Advertisement|Remove ads.

What Did DraftKings Say About Prediction Markets?

- DraftKings forecast 2026 revenue below analysts’ expectations, sending its shares down 15% in extended trading.

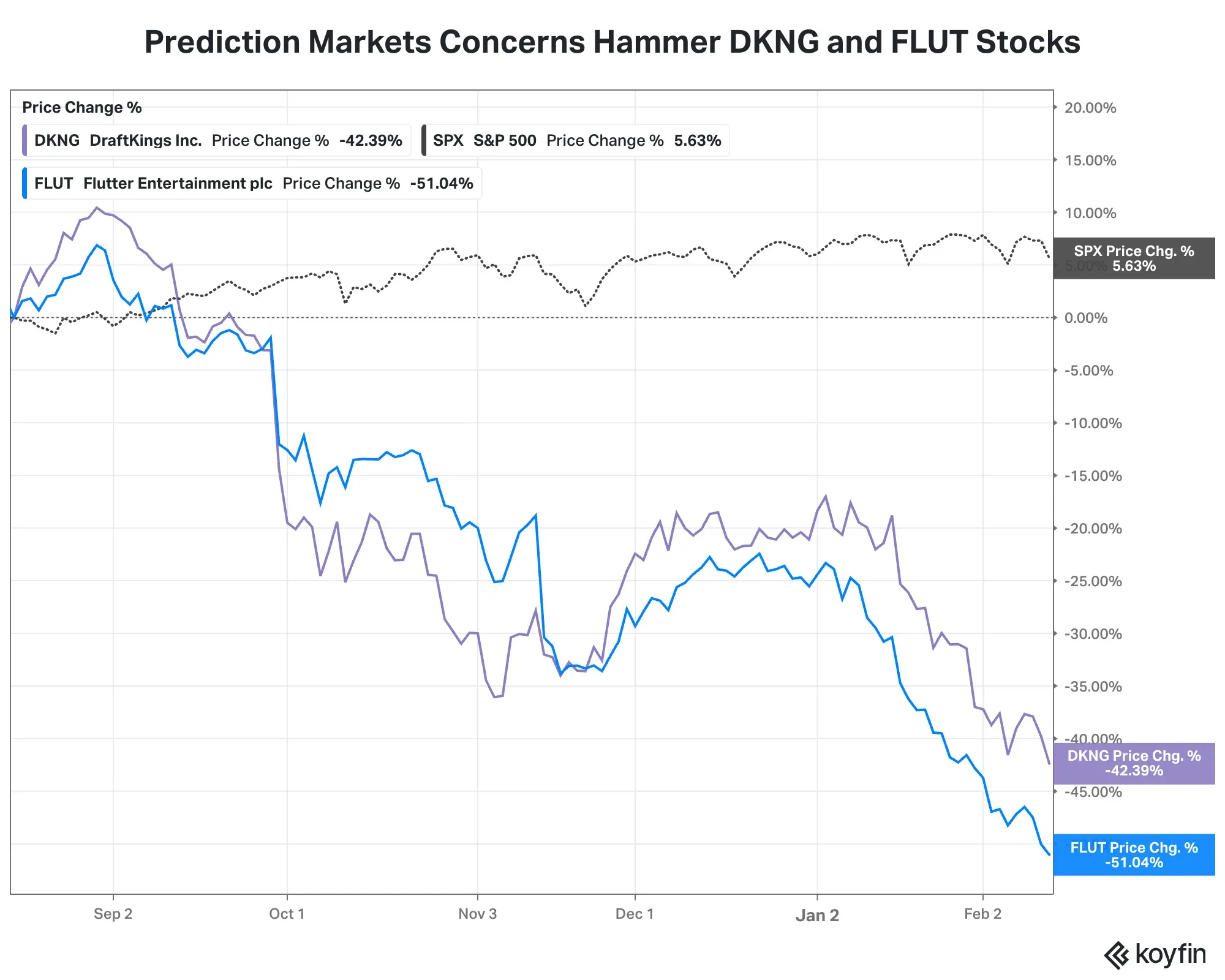

- The rise of prediction market platforms like Polymarket and Kalshi has been an overhang of sports betting firms like DraftKings and Flutter Entertainment.

- Sports betting firms have launched their own prediction market products, with Robins saying DraftKings Predictions will bring in “hundreds of millions in revenue.”

DraftKings (DKNG) on Thursday forecast annual revenue below analysts’ expectations, sending its stock tumbling in extended trading and reviving fears that new prediction market platforms are eating into its core iGaming and sports betting businesses.

Over the past several months, rising traction for Polymarket and Kalshi has weighed on shares of DraftKings and rival Flutter Entertainment. While DraftKings and Flutter’s FanDuel have rolled out their own prediction market production, investors have expressed concern over lingering competition and how the industry would shape up.

Prediction Markets Impact

“Internal and third-party data suggest Predictions impacted our January handle only very slightly and primarily impacted low-margin customers,” DraftKings CEO Jason Robins said in the company's fourth-quarter (Q4) shareholder letter.

Handle refers to the total amount of money wagered (bet) by customers over a specific period. “Consequently, the impact to our revenue has been de minimis,” he said.

The comments mark a slight shift in tone, given that DraftKings has long argued that prediction markets and sportsbetting are fundamentally distinct services, with little scope of cannibalizing users for each other.

Highlighting the company’s newly-launched DraftKings Predictions, Robins said the prediction market industry could be worth $10 billion in the coming years and forecasted “hundreds of millions in annual revenue for DraftKings Predictions in the years ahead.”

He also noted that DraftKings Predictions saw over three times its average trading volume and the second most downloads in its app category during the Super Bowl game last Sunday.

DraftKings shares declined 15.2% in the after-market session on Thursday. Peer Flutter Entertainment’s shares declined 6.3% in response.

Earnings Recap

DraftKings’ Q4 revenue rose 43% to $1.99 billion, in line with estimates from FactSet, per Koyfin. Adjusted profit of $0.36 was below expectations of $0.39.

Monthly active users were flat at 4.8 million, but the average revenue per monthly active user rose 43% to $139. The standout item was the 2026 revenue forecast of $6.5 billion to $6.9 billion, which was significantly below analysts’ target of $7.29 billion.

In an investor note, CFRA Research analysts said, “the slowing rate of legalization in the U.S. over the past 18 months is driving stagnant user growth.”

“With large states like Florida, Texas, and California continuing to hold out, we are unsure where future growth will come from,” they added.

The management is expected to provide more insights on the prediction markets and sportsbook demand at DraftKings’ post-earnings call, scheduled at 8:30 am ET on Friday.

For updates and corrections, email newsroom[at]stocktwits[dot]com.

/filters:format(webp)https://news.stocktwits-cdn.com/Getty_Images_2218181288_jpg_d22b8a81ff.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/vivekkrishnanphotography_58_jpg_0e45f66a62.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_Getty_Images_2243840626_jpg_6a78fa8844.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/shivani_photo_jpg_dd6e01afa4.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_jeff_merkley_jpg_aca807f10f.webp)

/filters:format(webp)https://st-everywhere-cms-prod.s3.us-east-1.amazonaws.com/Rounak_Author_Image_7607005b05.png)

/filters:format(webp)https://st-everywhere-cms-prod.s3.us-east-1.amazonaws.com/large_stock_rising_resized_f17852d7aa.jpg)

/filters:format(webp)https://news.stocktwits-cdn.com/large_Getty_Images_2230437216_jpg_6078a75ee4.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_Getty_Images_2149037439_jpg_ab9f73d5f7.webp)