Advertisement|Remove ads.

Align Tech’s Stock Rises On $275M Buyback Plan: Retail Mood Brightens

Shares of medical device manufacturer Align Technology Inc ($ALGN) jumped over 4% on Friday after the firm said it will be repurchasing shares from the open market.

The firm is planning to buy back $275 million of its common stock through open market repurchases under its $1 billion stock repurchase program that was approved by Align's board in January 2023.

Align said the repurchases are expected to be completed by the end of January 2025 and will be funded with its cash on hand. As of Sept. end, Align had approximately 74.8 million shares outstanding and $1.04 billion in cash and cash equivalents.

CFO John Morici said the firm has made strategic investments in technology and scalability to enable a new phase of growth.

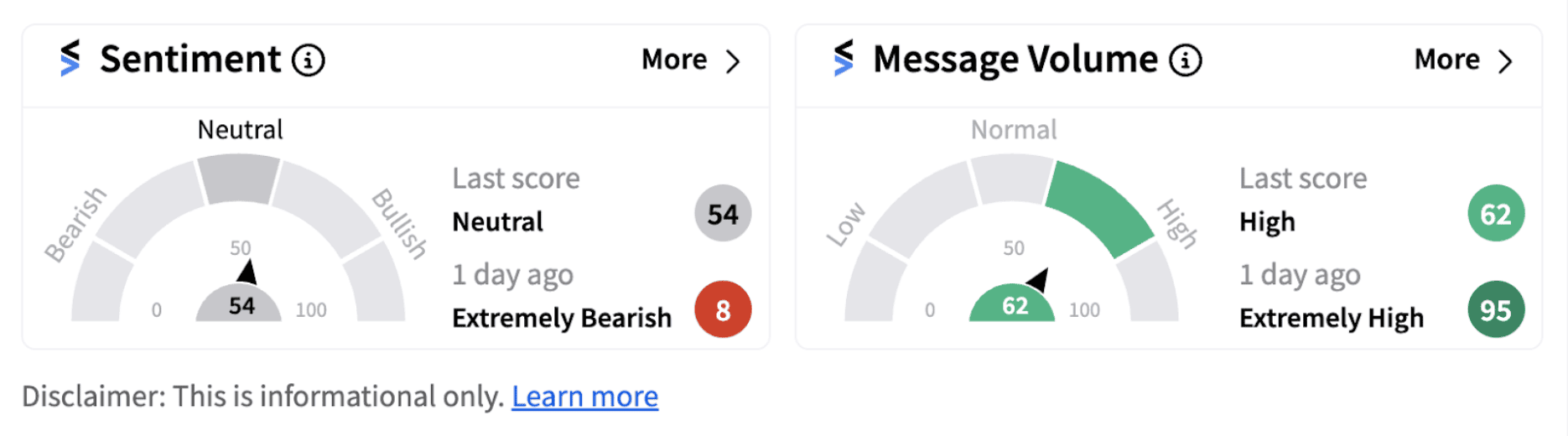

Following the announcement, retail sentiment on Align Technology jumped into the ‘neutral’ territory (54/100) from ‘extremely bearish’ a day ago. The move was accompanied by ‘high’ message volume.

The firm recently announced its third-quarter results. Total revenues rose 1.8% year-over-year (YoY) to $977.9 million. Net income fell 4.5% YoY to $116 million. Align also announced a global restructuring plan during its earnings release that eliminates or transfers identified positions to other locations.

“As part of the restructuring plan, Raj Pudipeddi’s position as executive vice president and managing director of the Americas region and chief marketing officer has been eliminated and he will leave Align in the fourth quarter of 2024,” the firm said.

The company anticipates incurring restructuring charges in the fourth quarter related to severance of approximately $30 million.

Shares of Align are down over 16% on a year-to-date basis.

Also See: Newell Brands Stock Jumps 17% As Firm Raises Full-Year Outlook: Retail’s Skeptical

For updates and corrections email newsroom@stocktwits.com

/filters:format(webp)https://news.stocktwits-cdn.com/Getty_Images_2221559761_jpg_71120b5aaa.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/vivekkrishnanphotography_58_jpg_0e45f66a62.webp)

/filters:format(webp)https://st-everywhere-cms-prod.s3.us-east-1.amazonaws.com/large_Biotech_lab_research_4e46efbd94.jpg)

/filters:format(webp)https://news.stocktwits-cdn.com/shivani_photo_jpg_dd6e01afa4.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_nuburu_jpg_20bd1efa23.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_US_economy_representative_image_jpg_88c3aa4736.webp)

/filters:format(webp)https://st-everywhere-cms-prod.s3.us-east-1.amazonaws.com/Rounak_Author_Image_7607005b05.png)

/filters:format(webp)https://news.stocktwits-cdn.com/large_Getty_Images_2232147544_jpg_6b4f358800.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_Getty_Images_2195701587_jpg_dde6526b92.webp)