Advertisement|Remove ads.

AI Networking Winner? Arista Surges After Blowout Quarter, Outshining Cisco

- Arista Networks reported Q4 revenue and profit above expectations; Q1 sales view also came in above targets.

- Its peer Cisco reported a day prior; its shares dropped on a weaker-than-expected margin view.

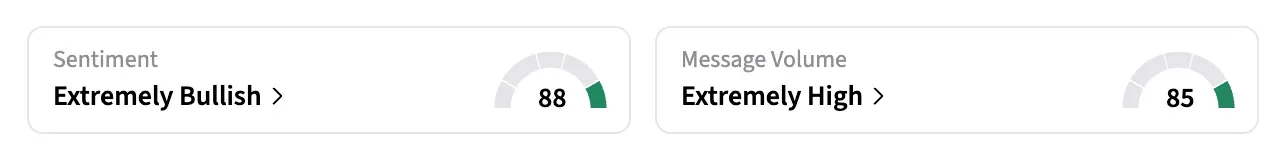

- Stocktwits sentiment for ANET shifted to ‘extremely bullish’ from ‘neutral.’

Arista Networks, Inc. reported fourth-quarter (Q4) revenue and profit, and forecast first-quarter sales above Wall Street’s expectations, driving its shares 12.5% higher in the after-market session on Thursday.

The report stands in contrast to that of its peer, Cisco’s, whose earnings report on Wednesday, while solid on revenue, triggered a sell-off as investors focused on its weaker-than-expected margin guidance.

AI Data Centre Demand Continues To Drive Growth

Networking equipment makers are witnessing a surge in demand from AI-driven data centers, one of the fastest-growing segments of the market, as they realign their product portfolios to better serve this expanding category.

Arista Networks made $0.82 profit, on an adjusted basis, on $2.49 billion of sales – both higher than analysts’ expectations of $0.76 per share profit and $2.38 billion, per FactSet. It reported adjusted net income of just over $1 billion, marking the first time it crossed the billion-dollar mark.

Strong Q1 Outlook Boosts Investor Confidence

The router and switches company forecasts Q1 sales of $2.6 billion and a gross margin between 62% and 63%. Analysts were expecting $2.46 billion in revenue and 63% gross margin.

“2025 was the year of validation of our Arista 2.0 momentum, as we hit the milestone of shipping a cumulative of 150 million ports,” CEO Jayshree Ullal said. "We exceeded both our AI networking and campus expansion goals, delivering profitable growth and revenue of $9 billion."

Contrast With Cisco’s Margin Concerns

Arista’s upbeat report comes a day after Cisco topped its December-quarter revenue targets. Although it raised its 2026 sales outlook, its 66% margin forecast fell short of the expected 68.2%, sending shares lower.

This highlights how investors are closely watching the AI exposure among networking stocks.

Retail Traders Turn Bullish

On Stocktwits, retail sentiment for the ANET shifted to ‘extremely bullish’ as of late Thursday, from ‘neutral’ the previous day, with members posting upbeat comments about the company.

“This earning call is a music to my ears.. what a management. The CEO is so knowledgeable. This is Gold,” said one user.

If ANET’s move holds in Friday’s trading, it would be the stock’s best day since August 2025. Arista Networks shares are up 3% year to date as of their last close.

For updates and corrections, email newsroom[at]stocktwits[dot]com.

Read Next: What Did DraftKings Say About Prediction Markets?

/filters:format(webp)https://news.stocktwits-cdn.com/large_Getty_Images_2229072591_jpg_18a80f859a.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/shivani_photo_jpg_dd6e01afa4.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_Getty_Images_2227931369_jpg_250f28d52d.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/vivekkrishnanphotography_58_jpg_0e45f66a62.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/Getty_Images_2253201649_jpg_ff6c9e331b.webp)

/filters:format(webp)https://st-everywhere-cms-prod.s3.us-east-1.amazonaws.com/Rounak_Author_Image_7607005b05.png)

/filters:format(webp)https://news.stocktwits-cdn.com/large_Getty_Images_2232102203_jpg_175efe6ca4.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_wall_street_resized1_jpg_7f200ce842.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/Getty_Images_2257784104_jpg_4f7b38e8a2.webp)