Advertisement|Remove ads.

DoorDash Puts In $3.6B Acquisition Proposal For UK's Deliveroo: Retail Investors See Opportunity

DoorDash (DASH) has made a $3.6-billion acquisition proposal for European peer Deliveroo Holdings Plc (ROO.L), in a bid to increase its presence across the Atlantic.

The American food-delivery major acquired Finnish delivery platform Wolt in an all-stock $8.1-billion deal in 2022. In recent years, it has done about half a dozen acquisitions to bolster its tech and customer base.

DoorDash has offered to pay 180 pence per share, totaling 2.7 billion pounds or about $3.6 billion, for Deliveroo, based on the latter's outstanding shares.

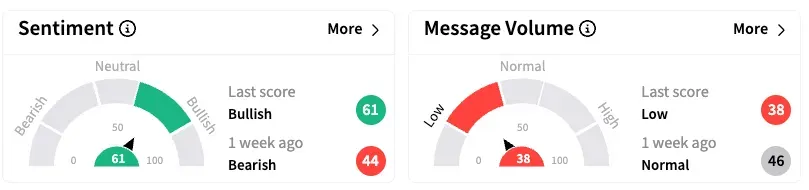

On Stocktwits, sentiment for DoorDash jumped to 'bullish' from 'bearish' a week ago. One user said it was a good opportunity to buy DASH shares.

The offer was made on April 5 and revealed by Deliveroo on the London Stock Exchange last Friday.

DoorDash's U.S.-listed shares rose 0.7% in Friday's after-market trading.

Deliveroo said its board has engaged with DoorDash regarding the offer and provided the San Francisco-based company with due diligence. It said DoorDash will need to make a formal offer by May 23.

The proposal comes in a period of weakness for the target company.

Deliveroo's stock has dropped by almost 50% since its 2021 listing, as the surge in online food delivery demand faded post-pandemic and investors turned their focus to companies with stronger profitability.

In March, Deliveroo revealed plans to withdraw from Hong Kong and sell parts of its business to Delivery Hero's food panda.

Wells Fargo analysts said in a note that they "see (the) deal as growth dilutive to the enterprise (DoorDash) and represents entry into some fiercely competitive, mature delivery markets."

Reuters reported that JPMorgan was acting as DoorDash's advisor on the deal.

DoorDash, whose shares are up 12% year to date, will report first-quarter earnings on May 7.

For updates and corrections, email newsroom[at]stocktwits[dot]com.

/filters:format(webp)https://news.stocktwits-cdn.com/large_Getty_Images_2239226376_jpg_c72fd10c8b.webp)

/filters:format(webp)https://st-everywhere-cms-prod.s3.us-east-1.amazonaws.com/unnamed_jpg_9dff551b50.webp)

/filters:format(webp)https://st-everywhere-cms-prod.s3.us-east-1.amazonaws.com/large_sealsq_stock_market_representative_resized_b05435011f.jpg)

/filters:format(webp)https://news.stocktwits-cdn.com/large_App_Lovin_jpg_42d40549b1.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/jaiveer_jpg_280ad67f36.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_US_economy_representative_image_jpg_88c3aa4736.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/Aashika_Suresh_Profile_Picture_jpg_2acd6f446c.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_trump_canada_jpg_0f117ea8e7.webp)