Advertisement|Remove ads.

Smartest Man In The World Predicts Bitcoin Is Entering A ‘Decade Long Supercycle’

- Bitcoin’s price remained under $90,000 on Tuesday night after dipping as low as $86,000 over the weekend.

- YoungHoon Kim’s claim suggests Bitcoin could see a prolonged multi-year uptrend with shallower pullbacks instead of sharp boom-and-bust cycles.

- A similar claim was made by Binance co-founder Changpeng ‘CZ’ Zhao last year at the Bitcoin MENA conference in December.

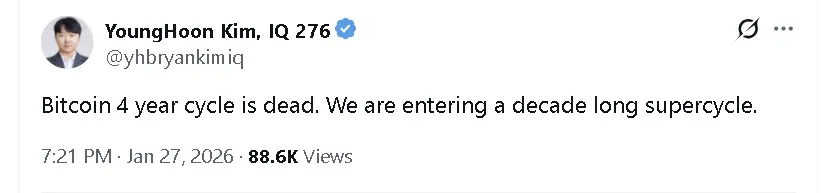

The smartest man in the world, recognised with an IQ of 276 in 2024, said on Tuesday that Bitcoin (BTC) may be entering a “decade long supercycle.”

In a post on X, YoungHoon Kim claimed that Bitcoin’s four-year cycle is dead. Instead of a boom-and-bust that usually follows the apex cryptocurrency’s halving events, Kim stated that Bitcoin is now entering a supercycle. A similar claim was made by Binance co-founder Changpeng ‘CZ’ Zhao last year at the Bitcoin MENA conference in December.

Bitcoin’s price gained 0.6% in the last 24 hours to $88,900 as of Tuesday night. The cryptocurrency has been struggling to recover back to $90,000 after its massive dip over the weekend to $86,000. On Stocktwits, retail sentiment around BTC fell to ‘extremely bearish’ from ‘bearish’ over the past day.

What Is Bitcoin’s Supercycle Thesis?

The Bitcoin supercycle thesis postulates that the cryptocurrency will see a steady multi-year uptrend with shallow dips, that is likely to be driven by macro triggers like interest rates and policy wins. Even if BTC’s price drops, the corrections will be will buyable bull market pullbacks, not the beginning of a crypto winter.

This contrasts Bitcoin’s four-year cycle driven by its “halving” events, which reduce mining rewards roughly every four years. These supply cuts have typically triggered bull markets that peak 12 to 18 months later, followed by sharp pullbacks often referred to as “crypto winters.”

Bitcoin To Hit New Record High In 2026

Analysts like Bitwise CIO Matt Hougan also expect Bitcoin to defy its historical four-year cycle, predicting that BTC’s price could hit a new all-time high in 2026.

BitMEX co-founder Arthur Hayes went a step further to state that the driver behind previous Bitcoin bear markets was monetary tightening, not the four-year cycle. With the Federal Reserve, pushing the pedal on quantitative easing this year, he also predicts that Bitcoin will hit a record high in 2026.

For updates and corrections, email newsroom[at]stocktwits[dot]com.

/filters:format(webp)https://news.stocktwits-cdn.com/large_Getty_Images_2058827032_jpg_5505a2a083.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/jaiveer_jpg_280ad67f36.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/Getty_Images_526218674_jpg_7b7468812b.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/Aashika_Suresh_Profile_Picture_jpg_2acd6f446c.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_Getty_Images_539991424_jpg_eeab1e0e26.webp)

/filters:format(webp)https://st-everywhere-cms-prod.s3.us-east-1.amazonaws.com/large_HPE_office_with_logo_resized_c15b2ba0d3.jpg)

/filters:format(webp)https://news.stocktwits-cdn.com/large_stock_market_fall_generic_jpg_f7dffafa95.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_Getty_Images_2219201937_jpg_67aaff68c1.webp)