Advertisement|Remove ads.

Alibaba, Baidu Boost Chinese Stocks In Hong Kong As Nvidia Faces Beijing Clampdown; Huawei's AI Push Adds Pressure

Chinese tech stocks in Hong Kong rose on Thursday, driven by AI-driven momentum in heavyweights such as Baidu and semiconductor companies, drawing fresh attention from U.S. investors.

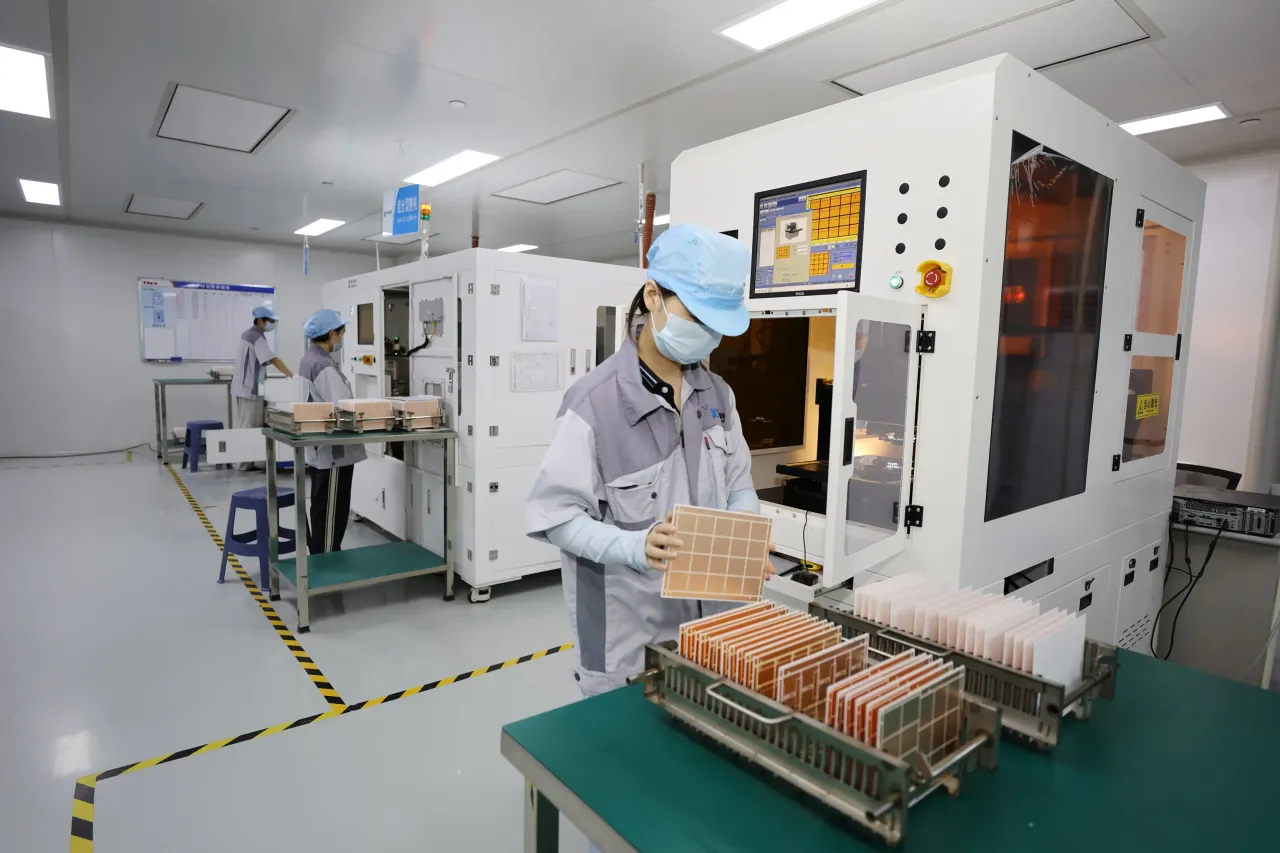

The surge comes after China reportedly ordered top tech firms to halt AI chip purchases from Nvidia and cancel existing orders.

The Hang Seng Tech Index, which tracks the 30 largest HSI-listed technology companies, mainly Chinese internet, fintech, and e-commerce firms, rose as much as 2% to its highest level since November 2021. The day before, the index rose 4.2%.

Chinese chip companies Hua Hong Semiconductor and SMIC saw their shares rise by 13% and 8.3%, respectively. Baidu shares rose 1.7%, while Alibaba shares, which had climbed over 34% in the past month, ended lower.

On Stocktwits, the retail sentiment was 'bullish' for Baidu's U.S.-listed shares, and 'neutral' for Alibaba's U.S.-listed shares, just as U.S. premarket trading on Thursday. BABA and BIDU stocks fell 1.2% in the early minutes.

Analysts said the Nvidia chip sales ban presents an opportunity for Chinese chip companies, according to a Bloomberg report. Alibaba recently won a chip order from China Unicom.

Meanwhile, Huawei added to Nvidia’s pressure on Thursday by unveiling new AI computing systems powered by its in-house Ascend chips and announcing plans to launch its “Atlas 950 SuperCluster” as early as next year.

The Financial Times, which first reported China's latest regulatory action on Wednesday, stated that officials now believe that Chinese AI processors have reached, or even surpassed, the performance levels of the restricted U.S. chips.

For updates and corrections, email newsroom[at]stocktwits[dot]com.

Read Next: Christmas Comes Early: Retailers Rush Holiday Goods Into US Ports To Blunt Hit From Trump Tariffs

/filters:format(webp)https://news.stocktwits-cdn.com/large_Getty_Images_2259210190_jpg_d48bbe3269.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/Anushka_Basu_make_me_smile_in_the_picture_b92832aa_af59_4141_aacc_4180d2241ba8_1_2_png_1086e0ed8c.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_Getty_Images_1396534113_jpg_b0e09f299b.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_Jane_Street_3ac3fb6443.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_Truth_social_5bfbc7389b.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_Getty_Images_2221283194_jpg_8178c730a4.webp)

/filters:format(webp)https://st-everywhere-cms-prod.s3.us-east-1.amazonaws.com/large_Morgan_Stanley_HQ_logo_5431c7f2ad.jpg)