Advertisement|Remove ads.

Ripple CEO Calls $500 Million Funding Round ‘Cherry On Top’ After Company Bags $40 Billion Valuation

Ripple (XRP) announced Wednesday that it has raised $500 million in new funding at a $40 billion valuation, a move CEO Brad Garlinghouse described as the “cherry on top” for the year.

“This investment isn’t just validation of Ripple’s growth strategy and business built on the foundation of XRP, but also a clear bet on what the future of crypto will look like,” he wrote in a post on X.

Funds To Accelerate Stablecoin, Custody, And Prime Brokerage Growth

Ripple stated that it will use its new funds to accelerate growth in custody solutions, stablecoins, and prime brokerage services. The company justified its spending, stating that these areas are experiencing an increase in institutional demand, particularly as the regulatory environment surrounding cryptocurrencies in the U.S. continues to evolve.

The company has been doubling down on its payments infrastructure since the passage of the GENIUS Act in July. Earlier this year, Ripple acquired stablecoin infrastructure company Rail, integrating Ripple USD (RLUSD) and XRP into a full-service cross-border payments platform. GTreasury, acquired in October, allows institutions to manage trillions in treasury payments and collateral using stablecoins and digital assets.

Plans For Ripple Prime

Ripple also recently completed its acquisition of Hidden Road, now Ripple Prime, where RLUSD is already deployed as collateral. The company said that, since the acquisition, client collateral has doubled, average daily transactions have exceeded 60 million, and the business has tripled in size. It added that Ripple Prime is expanding into collateralized lending for XRP.

The company stated that it has processed more than $95 billion in Ripple Payments volumes to date, and earlier this week, its stablecoin, RLUSD, surpassed $1 billion in market capitalization.

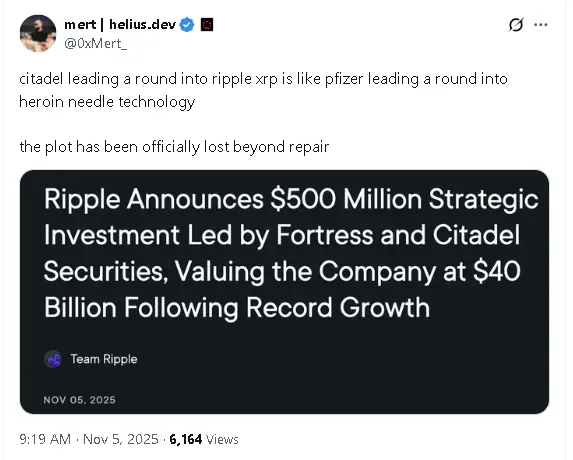

However, the funding round drew criticism from some in the crypto community. Mert Mumtaz, CEO of Helius Labs and a privacy coin advocate, questioned Ripple’s ethos, saying in a post on X, “Citadel leading a round into Ripple XRP is like Pfizer leading a round into heroin needle technology. The plot has officially been lost beyond repair.”

Despite the news, XRP’s price dipped 1.8% in the last 24 hours, according to CoinGecko data. This takes it more than 38% below its all-time high of $3.65 seen in July, earlier this year. Retail sentiment on Stocktwits around the altcoin improved to 'neutral' from 'bearish' as chatter increased to 'normal' from 'low' levels over the past day. Meanwhile, retail sentiment around RLUSD trended in 'bullish' territory amid 'extremely high' levels of chatter.

Read also: Crypto Markets See $1.7 Billion In Liquidations As Fear Index Hits Lowest Levels Since April

For updates and corrections, email newsroom[at]stocktwits[dot]com.

/filters:format(webp)https://news.stocktwits-cdn.com/large_donald_trump_jpg_39d73f48c3.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/IMG_8805_JPG_6768aaedc3.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_Getty_Images_2212776621_jpg_54c763cf43.webp)

/filters:format(webp)https://st-everywhere-cms-prod.s3.us-east-1.amazonaws.com/IMG_9209_1_d9c1acde92.jpeg)

/filters:format(webp)https://news.stocktwits-cdn.com/large_Getty_Images_2226079120_jpg_10ed2924af.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/IMG_4530_jpeg_a09abb56e6.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_bitcoin_OG_oct23_jpg_588046d0a9.webp)

/filters:format(webp)https://st-everywhere-cms-prod.s3.us-east-1.amazonaws.com/Prabhjote_DP_67623a9828.jpg)

/filters:format(webp)https://news.stocktwits-cdn.com/Getty_Images_2239867148_jpg_8df22810c1.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_Getty_Images_2227347123_jpg_b7a8c29717.webp)