Advertisement|Remove ads.

Airtel Shares Gain Ahead Of Q1 Earnings: Technicals Hint At Breakout, Says SEBI RA Deepak Pal

Bharti Airtel shares traded nearly 1% higher in early trade, indicating strong buying interest ahead of its Q1 results on Tuesday.

On the technical charts, SEBI-registered analyst Deepak Pal noted that the stock witnessed some profit booking at higher levels last month, causing mild selling pressure.

He believes that Airtel stock remains fundamentally strong, and expectations of positive results may lead to further upside.

Technical Outlook

Technically, it trades near key moving averages of 20, 50, and 100-day Exponential Moving Averages (EMA), reflecting short-term indecision.

Also, the Parabolic SAR has shifted below price candles, showing early signs of bullishness. Its Relative Strength Index (RSI) is at 47.43, suggesting neutral momentum, while MACD remains negative with signs of decreasing bearish strength.

Pal added that if Bharti Airtel sustains above ₹1,920–₹1,935, a rally toward ₹1,975–₹2,000 is possible. Any dip could be an opportunity for fresh buying, though some volatility is expected due to earnings, he said.

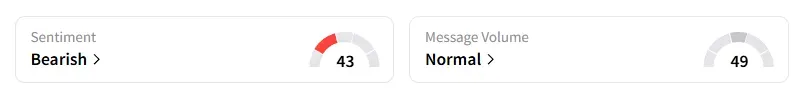

Data on Stocktwits shows that retail sentiment turned ‘bearish’ a day ago.

Airtel Q1 Preview

A largely stable quarter is expected from Bharti Airtel. Nuvama analysts expect 2.6% quarter-on-quarter (QoQ) growth in consolidated revenues, with 4.3% growth for the India business and 2.7% for Africa (QoQ). Meanwhile, analysts at Kotak Equities expect Airtel's consolidated revenue to rise 25.2% YoY.

Among key factors to watch are subscriber additions, ARPUs, and momentum in Africa operations.

Bharti Airtel shares have risen 20% year-to-date (YTD).

For updates and corrections, email newsroom[at]stocktwits[dot]com.

/filters:format(webp)https://st-everywhere-cms-prod.s3.us-east-1.amazonaws.com/large_stock_rising_resized_f17852d7aa.jpg)

/filters:format(webp)https://st-everywhere-cms-prod.s3.us-east-1.amazonaws.com/unnamed_jpg_9dff551b50.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/Getty_Images_2231786698_jpg_4d7b65921f.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/shivani_photo_jpg_dd6e01afa4.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_federal_reserve_jpg_92efa5a8c7.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/Aashika_Suresh_Profile_Picture_jpg_2acd6f446c.webp)

/filters:format(webp)https://st-everywhere-cms-prod.s3.us-east-1.amazonaws.com/large_Visa_resized_82d951e81e.jpg)

/filters:format(webp)https://news.stocktwits-cdn.com/Anushka_Basu_make_me_smile_in_the_picture_b92832aa_af59_4141_aacc_4180d2241ba8_1_2_png_1086e0ed8c.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_Getty_Images_1218279776_jpg_d381694a09.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/vivekkrishnanphotography_58_jpg_0e45f66a62.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_Getty_Images_2199360480_jpg_41abd97106.webp)