Advertisement|Remove ads.

52-Week High Watch: Here’s Why SEBI RA Is Backing These Seven Stocks

Several high-performing stocks have surged to or near their 52-week highs, backed by strong fundamentals, steady earnings, and positive sentiment, said SEBI-registered analyst Mayank Singh Chandel.

Hyundai Motor India

Hyundai is just shy of its 52-week high of ₹2,048, having closed at ₹1,996. While Q4 profits dipped slightly, steady revenue growth to ₹17,562 crore in FY25, and strong sales momentum have kept the stock in demand

Chandel noted that its growing EV portfolio, with focus on new launches, is attracting investor attention. The stock has gained 18% in three months and 11% year-to-date.

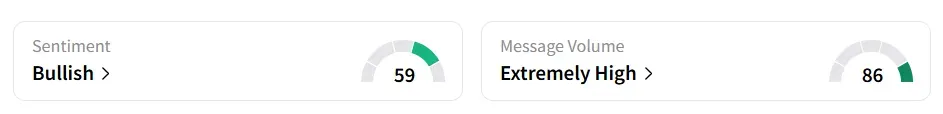

On Stocktwits, retail sentiment turned ‘bullish’ from ‘bearish’ a day earlier, amid ‘extremely high’ message volumes.

Multi Commodity Exchange (MCX)

MCX breached its 52-week high of ₹8,085 on Monday, closing at ₹8,270. It has a 1-year return of 117% and YTD gains of 32%.

The stock is riding high on record trading volumes, with improved profitability at ₹560 crore in FY25, buoyed by positive investor sentiment triggered by tech upgrades and product launches, he added.

Bharti Airtel

At ₹1,935, Airtel is nearly at its 52-week high of ₹1,949. A solid FY25 performance with ₹37,481 crore net profit, driven by higher ARPU and subscriber growth, and digital growth has propelled the stock 36.77% in the past year and 21% YTD.

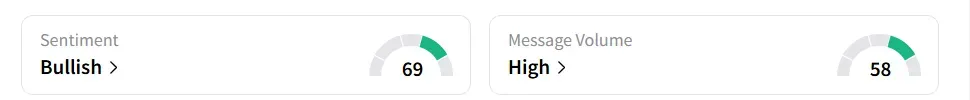

Retail sentiment on Stocktwits remained ‘bullish,’ amid 'high' message volumes.

Bharat Electronics

The stock hit a fresh 52-week high after closing 3.5% higher at ₹421.25 on Monday. A strong order book, revenue of ₹23,022 crore, and support from defence indigenization have boosted confidence, according to Chandel.

YTD, the stock has gained nearly 44%.

Retail sentiment on Stocktwits turned ‘bullish’ from ‘neutral’ a day ago.

Aditya Birla Capital

The stock closed at a fresh 52-week high of ₹264.1. It is riding on diversified growth across lending, insurance, and asset management, and posted a net profit of ₹3,410 crore for FY25.

YTD, the stock was up nearly 49%.

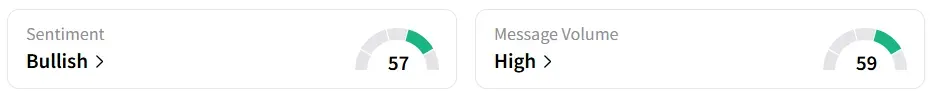

Retail sentiment on Stocktwits turned ‘bullish’ from ‘neutral’ a day ago, amid 'high' message volumes.

Authum Investment & Infrastructure

The stock closed near its 52-week high of ₹2,597 on Monday. A strong rebound in profits (₹4,248 crore) and a robust investment portfolio make it a financial sector standout, Chandel observed.

YTD, the stock has risen 51%.

Max Financial Services (MFSL)

The stock closed at a fresh 52-week high of ₹1,600.1. MFSL benefits from higher premium collections and a strong position in the private life insurance sector.

YTD, it has grown by over 44%.

For updates and corrections, email newsroom[at]stocktwits[dot]com.

/filters:format(webp)https://news.stocktwits-cdn.com/large_Truth_social_5bfbc7389b.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/Anushka_Basu_make_me_smile_in_the_picture_b92832aa_af59_4141_aacc_4180d2241ba8_1_2_png_1086e0ed8c.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_Getty_Images_2221283194_jpg_8178c730a4.webp)

/filters:format(webp)https://st-everywhere-cms-prod.s3.us-east-1.amazonaws.com/large_Morgan_Stanley_HQ_logo_5431c7f2ad.jpg)

/filters:format(webp)https://news.stocktwits-cdn.com/large_Getty_Images_1549425533_jpg_483afd6d69.webp)

/filters:format(webp)https://st-everywhere-cms-prod.s3.us-east-1.amazonaws.com/unnamed_jpg_9dff551b50.webp)

/filters:format(webp)https://st-everywhere-cms-prod.s3.us-east-1.amazonaws.com/large_stock_down_resized_901c19c371.jpg)

/filters:format(webp)https://news.stocktwits-cdn.com/Getty_Images_2235778544_jpg_2b7ceca102.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/Aashika_Suresh_Profile_Picture_jpg_2acd6f446c.webp)