Advertisement|Remove ads.

BURU Stock Set To Open At Record Low After Pricing Of Public Offering – Retail Signals Further Downside

- Nuburu said the offering comprises around 58.4 million common shares and 50.7 million pre-funded warrants, priced at $0.11 per share and $0.1099 per warrant.

- The company said gross proceeds will be used to fund its Defense & Security Transformation Plan.

- A major focus will be the rollout of its drone and counter-drone strategy, Nuburu added.

Shares of Nuburu, Inc. (BURU) tumbled about 15% in pre-market trading on Friday after the company announced the pricing of a $12 million public offering to fund its Defense & Security Transformation Plan.

If the pre-market levels hold after the opening bell, BURU shares could crash to their all-time low.

Public Offering At 8% Discount

Nuburu said the offering comprises approximately 58.4 million common shares and 50.7 million pre-funded warrants, priced at $0.11 per common share and $0.1099 per pre-funded warrant. The pricing represents a discount of more than 8% compared with the stock’s closing price of $0.12 on Thursday.

The company also issued common warrants with up to 150% coverage, which could provide additional capital upon exercise.

Proceeds To Support Roll Out Of Drone Technologies

Nuburu expects gross proceeds of about $12 million, with funds primarily earmarked to advance its integrated defense platform and support working capital needs.

A major focus will be the rollout of its drone and counter-drone strategy, including investments in modular drone systems, multi-sensor detection technologies, mobile counter-drone platforms, and directed-energy countermeasures aligned with U.S., NATO, and European defense systems.

The company also plans to develop a field-deployable mobile additive manufacturing system with Maddox Defense for the production of drones, mission pods, and other critical components.

“We are progressing defense mobility initiatives under the Tekne Network Contract framework, advancing next-generation mission-critical infrastructure software capabilities through Orbit, and developing non-kinetic technologies through Lyocon — all within applicable U.S., NATO, and European regulatory frameworks,” said Alessandro Zamboni, Chairman and Co-CEO.

Earlier this week, Nuburu acquired an equity stake in Heckler & Koch AG, a manufacturer of small arms for NATO and allied forces. The financial terms of the deal were not disclosed.

How Did Stocktwits Users React?

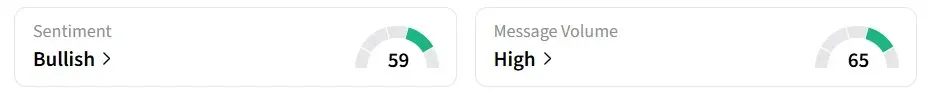

Despite the pre-market decline, retail sentiment on Stocktwits remained ‘bullish’ over the past 24 hours, amid ‘high’ message volumes.

One user expects the stock price to halve.

Another user said they would take up new positions if the stock price drops further.

The stock has declined around 39% so far in 2026.

For updates and corrections, email newsroom[at]stocktwits[dot]com.

/filters:format(webp)https://news.stocktwits-cdn.com/large_altimmune_jpg_8f251e2911.webp)

/filters:format(webp)https://st-everywhere-cms-prod.s3.us-east-1.amazonaws.com/unnamed_jpg_9dff551b50.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_Getty_Images_2229918735_jpg_e905cbd5e3.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/Aashika_Suresh_Profile_Picture_jpg_2acd6f446c.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_Netflix_jpg_ed6fa4554b.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/shivani_photo_jpg_dd6e01afa4.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_paramount_skydance_warner_bros_discovery_jpg_709742214d.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_Broadcom_jpg_f302b01f15.webp)

/filters:format(webp)https://st-everywhere-cms-prod.s3.us-east-1.amazonaws.com/Rounak_Author_Image_7607005b05.png)

/filters:format(webp)https://news.stocktwits-cdn.com/large_new_york_stock_exchange_jpg_e1f85c0d8c.webp)