Advertisement|Remove ads.

Solana Rallies While Bitcoin Stalls Near $91,000 Ahead Of Trump Tariff Ruling, Jobs Data

- Overall crypto market capitalization held steady at around $3.2 trillion.

- CoinGlass data showed around $378 million in liquidations over the past day, driven primarily by long positions.

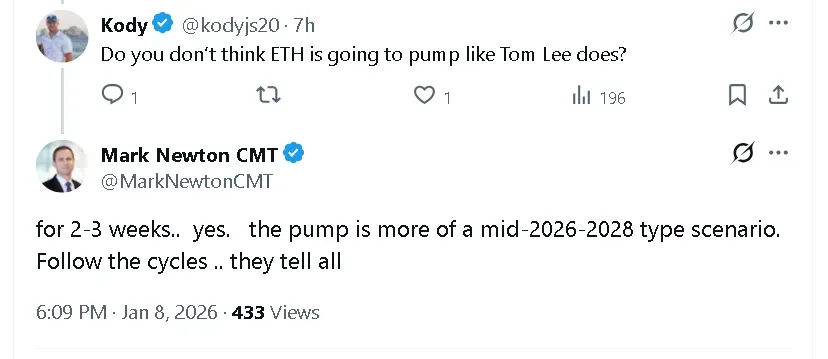

- Fundstrat managing director Mark Newton predicted that crypto is more likely a mid-2026 to 2028 opportunity.

Solana (SOL) outperformed Bitcoin (BTC) and other crypto majors on Thursday night as the market braced the U.S. Supreme Court’s ruling on Trump’s tariffs and unemployment data, set to be released on Friday.

Bitcoin’s price traded flat in the last 24 hours, recovering to around $91,000 after dipping below $90,000 in intra-day trade, while retail sentiment around the apex cryptocurrency on Stocktwits remained in ‘extremely bullish’ territory amid ‘high’ levels of chatter.

Solana’s price, meanwhile, rose more than 2% in the last 24 hours to $139. However, retail sentiment around the altcoin trended in ‘bearish’ territory over the past day even amid ‘high’ levels of chatter.

Tariff Ruling, Jobs Data Set Macro Tone

Sentiment may shift with markets pricing a high probability of the Trump-era tariffs being struck down. The odds of the Supreme Court ruling in favor of the tariffs are 27% at Kalshi while Polymarket is pricing in only a 25% chance. A negative ruling could dent confidence by forcing the government to refund a large share of tariff revenue and weakening the policy outlook, prompting risk-off moves that typically weigh on crypto.

Meanwhile, Friday’s U.S. unemployment data will shape expectations around recession risk and interest rates. Weak data would raise economic slowdown fears, while strong data could further push out rate-cut expectations, creating pressure on risk assets in either scenario.

Fundstrat managing director Mark Newton struck a longer-term note of caution in a post on X. He stated that digital assets remain part of a broader multi-year cycle rather than an immediate breakout story. Newton predicted that crypto is more likely a mid-2026 to 2028 opportunity.

Dogecoin, Tron Clock Heaviest Losses

Dogecoin (DOGE) led losses among the top 10 cryptocurrencies by market capitalization. DOGE’s price dropped 2.6% in the last 24 hours to $0.142, with retail sentiment on Stocktwits trending in ‘extremely bullish’ territory. Chatter thinned out to ‘high’ from ‘extremely high’ levels over the past day.

Tron (TRX), which had been bucking the broader drawdown in the market over the past two days, also retreated on Thursday night. Tron’s price fell 1.4% in the last 24 hours to $0.2934. Retail sentiment on Stocktwits around the token also trended in ‘extremely bullish’ territory over the past day. Chatter remained at ‘high’ levels.

Cardano (ADA), Ripple’s XRP (XRP) and Ethereum (ETH) fell around 0.8% each in the last 24 hours. Binance Smart Chain (BNB) traded flat. Overall crypto market capitalization held steady at around $3.2 trillion. CoinGlass data showed around $378 million in liquidations over the past day. Around $297 million came from long positions and $81 million from short bets.

For updates and corrections, email newsroom[at]stocktwits[dot]com.

/filters:format(webp)https://news.stocktwits-cdn.com/Getty_Images_2261646866_jpg_de6ca7bdf0.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/shivani_photo_jpg_dd6e01afa4.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/iran_fm_iaea_chief_rafael_mariano_grossi_jpg_79ef4dc11f.webp)

/filters:format(webp)https://st-everywhere-cms-prod.s3.us-east-1.amazonaws.com/Rounak_Author_Image_7607005b05.png)

/filters:format(webp)https://news.stocktwits-cdn.com/large_coinbase_new_jul_2eaf8eb2ac.webp)

/filters:format(webp)https://st-everywhere-cms-prod.s3.us-east-1.amazonaws.com/Prabhjote_DP_67623a9828.jpg)

/filters:format(webp)https://news.stocktwits-cdn.com/large_qualcomm_CEO_OG_jpg_7352181faa.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_Getty_Images_2058827032_jpg_5505a2a083.webp)

/filters:format(webp)https://st-everywhere-cms-prod.s3.us-east-1.amazonaws.com/large_US_stocks_3e2253bcca.jpg)

/filters:format(webp)https://news.stocktwits-cdn.com/Revised_Profile_JPG_0e0afdf5e2.webp)