Advertisement|Remove ads.

3M Stock Rises Pre-Market After Earnings Beat, Retail Gets More Bullish

3M Co. ($MMM) shares surged nearly 5% pre-market on Tuesday after posting strong third-quarter earnings, lifting retail sentiment.

The industrial giant reported net income of $1.37 billion, or $2.48 per share, a sharp turnaround from last year’s loss of $2.08 billion.

On an adjusted basis, 3M earned $1.98 per share, beating analysts’ expectations of $1.90.

The company also slightly raised its full-year guidance, now targeting $7.20-$7.30 in adjusted EPS, up from its prior range of $7.00-$7.30. Revenue reached $6.29 billion, above the consensus estimate of $6.06 billion.

The company’s safety and industrial business grew 0.9% organically, while the transportation and electronics business saw a 2% increase.

However, the consumer segment dipped 0.7%, with softness in packaging and consumer safety partially offset by growth in home improvement.

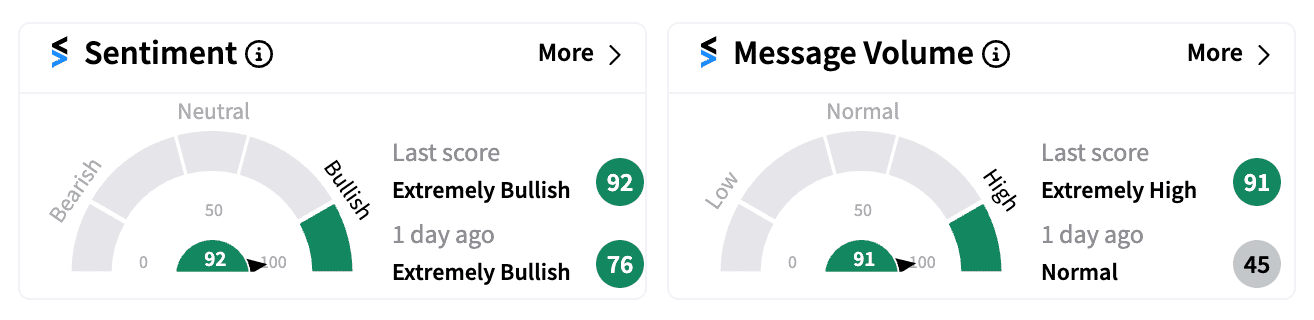

On Stocktwits, retail sentiment climbed deeper into ‘extremely bullish’ territory, with message volume spiking early Tuesday.

3M reportedly benefited from increased demand for electronics in vehicles and mobile phones, despite broader industry struggles from high inflation.

Analysts expect the industrial sector to gain further as consumer spending rebounds following the Federal Reserve’s September rate cuts.

The company has also undergone strategic shifts, cutting jobs and spinning off its healthcare unit to counter slowing demand.

Last week, Mizuho called 3M a “large-cap turning the corner,” with CEO Bill Brown executing a plan that could drive further gains.

MMM shares are up over 45% this year, outpacing the Industrial Select Sector SPDR Fund ($XLI) and broader indices.

For updates and corrections email newsroom@stocktwits.com

Read next: Logitech Stock Drops Pre-Market After In-Line Q2 Revenue: Retail Holds Steady

/filters:format(webp)https://news.stocktwits-cdn.com/large_Getty_Images_2211638677_jpg_6d639f282d.webp)

/filters:format(webp)https://st-everywhere-cms-prod.s3.us-east-1.amazonaws.com/unnamed_jpg_9dff551b50.webp)

/filters:format(webp)https://st-everywhere-cms-prod.s3.us-east-1.amazonaws.com/large_stock_chart_down_94a394e31b.jpg)

/filters:format(webp)https://news.stocktwits-cdn.com/IMG_4530_jpeg_a09abb56e6.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_Getty_Images_491310329_jpg_e91ab647c0.webp)

/filters:format(webp)https://st-everywhere-cms-prod.s3.us-east-1.amazonaws.com/large_asml_logo_resized_a8ba5209aa.jpg)

/filters:format(webp)https://news.stocktwits-cdn.com/shivani_photo_jpg_dd6e01afa4.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_meta_logo_headquarters_original_jpg_d9fbb245f9.webp)

/filters:format(webp)https://st-everywhere-cms-prod.s3.us-east-1.amazonaws.com/Prabhjote_DP_67623a9828.jpg)

/filters:format(webp)https://news.stocktwits-cdn.com/large_bulls_versus_bears_stock_market_jpg_c083ddc168.webp)

/filters:format(webp)https://st-everywhere-cms-prod.s3.us-east-1.amazonaws.com/Rounak_Author_Image_7607005b05.png)