Advertisement|Remove ads.

Justin Sun’s TRON Faces Fresh Allegations As Lawmakers Question SEC’s Pause

- Justin Sun’s former partner, Zeng Ying, accused him of artificially inflating TRON prices.

- The claims emerged as U.S. lawmakers questioned the SEC’s pause in Sun’s case.

- Sun has denied any wrongdoing, while the SEC enforcement action remains unresolved.

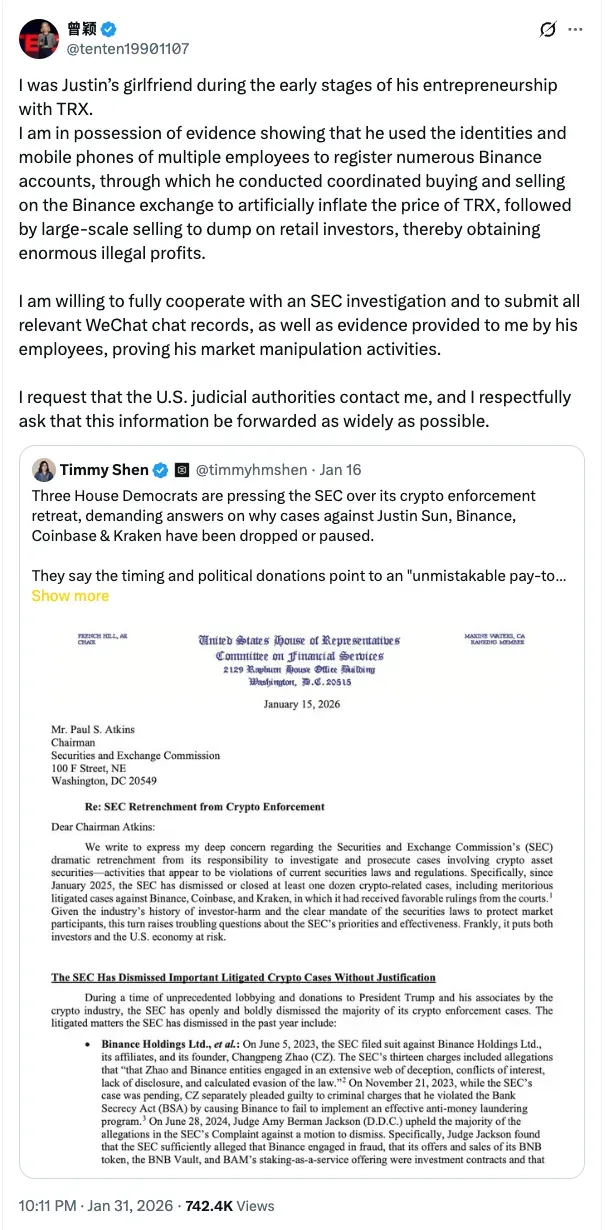

Justin Sun is facing renewed scrutiny after Zeng Ying, the former partner of the TRON founder, publicly accused him of artificially inflating the token associated with TRON’s (TRX) price.

Ying in her X post on Sunday alleged that Sun used the identities and mobile phones of multiple employees to operate numerous Binance accounts, coordinating buying and selling activity to inflate TRON (TRX) prices before selling into retail demand. She is willing to “fully cooperate with an SEC investigation and to submit all relevant WeChat chat records” as well as other evidence that was provided by Sun’s employees.

The claims have not been confirmed by anyone else, and there have been no official findings from the government.

TRON’s (TRX) price was trading at $0.2822, down by 1.5% in the past 24 hours. On Stocktwits, retail sentiment around TRX remained in ‘bullish territory’, as chatter remained at ‘normal’ levels over the past day.

Allegations Point To Retail Investor Losses

She also noted that a significant part of the Chinese crypto influencer ecosystem consisted of anonymous "signal-calling" accounts that worked closely with project teams to promote tokens when prices were at their highest. Ying said that once retail investors bought in, insiders and project teams sold into the surge, making money while retail holders lost money.

Ying claimed that Sun’s rapid rise to wealth in 2018 stemmed not from technological breakthroughs, but from repeatedly selling tokens he controlled. She added that employees were told to use their real names to open KYC-verified accounts on Binance. These accounts were then used to slowly sell TRX holdings on the market, according to Ying.

She also said that after she spoke out, anonymous crypto accounts tried to discredit her online, and retail investors, whom she called the most vulnerable participants, lost money and had few options.

