Advertisement|Remove ads.

Logitech Stock Drops Pre-Market After In-Line Q2 Revenue: Retail Holds Steady

Logitech International S.A. ($LOGI) shares dropped nearly 8% pre-market on Tuesday, despite reporting solid second-quarter earnings.

The Swiss tech firm, known for its computer peripherals, posted Q2 earnings per share of $1.20 (vs consensus of $1.11) and revenue of $1.12 billion, matching expectations.

Logitech also raised its full-year revenue forecast to $4.39 billion-$4.47 billion, slightly above the previous range, and lifted its operating income outlook to $720 million-$750 million.

CEO Hanneke Faber attributed the strong performance to “broad-based growth” across regions and categories, as well as innovations launched ahead of the holiday season.

Shares closed up over 3.5% on Monday following the results, but there was some selling pressure early Tuesday.

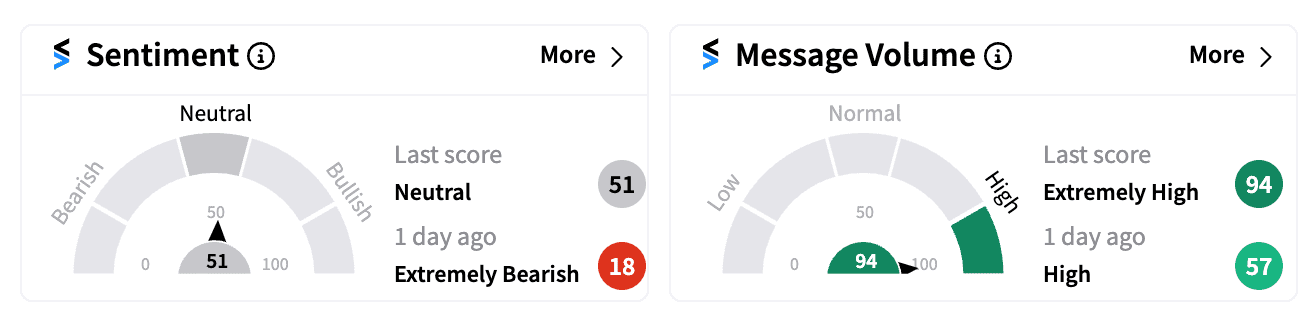

On Stocktwits, retail sentiment was ‘neutral’, with some traders divided after the recent gains.

One user said they cashed out on a short position, while another remained optimistic about a rebound to $90.

Early in its Q2, Logitech reported growth in both business-to-business and consumer categories like gaming.

However, some analysts cautioned that much of this growth came from distributors stocking up for the holiday season, amid concerns about weak demand in China.

Year-to-date, LOGI shares are down nearly 2%, underperforming the S&P 500 and Nasdaq indices.

For updates and corrections email newsroom@stocktwits.com

/filters:format(webp)https://news.stocktwits-cdn.com/large_axis_bank_resized_jpg_55222ac42f.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/IMG_8805_JPG_6768aaedc3.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_hbomax_logo_resized_jpg_31a3f0b392.webp)

/filters:format(webp)https://st-everywhere-cms-prod.s3.us-east-1.amazonaws.com/IMG_9209_1_d9c1acde92.jpeg)

/filters:format(webp)https://news.stocktwits-cdn.com/resized_diwali_bse_picks_jpg_1aab244fa1.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/Revised_Profile_JPG_0e0afdf5e2.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_JBHT_resized_jpg_b59ef84857.webp)

/filters:format(webp)https://st-everywhere-cms-prod.s3.us-east-1.amazonaws.com/Sourasis_Bose_Author_Image_939f0c5061.jpg)

/filters:format(webp)https://news.stocktwits-cdn.com/large_resized_eternal_zomato_jpg_2400eee879.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_nio_jpg_006db9f466.webp)