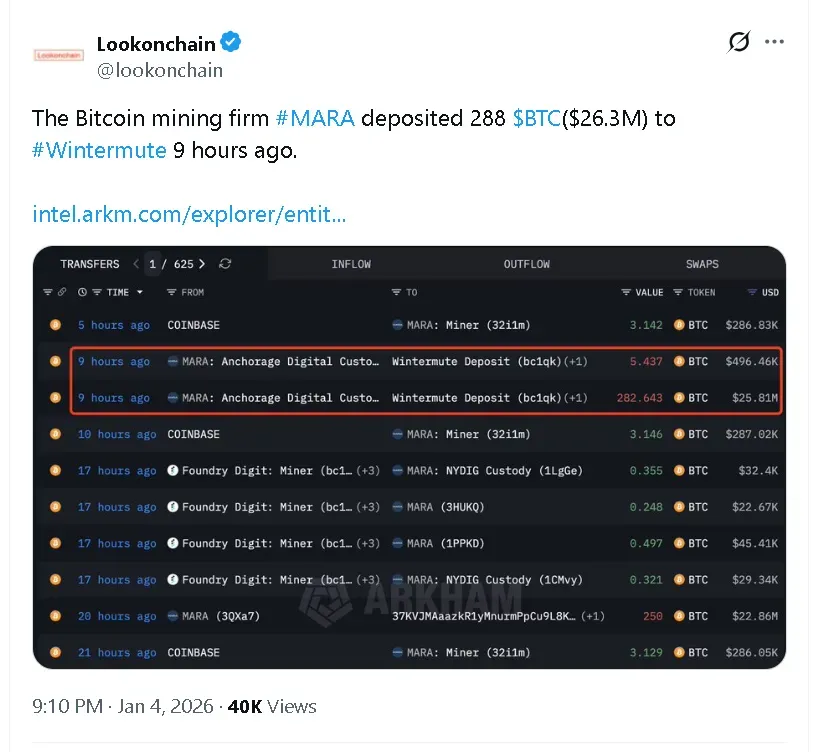

- On-chain data showed Marathon deposited 288 Bitcoin, worth about $26.3 million, to Wintermute.

- Such transfers are commonly linked to selling or hedging activity to raise fiat liquidity.

Shares of crypto miner Marathon Holdings (MARA) rose in pre-market trade on Monday after on-chain data suggested the company may be preparing to sell some of its Bitcoin (BTC) holdings to fund its expanding AI and high-performance computing business.

MARA’s stock was among the top trending tickers on Stocktwits at the time of writing. The shares gained as much as 3.5% in pre-market trade, but retail sentiment on the platform around the company dipped to ‘bearish’ from ‘neutral ‘territory over the past day, while chatter remained at ‘high’ levels.

Meanwhile, Bitcoin’s price rose 1.5% in the last 24 hours to $92,783 – paring gains after recovering to $93,000 on Sunday. On Stocktwits, retail sentiment around the apex cryptocurrency improved to ‘extremely bullish’ from ‘bullish’ territory over the past day.

Marathon Holdings Is Moving Its Bitcoin

According to Arkham Intelligence data, flagged by Lookonchain, Marathon Holdings deposited 288 Bitcoin, worth about $26.3 million, to trading firm Wintermute on Sunday. Such transfers are often associated with preparations to sell or hedge crypto holdings to raise fiat liquidity.

For Marathon, a transfer of 288 Bitcoin represents a mid-sized transaction and aligns with the company’s pattern of periodic sales used to fund more than 1.5 gigawatts (GW) of capacity buildouts, even as the company manages a debt load of around $2.4 billion.

Why Is Marathon Holdings Stock Gaining?

One Stocktwits user noted that Marathon’s stock was forming a “falling wedge pattern” that could spell a potential bull rally ahead.

Another said they expect MARA’s stock to gain on Monday after the market opens on the basis of Bitcoin’s price movement.

Bitcoin Treasuries data shows that Marathon Holdings is the second-largest corporate holder of Bitcoin after Michael Saylor’s Strategy (MSTR), with around 53,230 BTC in its coffers.

The company announced its strategic pivot into AI and HPC infrastructure in August last year alongside an investment agreement to acquire a majority stake in Exaion, a French EDF subsidiary focused on AI data centers.

Read also: MSTR, COIN, CLSK Gain As Crypto-Linked Stocks Rally After Bitcoin Breaks Above $93,000

For updates and corrections, email newsroom[at]stocktwits[dot]com.

/filters:format(webp)https://news.stocktwits-cdn.com/large_Getty_Images_2058827032_jpg_5505a2a083.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/jaiveer_jpg_280ad67f36.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/Getty_Images_526218674_jpg_7b7468812b.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/Aashika_Suresh_Profile_Picture_jpg_2acd6f446c.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_Getty_Images_539991424_jpg_eeab1e0e26.webp)

/filters:format(webp)https://st-everywhere-cms-prod.s3.us-east-1.amazonaws.com/large_HPE_office_with_logo_resized_c15b2ba0d3.jpg)

/filters:format(webp)https://news.stocktwits-cdn.com/large_stock_market_fall_generic_jpg_f7dffafa95.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_Getty_Images_2219201937_jpg_67aaff68c1.webp)