Advertisement|Remove ads.

AbbVie Reports Upbeat Q1 Earnings, Raises 2025 Earnings Forecast: Retail’s Elated

Shares of AbbVie (ABBV) traded 3% higher on Friday morning after the company reported an upbeat first-quarter (Q1) and raised its full-year earnings guidance.

The pharmaceutical firm reported adjusted diluted earnings per share (EPS) of $2.46, marking a 6.5% year-over-year increase and exceeding an analyst estimate of $ 2.40, according to FinChat data.

Net revenues increased 8.4% YoY to $13.34 billion, and exceeded an analyst estimate of $12.93 billion.

While net revenue from the company’s immunology and neuroscience portfolio increased by over 16% in the three months, revenue from the company’s aesthetics portfolio declined by about 12%. Net revenues from the company’s oncology portfolio rose by about 6%.

The immunology portfolio was the biggest revenue generator in the quarter, accounting for $6.264 billion or nearly 47% of the company’s overall revenue.

The company’s immunology drugs, Skyrizi and Rinvoq, marked significant revenue growth, offsetting a 50.6% decrease in net revenue from its arthritis drug, Humira.

AbbVie also raised its adjusted diluted EPS guidance for the full year 2025 from $11.99 – $12.19 to $12.09 – $12.29. The new guidance is based on the existing trade environment and does not include potential pharmaceutical sector-specific tariffs, the company said.

CEO Robert A. Michael said that Q1 earnings results were “well ahead of our expectations.”

The company is “well-positioned” for the long term, he said, while adding that the fundamentals of the business are “strong.”

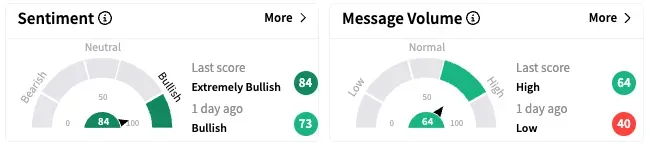

On Stocktwits, retail sentiment around AbbVie rose from ‘bullish’ to ‘extremely bullish’ territory over the past 24 hours while message volume rose from ‘low’ to ‘high’ levels.

ABBV stock is up by nearly 4% so far this year and by over 11% over the past 12 months.

For updates and corrections, email newsroom[at]stocktwits[dot]com

/filters:format(webp)https://news.stocktwits-cdn.com/large_Getty_Images_2259210190_jpg_d48bbe3269.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/Anushka_Basu_make_me_smile_in_the_picture_b92832aa_af59_4141_aacc_4180d2241ba8_1_2_png_1086e0ed8c.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_Getty_Images_1396534113_jpg_b0e09f299b.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_Jane_Street_3ac3fb6443.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_Truth_social_5bfbc7389b.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_Getty_Images_2221283194_jpg_8178c730a4.webp)

/filters:format(webp)https://st-everywhere-cms-prod.s3.us-east-1.amazonaws.com/large_Morgan_Stanley_HQ_logo_5431c7f2ad.jpg)