Advertisement|Remove ads.

Solana Token Bucks Crypto Market Slump As CME Group Announces SOL Futures Launch – Retail Surprised But Not Convinced

Solana (SOL) was the only major cryptocurrency to gain in morning trade during U.S. market hours on Friday, rising 6%, while the broader market remained under pressure.

The rally followed CME Group’s announcement that it would introduce Solana futures on March 17, pending regulatory approval.

Bitcoin (BTC) declined 3.1% in the past 24 hours, while Ethereum (ETH) dropped 5.6%.

Dogecoin (DOGE) and Cardano (ADA) were the worst hit as the market reeled from Bitcoin dipping below its 200-day simple moving average (SMA) for the first time since October.

Solana’s gains stood in sharp contrast to the overall market sell-off as retail traders reacted to the upcoming futures launch.

CME’s new derivatives product will allow traders to manage SOL price risk through two contract sizes: 25 SOL and 500 SOL.

The contracts will be cash-settled using the CME CF Solana-Dollar Reference Rate, which tracks SOL’s price daily at 4:00 p.m. London time.

CME Group’s Global Head of Cryptocurrency Products, Giovanni Vicioso, said the new SOL futures contracts were launched in response to increased client demand for a broader set of regulated products to manage cryptocurrency price risk.

"As Solana continues to evolve into the platform of choice for developers and investors, these new futures contracts will provide a capital-efficient tool to support their investment and hedging strategies," he added.

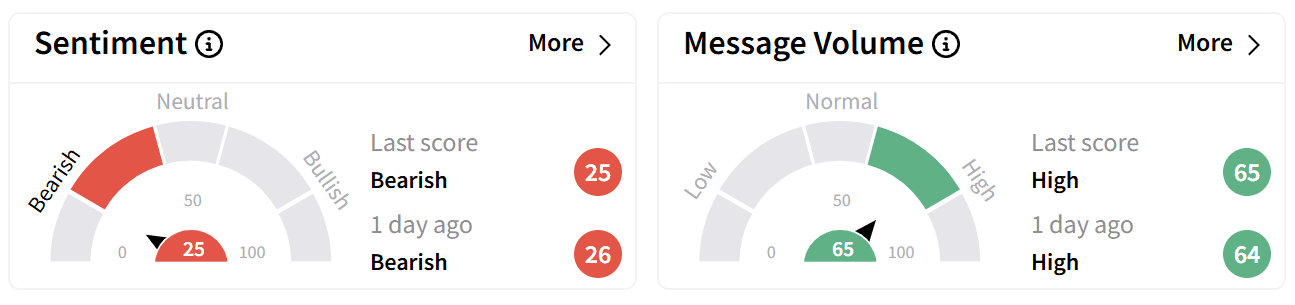

Despite Solana’s price resilience amid a broader market slump, retail sentiment on Stocktwits remained in the ‘bearish’ zone. However, chatter was at ‘high’ levels as traders reacted to the news.

While Solana outperformed on Friday, it remains down 18% for the week and has lost 36% over the past month.

For updates and corrections, email newsroom[at]stocktwits[dot]com.

/filters:format(webp)https://news.stocktwits-cdn.com/large_Getty_Images_2259655311_jpg_20124bbeb9.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/Anushka_Basu_make_me_smile_in_the_picture_b92832aa_af59_4141_aacc_4180d2241ba8_1_2_png_1086e0ed8c.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_Donald_Trump_451371e34e.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_Getty_Images_2228736233_jpg_f3ebe80a4c.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_Getty_Images_2192180432_jpg_5a4c947a6a.webp)

/filters:format(webp)https://st-everywhere-cms-prod.s3.us-east-1.amazonaws.com/large_sealsq_stock_market_representative_resized_b05435011f.jpg)

/filters:format(webp)https://st-everywhere-cms-prod.s3.us-east-1.amazonaws.com/unnamed_jpg_9dff551b50.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_Cybersecurity_jpg_bb1da91dbe.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/Aashika_Suresh_Profile_Picture_jpg_2acd6f446c.webp)