Advertisement|Remove ads.

Nvidia Q4 Earnings Beat Expectations, Jensen Huang Says Blackwell Production Ramped Up On ‘Massive Scale:’ Retail Turns Bullish

AI bellwether Nvidia Corp. (NVDA) delivered a strong performance in the fourth quarter, surpassing Wall Street expectations as its flagship Blackwell chips began contributing to the company’s top and bottom lines.

While Nvidia’s shares gained nearly 3.7% during regular trading hours, ahead of the earnings announcement, the stock fell nearly 1.5% during the after-market hours.

Nvidia reported earnings per share of $0.89, handily beating an estimated $0.85 and rising over 71% year-on-year (YoY). Its revenue reached $39.3 billion in Q4, beating expectations of $38.1 billing and surging 78% YoY.

The company’s beat-and-raise performance resulted in a surge in retail chatter on Stocktwits, with Nvidia emerging as the top trending stock on the platform. Message volume more than tripled in the past 24 hours.

The data center segment drove Nvidia’s Q4 surge. Its revenue nearly doubled year over year to $35.6 billion, growing by 93%.

For the full year, Nvidia’s EPS more than doubled to $2.99 from $1.30. Revenue rose to $130.5 billion from $60.9 billion a year ago.

Talking about the company’s flagship chip, Nvidia CEO Jensen Huang said, “Demand for Blackwell is amazing as reasoning AI adds another scaling law - increasing compute for training makes models smarter and increasing compute for long thinking makes the answer smarter.”

Looking ahead, Nvidia guided for Q1 revenue of $43 billion, plus or minus 2%. This is higher than consensus estimates of $42.05 billion.

“We’ve successfully ramped up the massive-scale production of Blackwell AI supercomputers, achieving billions of dollars in sales in its first quarter,” Huang added.

This aligns with what analysts at Baird observed. In a recent research note, the brokerage observed that GB200 demand is gaining momentum. The brokerage has an ‘Outperform’ rating on the stock with a price target of $195, implying an upside of 49% from Wednesday’s closing price.

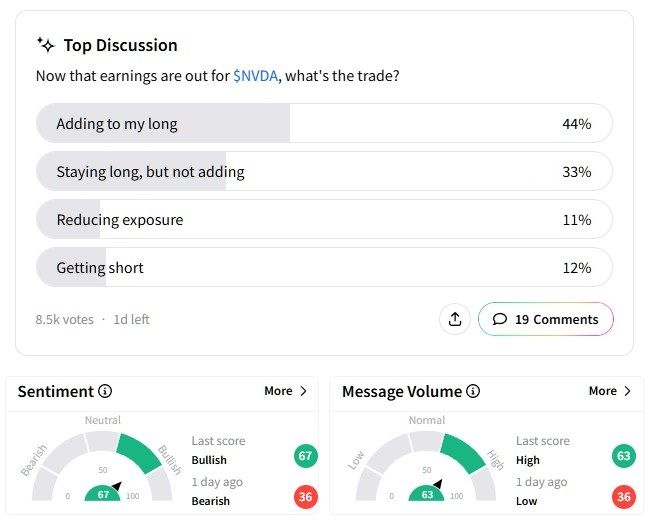

Retail sentiment on Stocktwits around the Nvidia stock flipped to enter the ‘bullish’ (67/100) territory from ‘bearish’ (36/100) a day ago.

In a Stocktwits poll with over 8,500 votes, users expressed a largely bullish outlook – 44% of the respondents said they are adding more long positions, while 33% said they are going to stay long.

On the other hand, 11% said they are reducing exposure to the stock, while 12% said they’re shorting it.

One user expects the stock to surge next week.

Nvidia’s stock has had a rough ride this year so far, falling over 2%. Its returns over the past six months have been muted, too, with gains of just 3.8%.

In contrast, it has gained 66% in the past year.

For updates and corrections, email newsroom[at]stocktwits[dot]com.

/filters:format(webp)https://news.stocktwits-cdn.com/large_Getty_Images_2230137825_jpg_d14459f501.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/jaiveer_jpg_280ad67f36.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_Getty_Images_2217651250_jpg_908ef236f4.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_Getty_Images_2194622714_jpg_c18475d557.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/Aashika_Suresh_Profile_Picture_jpg_2acd6f446c.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_Getty_Images_2199618807_jpg_0e9f26c6c5.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_Getty_Images_2262651778_jpg_54075aa1d9.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_Getty_Images_2246580703_jpg_9700e1e7e8.webp)

/filters:format(webp)https://st-everywhere-cms-prod.s3.us-east-1.amazonaws.com/unnamed_jpg_9dff551b50.webp)