Advertisement|Remove ads.

After 80% Slide This Year, Solidion Draws A Second DOE Grant For Advanced Nuclear Tech

- The latest DOE funding is intended to help scale up manufacturing of an engineered nanomaterial that can act as a corrosion-resistant additive.

- Solidion will partner with the Oak Ridge National Laboratory (ORNL) on this project.

- Solidion also received earlier federal support to advance electrochemical manufacturing methods for high-performance graphite anodes.

After losing more than 80% of its market value this year, Solidion Technology (STI) is getting another vote of confidence from the U.S. government. The company announced a second Department of Energy grant to scale a corrosion-resistant nanomaterial aimed at improving next-generation nuclear reactor systems.

The stock hit its 52-week low in mid-August 2025, followed by a brief rally in October. However, since its October peak, it has steadily lost ground and is now near multi-month lows.

Following the announcement, Solidion stock traded over 7% higher in Monday’s premarket.

Grant Purpose

The latest DOE funding is intended to help scale up manufacturing of an engineered nanomaterial that can act as a corrosion-resistant additive in high-temperature molten salt fluids used for heat transfer in next-generation nuclear systems.

The additive could enhance fluid performance and long-term system reliability.

"Consecutive awards from the Department of Energy is proof positive that Solidion is not only innovative in energy storage, but energy processes, liquids and materials as well."

-Jaymes Winters, CEO, Solidion Technology

Collaboration With National Lab

Solidion will partner with the Oak Ridge National Laboratory (ORNL) on this project, leveraging the lab’s expertise in nuclear materials research to refine the nanofluid technology for industrial application.

The company has recently received a 2025 R&D 100 Award for work in electrochemical graphitization techniques developed with ORNL. Solidion also received earlier federal support to advance electrochemical manufacturing methods for high-performance graphite anodes.

Solidion has also developed a high-capacity, silicon-rich lithium-ion battery anode. Using elastic encapsulation, it protects 45%-95% Si content, extending range by 20%-45%.

What Is Retail Mood On Stocktwits?

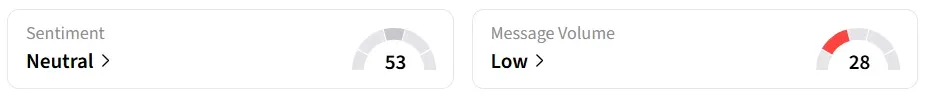

On Stocktwits, retail sentiment around the stock remained in ‘neutral’ territory amid ‘low’ message volume levels.

Also See: DigitalBridge Buyout Buzz Gains Traction – JPMorgan Flags Softbank’s Strategic Fit

For updates and corrections, email newsroom[at]stocktwits[dot]com.

/filters:format(webp)https://news.stocktwits-cdn.com/large_Getty_Images_1549425533_jpg_483afd6d69.webp)

/filters:format(webp)https://st-everywhere-cms-prod.s3.us-east-1.amazonaws.com/unnamed_jpg_9dff551b50.webp)

/filters:format(webp)https://st-everywhere-cms-prod.s3.us-east-1.amazonaws.com/large_stock_down_resized_901c19c371.jpg)

/filters:format(webp)https://news.stocktwits-cdn.com/Getty_Images_2235778544_jpg_2b7ceca102.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/Aashika_Suresh_Profile_Picture_jpg_2acd6f446c.webp)

/filters:format(webp)https://st-everywhere-cms-prod.s3.us-east-1.amazonaws.com/large_hawaiian_electric_resized_4b766fd741.jpg)

/filters:format(webp)https://news.stocktwits-cdn.com/jaiveer_jpg_280ad67f36.webp)

/filters:format(webp)https://st-everywhere-cms-prod.s3.us-east-1.amazonaws.com/large_sealsq_stock_market_representative_resized_b05435011f.jpg)

/filters:format(webp)https://news.stocktwits-cdn.com/large_Getty_Images_2230137825_jpg_d14459f501.webp)