Advertisement|Remove ads.

Airbnb Scores A 'Buy' Rating From Jefferies On Bookings Growth Potential, But Retail's Holding Back For Now

Shares of Airbnb (ABNB) slipped 3.61% in after-hours trading even as the travel company received an analyst upgrade, but retail sentiment was subdued.

Jefferies analyst John Colantuoni upgraded Airbnb to ‘Buy’ from ‘Hold’ with a price target of $185, up from $165, the Fly reported.

According to the research firm, Airbnb's lodging share gains will be augmented by increased adoption of experiences that it thinks the travel company "is uniquely well positioned to capture."

Additionally, there is an upside in “take rate driven mainly by the launch of sponsored listings,” said the report, citing the analyst firm. The core lodging business alone is worth Airbnb's current value, with major potential in its Experiences segment or take rate, said the report.

According to Jefferies, the company’s spend on Experiences is about $260 billion globally, but only $70 billion includes online bookings, Investing.com reported.

With more online bookings – projected to grow from 28% today to 65% by 2030 – Jefferies expects the company to double its market share in experiences to 6%, adding $8 billion in bookings and $1.6 billion in revenue by 2030, said the Investing report.

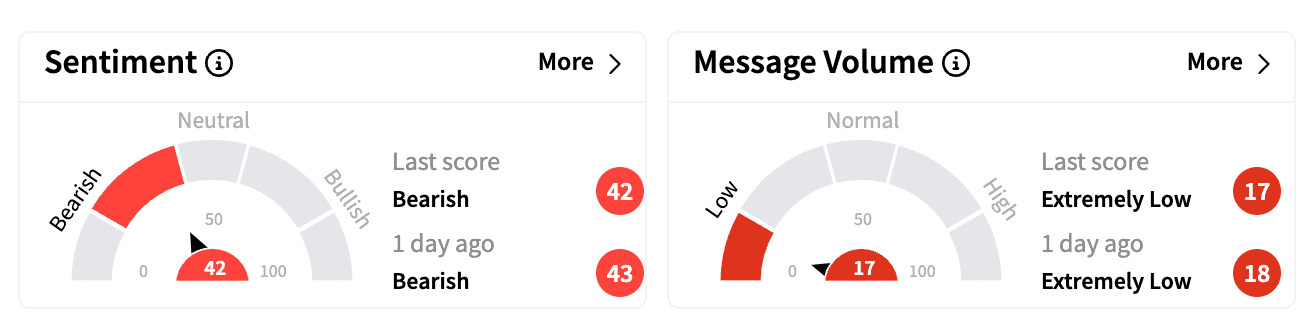

Sentiment on Stocktwits was subdued, however, and ended Monday on a ‘bearish’ note. Message volume was ‘extremely low.’

A skeptical watcher believes the stock will fall further to $100 due to a “big dump.”

Another urged investors to stay focused on the company’s cash flow.

One bullish watcher, however, was looking to invest more in the opportunity to buy the dip and hold long-term.

Airbnb stock is up 0.5% year-to-date.

For updates and corrections, email newsroom[at]stocktwits[dot]com.

/filters:format(webp)https://news.stocktwits-cdn.com/large_Getty_Images_1236271712_jpg_16001d2299.webp)

/filters:format(webp)https://st-everywhere-cms-prod.s3.us-east-1.amazonaws.com/unnamed_jpg_9dff551b50.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_Figma_jpg_4536c33786.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/Aashika_Suresh_Profile_Picture_jpg_2acd6f446c.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_Getty_Images_2219201717_1_jpg_a4257a5acc.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/shivani_photo_jpg_dd6e01afa4.webp)

/filters:format(webp)https://st-everywhere-cms-prod.s3.us-east-1.amazonaws.com/large_Stock_market_Image_public_domain_declining_wc_96197f57d2.jpg)

/filters:format(webp)https://news.stocktwits-cdn.com/vivekkrishnanphotography_58_jpg_0e45f66a62.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_donald_trump_jpg_e07360ccae.webp)

/filters:format(webp)https://st-everywhere-cms-prod.s3.us-east-1.amazonaws.com/Rounak_Author_Image_7607005b05.png)

/filters:format(webp)https://news.stocktwits-cdn.com/large_immunitybio_jpg_eb6402d336.webp)