Advertisement|Remove ads.

AKA Stock Soars Over 40% After-Hours, Draws Interest From Retail Traders

A.k.a. Brands Holding Corp's stock rose 43% to $14.92 in the after-market session on Monday, the fourth biggest gainer among U.S. equities, garnering interest from Stocktwits members.

Shares had gained 13.4% in the regular session, although there was no apparent trigger for the rally that day.

A.k.a. Brands sells fashion apparel under brands such as Princess Polly, Culture Kings, Petal & Pup, and mnml. It operates both e-commerce and store properties.

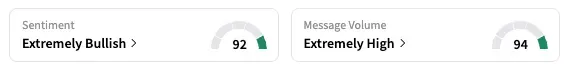

On Stocktwits, the retail sentiment for AKA jumped to 'extremely bullish' (92/100) as of early Tuesday, from 'neutral the previous day, with 24-hour message volume going from 'high' to 'extremely high.'

Several users said they would watch the stock on Tuesday to see if the rally holds before deciding on a position. Notably, the stock has been on a downward trajectory, falling 44% year-to-date.

According to a report in fashion publication Women's Wear Daily on Monday, A.k.a. Brands CEO Ciaran Long appeared on a podcast and spoke about how the company is keeping Gen Z and Millennial buyers engaged.

In August, the company reported a 7.8% increase in its second-quarter net sales, and a 13.7% in U.S. net sales. Subsequently, A.k.a. Brands raised the net sales outlook for the full year.

Currently, three of the five analysts covering the stock have a ‘Hold’ rating, and the rest recommend ‘Buy,’ according to Koyfin’s data. Their average price target is $20.50, implying a 96% upside to the stock’s last close.

For updates and corrections, email newsroom[at]stocktwits[dot]com.

/filters:format(webp)https://news.stocktwits-cdn.com/large_eric_trump_OG_jpg_19bc149869.webp)

/filters:format(webp)https://st-everywhere-cms-prod.s3.us-east-1.amazonaws.com/Prabhjote_DP_67623a9828.jpg)

/filters:format(webp)https://news.stocktwits-cdn.com/large_Palantir_jpg_da95861470.webp)

/filters:format(webp)https://st-everywhere-cms-prod.s3.us-east-1.amazonaws.com/IMG_9209_1_d9c1acde92.jpeg)

/filters:format(webp)https://news.stocktwits-cdn.com/large_Trade_Desk_jpg_e7ed8e2266.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_Getty_Images_2243565350_jpg_6cd80dbe6d.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_capricor_jpg_9f4f8ab098.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/IMG_8805_JPG_6768aaedc3.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_Getty_Images_2233716109_jpg_230d917a7e.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/IMG_4530_jpeg_a09abb56e6.webp)