Advertisement|Remove ads.

Accenture Deepens AI Push With Strategic Investment In Lyzr

- Lyzr will join Accenture Ventures’ Project Spotlight to scale its AI capabilities.

- The funding, made through Accenture Ventures, will help both companies collaborate on deploying advanced agentic AI technologies across the banking, insurance, and financial services sectors.

- The move aligns with Accenture’s broader AI-driven restructuring plan aimed at $1 billion in savings.

Accenture Plc (ACN) on Wednesday announced a strategic investment in Lyzr, an artificial intelligence startup specializing in enterprise-grade agent infrastructure.

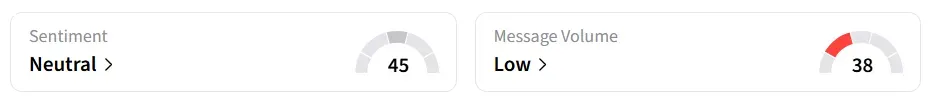

Following the move, Accenture’s stock inched 0.5% higher on Wednesday afternoon. On Stocktwits, retail sentiment around the stock improved to ‘neutral’ from ‘bearish’ territory the previous day amid ‘low’ message volume levels.

A Boost To AI-Driven Automation

The funding, made through Accenture Ventures, will help both companies collaborate on deploying advanced agentic AI technologies across the banking, insurance, and financial services sectors.

Lyzr’s flagship product, Agent Studio, allows both developers and non-technical users to build, train, and manage custom AI agents capable of handling complex workflows.

These agents can automate core business functions such as customer support, claims management, compliance checks, and data analysis.

Ecosystem Expansion

As part of the deal, Lyzr will join Accenture Ventures’ Project Spotlight, which is a vertical accelerator for AI and data companies. Lyzr CEO Siva Surendira said the company’s goal is to help its clients move from experimentation with agentic AI to production and scaling.

“Agentic AI represents the next frontier in financial services firms’ efforts to adopt and scale AI.”

— Kenneth Saldanha, Global Lead, Accenture’s Insurance industry practice

Saldanha added that Lyzr’s platform will help companies create secure, explainable, and compliant AI agents.

The undisclosed investment marks Accenture’s continued push into AI solutions designed to modernize business processes for large enterprises. In its pivot to AI-led operations, Accenture launched a six-month restructuring plan in September that is expected to yield over $1 billion in savings.

Accenture stock has shed over 29% in the last 12 months.

Also See: Apple’s Earnings Could Double By 2030, Says BofA, Ahead Of Q4 Print

For updates and corrections, email newsroom[at]stocktwits[dot]com.

/filters:format(webp)https://news.stocktwits-cdn.com/large_Oil_drill_06147e8349.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/IMG_8805_JPG_6768aaedc3.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_Stock_chart_image_d3ebab70ec.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/IMG_4530_jpeg_a09abb56e6.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_ras_tanura_jpg_b79d6fe085.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/Getty_Images_2202580632_jpg_9b97227b1a.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/Aashika_Suresh_Profile_Picture_jpg_2acd6f446c.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_ACHR_resized_jpg_25097dbec7.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/jaiveer_jpg_280ad67f36.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_Plug_resized_jpg_82cf2f0bcd.webp)