Advertisement|Remove ads.

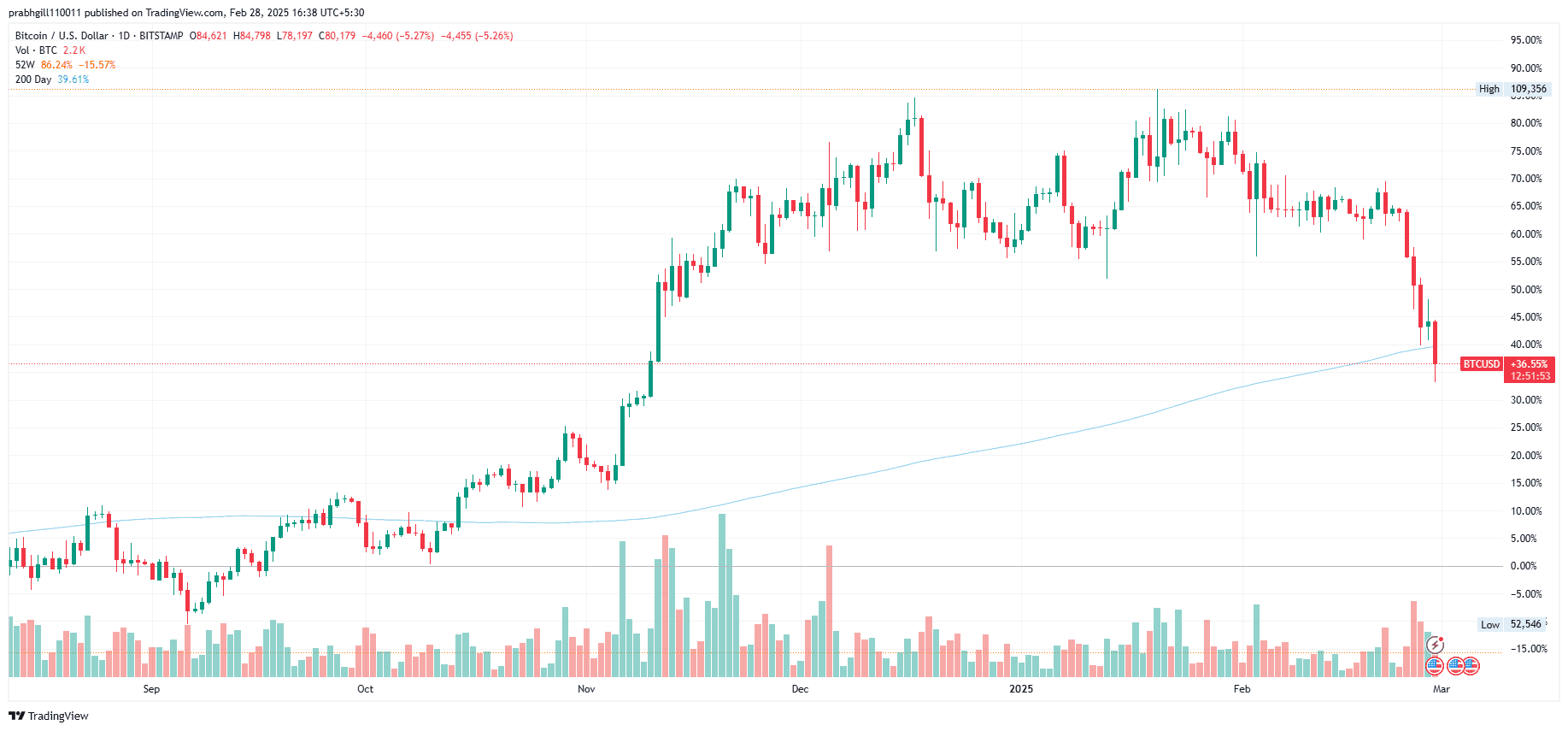

Bitcoin Breaks 200-Day SMA For First Time Since October As It Drops Below $80K – Retail Sentiment Worsens

Bitcoin broke the 200-day simple moving average (SMA) for the first time since October after the apex cryptocurrency’s price dipped below $80,000.

