Advertisement|Remove ads.

ACM Research Sees Retail Chatter Spike Over 500% As Q4 Earnings Blow Past Estimates: Roth MKM Raises Price Target

Shares of ACM Research Inc. (ACMR) surged nearly 21% after the company’s fourth-quarter earnings blew past estimates, with the stock climbing to a 10-month high.

ACM Research reported Q4 earnings per share (EPS) of $0.56, significantly higher than the Wall Street consensus of $0.40. During the same period last year, the company’s EPS stood at $0.43.

The semiconductor company posted revenue of $223.5 million during the quarter, notably higher than the estimated $194.9 million, and surging 31% year-on-year (YoY).

For the full year, ACM Research reported an EPS of $2.26, ahead of $1.85 estimated by analysts. Revenue came in at $782 million for the year, higher than the expected $751 million.

“We gained additional market share by capitalizing on product cycles and deepening engagements with key customers, demonstrating the strength of our multi-product portfolio,” said ACM CEO Dr. David Wang.

He also announced that ACM has commenced operations at its Liangang production facility in China, with capacity expansion planned through the year.

ACM also announced that it achieved process qualification of its thermal and plasma-enhanced atomic layer deposition (ALD) furnace tools at two semiconductor customers in mainland China.

Analysts at Roth MKM were “encouraged” by ACM’s performance, hiking their price target for the stock to $40 from $25 while maintaining their ‘Buy’ rating, according to The Fly. This implies an upside of over 44% from Wednesday’s closing price.

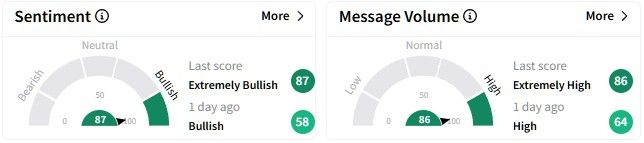

After the company’s Q4 results, retail chatter on Stocktwits surged considerably, rising 571% in the past 24 hours.

Sentiment saw a dramatic improvement, too, entering the ‘extremely bullish’ (79/100) territory from ‘bullish’ a day ago.

ACM’s stock has been on a bull run this year, surging nearly 78% year-to-date (YTD). Its one-year returns are relatively less stellar, with gains of nearly 28%.

For updates and corrections, email newsroom[at]stocktwits[dot]com.

/filters:format(webp)https://news.stocktwits-cdn.com/large_Getty_Images_140648412_jpg_05552b4117.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/Anushka_Basu_make_me_smile_in_the_picture_b92832aa_af59_4141_aacc_4180d2241ba8_1_2_png_1086e0ed8c.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_Getty_Images_912727778_jpg_3bd44c57ad.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_Getty_Images_1235943608_jpg_91702ef0ab.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_Getty_Images_167578473_jpg_29255f031f.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_Michael_Burry_jpg_fa0de6ac92.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_winklevoss_1c7de389e0.webp)