House Democrats Question SEC’s Pause in Justin Sun Case

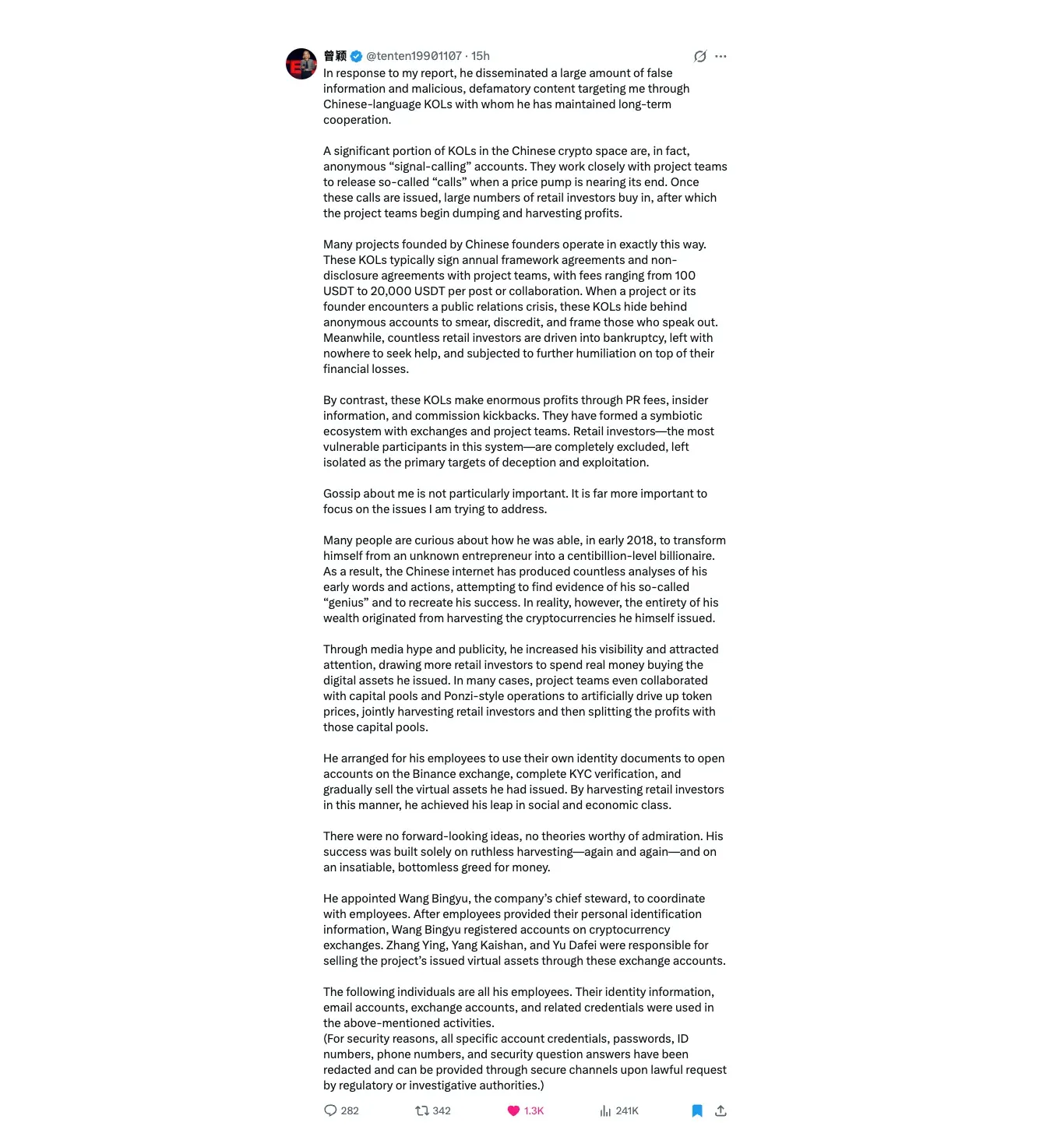

House Democrats renewed pressure on the U.S. Securities and Exchange Commission (SEC) regarding its handling of the Justin Sun case. Lawmakers questioned why the SEC paused enforcement actions against Sun, raising concerns that political influence and industry pressure may be affecting regulatory decisions.

Previously, House Democrats Maxine Waters (D-CA), Sean Casten (D-IL), and Brad Sherman (D-CA) formally urged the SEC to explain its pullback from multiple crypto enforcement cases, including one involving Justin Sun.

The lawmakers argued that the retreat coincided with a surge in political spending by crypto firms and warned of a possible “pay-to-play scheme.” Sun was sued by the SEC in 2023 over alleged unregistered securities offerings and market manipulation, and the case was officially paused in late February as the agency explored a potential settlement.

Read also: Coinbase CEO Armstrong Pushes Back After WSJ Brands Him Wall Street’s ‘Enemy No. 1’

For updates and corrections, email newsroom[at]stocktwits[dot]com

/filters:format(webp)https://news.stocktwits-cdn.com/large_Novo_Nordisk_jpg_96dd19f953.webp)

/filters:format(webp)https://st-everywhere-cms-prod.s3.us-east-1.amazonaws.com/Rounak_Author_Image_7607005b05.png)

/filters:format(webp)https://news.stocktwits-cdn.com/Getty_Images_2203832195_jpg_d80f13d1c7.webp)

/filters:format(webp)https://st-everywhere-cms-prod.s3.us-east-1.amazonaws.com/IMG_9209_1_d9c1acde92.jpeg)

/filters:format(webp)https://news.stocktwits-cdn.com/large_opendoor_OG_jpg_55300f4def.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_Getty_Images_2262161352_jpg_832967dbca.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_capricor_jpg_9f4f8ab098.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/IMG_8805_JPG_6768aaedc3.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_bitdeer_OG_jpg_8f9fd0249d.webp)

/filters:format(webp)https://st-everywhere-cms-prod.s3.us-east-1.amazonaws.com/Prabhjote_DP_67623a9828.jpg)