Advertisement|Remove ads.

Accenture Stock Heads Toward 5th Consecutive Day Of Losses As Wall Street Tempers Q2 Expectations – Retail's Skeptical Too

Accenture shares edged higher in early morning trade on Friday but pared all the gains, heading toward a five-session losing streak. Analysts tempered expectations on the stock ahead of the company’s second-quarter earnings report next week.

According to TheFly, Piper Sandler trimmed its price target on Accenture to $396 from $429 while maintaining an ‘Overweight’ rating.

The brokerage noted that investor sentiment had improved following Accenture’s first-quarter (Q1) results when the company raised its full-year estimates.

However, that optimism has made it more difficult for the company to deliver another upside surprise in the second quarter (Q2), Piper said in a note.

The cautious stance follows a similar move by TD Cowen, which lowered its price target to $394 from $401 on Thursday.

The brokerage expects the consulting giant to post results ahead of the Wall Street consensus but warned of potential variability amid shifting U.S. policy expectations under Trump’s administration.

Despite that, demand trends for Accenture’s services are expected to remain steady, according to TD Cowen’s note to investors.

According to Koyfin, Accenture is projected to report earnings of $2.81 per share on $16.62 billion in revenue for its fiscal second quarter.

Analysts expect the company to report gross profit of $5.17 billion and a net income of $1.76 billion. Meanwhile, book value per share is projected to rise 22.8% year-over-year and 43% sequentially to $52.33.

Analyst sentiment on the stock remains largely positive. The average price target for Accenture sits at $392.42, with 17 out of 26 analysts rating it as a ‘Buy’ or equivalent, while the remaining nine analysts maintain a ‘Hold’ rating.

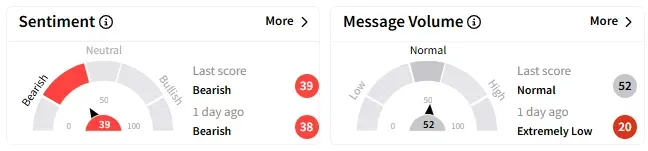

On Stocktwits, retail sentiment around Accenture’s stock improved slightly but remained in ‘bearish’ territory.

Accenture shares have lost more than 16% over the past year, including a decline of over 10% so far in 2025.

For updates and corrections, email newsroom[at]stocktwits[dot]com.

/filters:format(webp)https://st-everywhere-cms-prod.s3.us-east-1.amazonaws.com/large_corning_HQ_resized_jpg_cd127e7be7.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/vivekkrishnanphotography_58_jpg_0e45f66a62.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_amd_jpg_c1e6ad7ae9.webp)

/filters:format(webp)https://st-everywhere-cms-prod.s3.us-east-1.amazonaws.com/Rounak_Author_Image_7607005b05.png)

/filters:format(webp)https://news.stocktwits-cdn.com/large_Trending_stock_resized_may_jpg_bc23339ae7.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_AI_chip_representative_image_jpg_ab73461e0d.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_home_depot_resized_jpg_41f1dc8f5a.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_Getty_Images_2260490321_1_jpg_e83ecbf5cd.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/shivani_photo_jpg_dd6e01afa4.webp)