In early morning U.S. market hours, Bitcoin was down around 7% for the day, recuperating some of its losses after touching $78,343, according to CoinGecko data.

According to Wolfe Research, the cryptocurrency could drop to pre-election levels, trading below $70,000. The analysts forecast that Bitcoin may continue to suffer from major risk off moves until a new catalyst emerges.

“Uncertainty is at the forefront of investors concerns and the willingness to take on risk is rapidly waning,” the brokerage said according to a CNBC report.

Bitcoin's price is now down over 26% from its all-time high of $108,786, reached on Jan. 20, ahead of U.S. President Donald Trump’s inauguration.

A decline of 20% or more from the latest peak is the technical definition of a bear market, marking a stark reversal for an asset that broke records just a month ago – now weighed down by regulatory influences, macroeconomic factors, and security breaches.

The latest blow to the asset came from Trump’s confirmation that he plans to impose tariffs on Canada and Mexico starting Tuesday and double the 10% universal tariff charged on imports from China.

While the President was largely anticipated to be pro-crypto, Bitcoin has been sensitive to Trump’s tariff threats since he took office in January.

Market sentiment also reflects the current administration's tedious progression of pro-crypto policies. The launch of Offical Trump (TRUMP) and its accompanying Melania (MELANIA) token has faced sharp declines, with meme coins in general suffering substantial losses.

Confidence deteriorated further in the aftermath of the $1.46 billion Bybit crypto exchange hack, the largest in industry history, linked to the North Korean hacker group Lazarus.

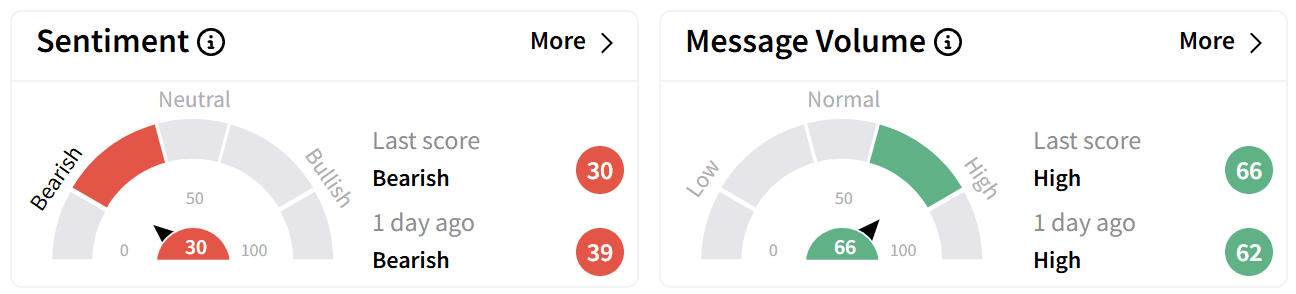

On Stocktwits, retail sentiment around Bitcoin dipped further into ‘bearish territory, accompanied by ‘high’ levels of chatter.

However, many users were excited about Bitcoin’s new lows, seeing it as an opportunity to pick up the apex cryptocurrency at a discount.

Total crypto market capitalization has dropped by nearly 9% over the last 24 hours to $2.77 trillion.

For updates and corrections, email newsroom[at]stocktwits[dot]com.

Read also: Bitcoin Slumps Below $85K Dragging Crypto Fear Index To 3-Year Low – Analyst Still Sees $200K Ahead

/filters:format(webp)https://news.stocktwits-cdn.com/large_Bitcoin_and_Ethereum_2b4356b70a.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/Anushka_Basu_make_me_smile_in_the_picture_b92832aa_af59_4141_aacc_4180d2241ba8_1_2_png_1086e0ed8c.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_Getty_Images_976546456_jpg_42ddd4a81d.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_Getty_Images_2259655311_jpg_20124bbeb9.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_Donald_Trump_451371e34e.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_Getty_Images_2228736233_jpg_f3ebe80a4c.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_Getty_Images_2192180432_jpg_5a4c947a6a.webp)