Advertisement|Remove ads.

Apple’s Earnings Could Double By 2030, Says BofA, Ahead Of Q4 Print

- Bank of America cited long-term AI and services growth in Apple.

- Apple hit a $4 trillion market cap as iPhone 17 demand stayed strong.

- Analysts expect fourth-quarter revenue of $101.7 billion and EPS of $1.76.

Apple Inc. (AAPL) received a vote of confidence from Bank of America on Wednesday, which raised its price target on the iPhone maker to $320 from $270 while maintaining a ‘Buy’ rating ahead of the fourth-quarter (Q4) earnings on October 30.

The bank cited stronger long-term growth potential fueled by new products and services, suggesting Apple’s profits could double by 2030, according to a note to clients cited by TheFly.

Long-Term Growth Confidence

Bank of America expressed confidence that Apple’s deepening integration of artificial intelligence and expansion of its services ecosystem position it as a likely “eventual winner” in the tech industry’s AI race.

The firm also said it had rolled forward its valuation model to fiscal 2027, reflecting higher conviction in the company’s earnings trajectory.

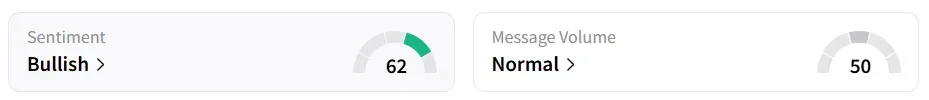

Apple stock inched 0.03% lower on Wednesday afternoon. On Stocktwits, retail sentiment around the stock remained in ‘bullish’ territory amid ‘normal’ message volume levels, over the past day.

Valuation Boost

On Tuesday, Apple reached the milestone of $4 trillion in market capitalisation, joining the ranks of the most valued companies. The demand momentum around iPhone 17 has helped propel the high valuation.

UBS’ Evidence Lab tracked iPhone availability across 30 global markets, showing that average wait times for most models remain steady or slightly lower week over week.

The firm said demand for the Pro and Pro Max versions in the U.S. saw a modest uptick, with the Pro Max’s delivery times running about six days longer year over year.

Analysts expect the tech giant to report a Q4 revenue of $101.7 billion and an earnings per share (EPS) of $1.76, according to Fiscal AI data.

Apple stock has gained over 7% year-to-date and over 15% in the last 12 months.

Also See: Verizon's New CEO Bats For Aggressive Cost Cuts To Fund Investments In Growth: Retail Agrees

For updates and corrections, email newsroom[at]stocktwits[dot]com.

/filters:format(webp)https://news.stocktwits-cdn.com/large_Getty_Images_1813801150_jpg_9e452258fa.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/Anushka_Basu_make_me_smile_in_the_picture_b92832aa_af59_4141_aacc_4180d2241ba8_1_2_png_1086e0ed8c.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_Getty_Images_2190302521_jpg_796f64970e.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_Getty_Images_2194612888_1_jpg_5f7b7f6186.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_Getty_Images_1384896168_jpg_87fab3f04d.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_Getty_Images_2263571605_jpg_f769289486.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_Getty_Images_2233719278_jpg_46dfac21ee.webp)