Advertisement|Remove ads.

Why Is Bitcoin Dropping? BTC’s Price Slides Towards $70K After A Week Of Lower Highs On 'Campaign Selling'

- 10x Research pointed to the unwinding of earlier cycle investments as a key driver.

- Peter Brandt described the move as campaign selling marked by steadily lower highs.

- Simply put, large-scale withdrawals might be tightening liquidity during a volatile period.

Bitcoin’s (BTC) price sank further on Wednesday night, hovering near $70,000 as traders speculated on why Bitcoin is dropping despite improving long-term narratives.

The apex cryptocurrency has fallen nearly 20% this year so far, and is trading 40% below its record high of over $126,000 seen in October. According to experts like Bitwise CIO Matt Hougan and Galaxy Digital CEO Mike Novogratz, this may be the tail-end of the crypto winter.

Why Is Bitcoin’s Price Dropping?

Analysts at 10x Research stated that the current drawdown in Bitcoin's price is because of a broader reassessment of capital deployed earlier in the cycle, rather than a collapse in conviction around Bitcoin’s long-term role.

“Each cycle introduces new narratives and promoters, often successfully attracting billions and, in this cycle, tens of billions of dollars in capital for single investments,” the firm said in a note. “Ironically, it is the subsequent reassessment of these allocations by investors, and the unwinding of the capital raised, that is now exerting downward pressure on Bitcoin.”

Veteran trader Peter Brandt echoed that view, describing the selloff as methodical rather than disorderly. In a post on X, Brandt said Bitcoin’s eight-day pattern of lower highs and lower lows carried “all the fingerprints of campaign selling, not retail liquidation,” adding that such phases can persist without a clear signal for when they will end.

Withdrawals Add Another Layer of Pressure

Binance co-founder Yi He said members of the crypto community have initiated what she described as a “withdrawal campaign” on the world’s largest crypto exchange, encouraging users to move assets off trading platforms.

“Although the number of assets in Binance addresses has increased after the campaign was launched, I believe that regularly initiating withdrawals from all trading platforms is a very effective stress test,” Yi He wrote.

Crypto Sentiment Sours Despite Long-Term Optimism

Broader market sentiment has deteriorated alongside the price action. “Feels like everyone just gave up on crypto,” crypto market water Lark Davis. “Metals and stocks were largely the better investments this cycle unless you got some big memecoin win. Bad times.”

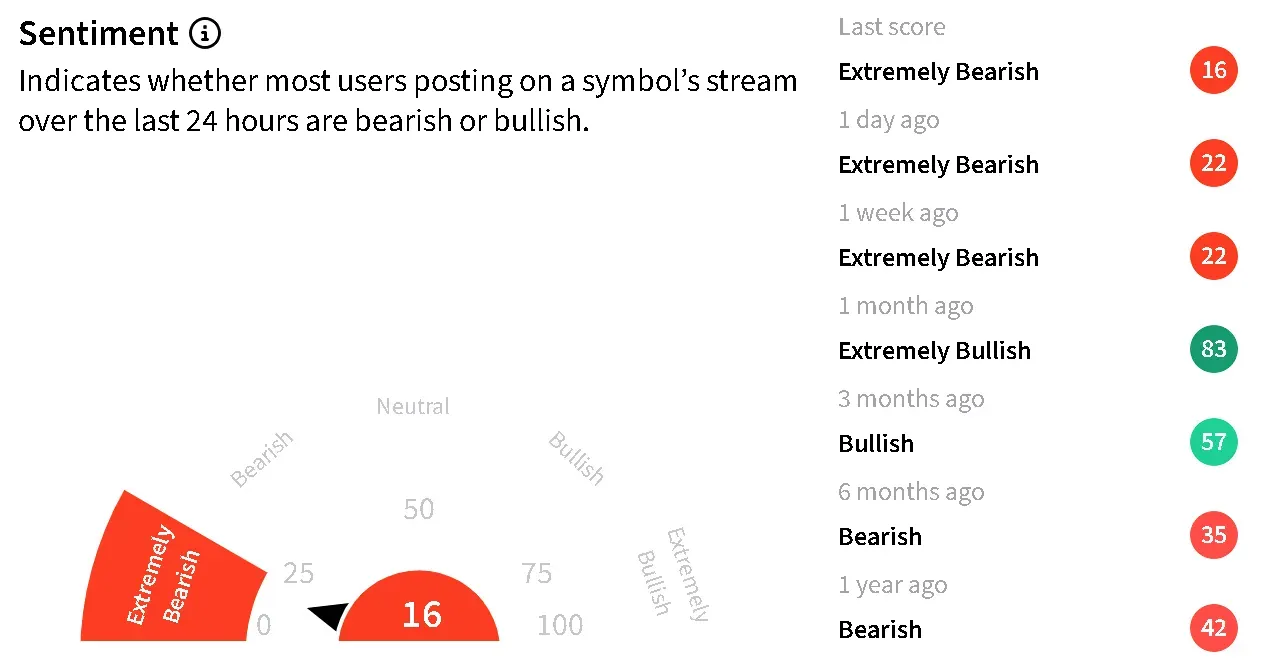

On Stocktwits, retail sentiment around BTC dropped lower within ‘extremely bearish’ territory even as chatter remained at ‘extremely high’ levels.

One user predicted that Bitcoin’s price may fall as low as $69,000 on Wednesday night.

Another anticipated a flash crash to $60,000.

The latest move downward in Bitcoin’s price comes after the market anticipated the apex cryptocurrency would rise following the marked improvement in ISM Manufacturing PMI on Monday. The reading crossed 50, usually a necessary condition for the crypto bull run.

For updates and corrections, email newsroom[at]stocktwits[dot]com.

/filters:format(webp)https://news.stocktwits-cdn.com/large_Getty_Images_2246580703_jpg_9700e1e7e8.webp)

/filters:format(webp)https://st-everywhere-cms-prod.s3.us-east-1.amazonaws.com/unnamed_jpg_9dff551b50.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_Getty_Images_2189643067_jpg_243b1172b6.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/jaiveer_jpg_280ad67f36.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_Getty_Images_1494564204_jpg_be6f667516.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_Getty_Images_2259256580_jpg_e72ea8ddc5.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_supermicro_resized_jpg_95d12828d5.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/Aashika_Suresh_Profile_Picture_jpg_2acd6f446c.webp)

/filters:format(webp)https://st-everywhere-cms-prod.s3.us-east-1.amazonaws.com/large_UWM_resized_f22f7e06b8.jpg)