Advertisement|Remove ads.

Three Years After FTX Collapse, SEC Finally Issues Guidance On Custody Of Crypto Assets

- SEC’s Trading & Markets Division issued interim guidelines on Wednesday on how broker-dealers can custody crypto asset securities under Rule 15c3-3.

- The guidelines apply to crypto assets deemed securities, including tokenized equity and debt, pending potential permanent rule changes.

- Commissioner Hester Peirce urged the SEC to move quickly toward formal amendments and broader market-structure clarity.

The U.S. Securities and Exchange Commission (SEC) on Wednesday released a series of statements that clarify how the SEC's existing securities law applies to crypto assets.

The SEC guidelines come three years after Sam Bankman-Fried’s FTX cryptocurrency exchange collapsed, which led to a market downturn and subsequent ‘crypto winter’. They clarify custody and trading rules for crypto securities and address gaps exposed by the 2022 collapse.

The SEC's Division of Trading & Markets (TM Division) published guidelines to assist broker-dealers in determining their obligations to hold crypto assets as described under the Customer Protection Rule, also known as SEC Rule 15c3-3.

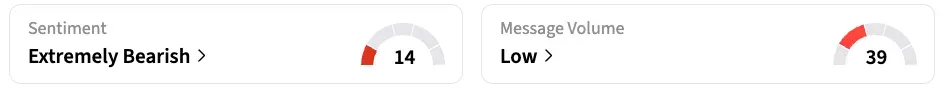

The total crypto market cap stood at around $3 trillion on Wednesday night, with Bitcoin (BTC) accounting for more than half of the market. Bitcoin was trading at $86,442, down 0.5% over the day. On Stocktwits, the retail sentiment around the cryptocurrency remained in the ‘extremely bearish’ zone, accompanied by ‘low’ levels of chatter over the past day.

SEC Outlines Interim Custody Standards For Crypto Securities

The guidelines indicated that the TM Division would not object to a broker-dealer classifying itself as having “physical possession or control” of the crypto asset it holds, provided the broker-dealer meets the four conditions – adequate protection of private keys, sufficient operational controls, a comprehensive assessment by the broker-dealer of the risks associated with the blockchain and an outline for the management of any disruption of service that can occur during the lifecycle of a broker-dealer's business, whether due to insolvency or other reasons.

The guidelines apply to any crypto asset that falls under the definition of a ‘security’ under the federal securities laws, including, but not limited to, tokenized equity and tokenized debt securities.

The TM Division indicated that these guidelines would be an interim measure while the SEC continues to evaluate whether additional formal amendments to Rule 15c3-3 are necessary.

FTX Collapse Revealed Custody And Regulation Gaps

The crypto industry has witnessed failures, prominently the collapse of crypto exchange FTX in 2022. FTX mixed customer assets with the exchange's own trading operations, which was possible due to the lack of adequate custody control. It exposed gaps in custody controls, asset segregation, and broker accountability. The current SEC guidelines clarify how custody and trading rules apply to crypto securities, aiming to reduce asset-misuse risks and market opacity.

Commissioner Peirce Urges Permanent SEC Rulemaking

Simultaneously, SEC Commissioner Hester Peirce commended the TM Division's guidelines and indicated that it was a significant step for broker-dealers interested in providing customers with crypto asset custody services. In her statement, Commissioner Peirce expressed hope that the SEC would take prompt action to propose permanent rule changes with respect to the custody of crypto assets.

Pierce also said that the TM Division solicited feedback and published answers to frequently asked questions regarding national security exchanges and alternative trading systems (ATS) and how they may be able to facilitate the trading of crypto asset securities, as well as those involving both such assets and other asset types.

The report addressed a wide range of topics, from record-keeping and disclosure requirements to whether the current market structure rules make it unnecessarily cumbersome for crypto trading platforms to operate.

Read also: Bitcoin Outperforms Amid Heavy Liquidations Weighing On Ethereum, Solana, And Cardano

For updates and corrections, email newsroom[at]stocktwits[dot]com.

/filters:format(webp)https://news.stocktwits-cdn.com/large_bmnr_OG_jpg_83d4f3cc27.webp)

/filters:format(webp)https://st-everywhere-cms-prod.s3.us-east-1.amazonaws.com/Prabhjote_DP_67623a9828.jpg)

/filters:format(webp)https://news.stocktwits-cdn.com/large_us_iran_jpg_753ef9f5af.webp)

/filters:format(webp)https://st-everywhere-cms-prod.s3.us-east-1.amazonaws.com/Rounak_Author_Image_7607005b05.png)

/filters:format(webp)https://news.stocktwits-cdn.com/large_capitol_market_OG_jpg_8111684a8f.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_Getty_Images_2222519332_jpg_15709268a8.webp)

/filters:format(webp)https://st-everywhere-cms-prod.s3.us-east-1.amazonaws.com/IMG_9209_1_d9c1acde92.jpeg)

/filters:format(webp)https://news.stocktwits-cdn.com/large_Plug_Power_jpg_08143c7fa0.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_stablecoin_rep_jpg_5ec196dfc2.webp)