Advertisement|Remove ads.

Accolade Stock Surges Pre-Market On Upbeat Earnings: Retail Turns Bullish

Accolade Inc.’s ($ACCD) stock surged nearly 18% in Tuesday’s pre-market session after the personalized health care services provider reported strong quarterly earnings, with a 10% jump in revenues, lifting retail sentiment.

Showing better-than-expected performance on containing its losses, its second-quarter (Q2) net loss figure narrowed by 27% to $23.9 million, compared to the year-ago quarter.

Net loss per share declined 30% to $0.30, beating the analysts’ average estimate of $0.44. Revenue stood at $106.4 million, beating analyst estimates of $105 million.

Accolade Chairman and CEO Rajeev Singh said the company is “well positioned” to deliver its first full year of adjusted EBITDA profitability and positive cash flow as it enters the second half.

Steve Barnes, Accolade Chief Financial Officer added its net cash position in the first half, compared to its convertible debt, has improved by more than $20 million, providing the operating leverage and flexibility to execute its strategy.

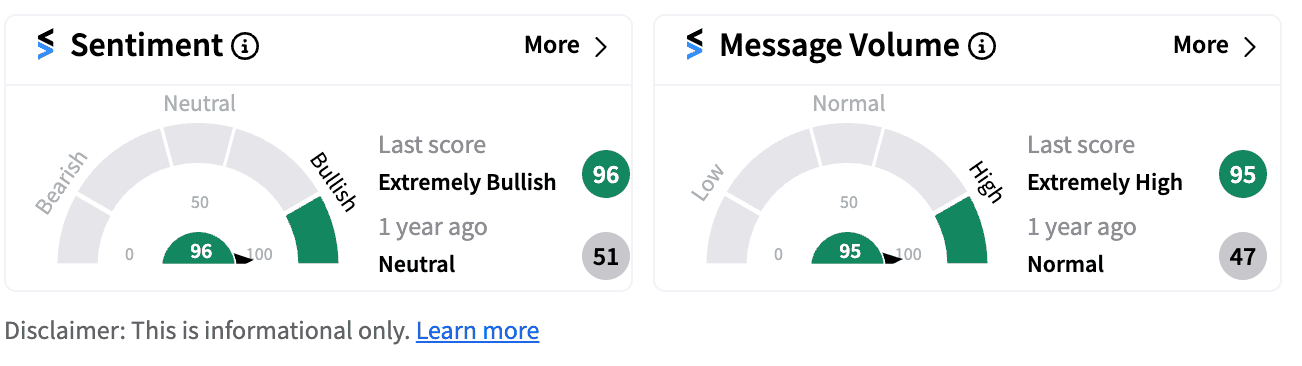

Retail sentiment turned ‘extremely bullish’ (96/100) from ‘neutral’ a year ago following the earnings update.

The company also said it expects third-quarter revenue to be between $104 million and $107 million. For the fiscal year, it predicts revenue to be between $460 million and $475 million.

Year-to-date, the company’s stock is down 67.2%; it saw a high of $14.99 in early January.

For updates and corrections email newsroom@stocktwits.com

/filters:format(webp)https://news.stocktwits-cdn.com/large_Tether_2376a55503.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/Anushka_Basu_make_me_smile_in_the_picture_b92832aa_af59_4141_aacc_4180d2241ba8_1_2_png_1086e0ed8c.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_robert_kiyosaki_d28a01cb4b.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_Bitcoin_and_Ethereum_2b4356b70a.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_Getty_Images_976546456_jpg_42ddd4a81d.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_Getty_Images_2259655311_jpg_20124bbeb9.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_Donald_Trump_451371e34e.webp)