Advertisement|Remove ads.

All Eyes On Sona BLW's Q4: Analysts Break Down Key Levels To Watch

Sona BLW shares experienced pressure in Wednesday's trade. The stock fell nearly 2% in afternoon trade amid a rangebound trade in Indian equities.

The stock has risen over 7% in the past week, buoyed by strong buying interest. Investors are watching out for its fourth-quarter earnings report, which is due today.

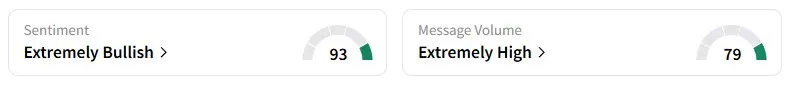

Data on Stocktwits showed retail sentiment remained ‘extremely bullish’ amid significant message volumes.

SEBI-registered analyst Rohit Mehta offered a more nuanced view on Stocktwits.

Mehta notes that significantly reduced debt levels characterize the company’s robust financial profile.

He added that over the past five years, the firm has delivered an impressive 24.4% compound annual growth rate (CAGR) in profits, reflecting consistent operational efficiency.

However, he highlights a notable concern in the 39.2% reduction in promoter holdings over the last three years, which may signal diminished insider confidence or strategic realignments, potentially impacting long-term investor sentiment.

From a technical standpoint, Mehta identified immediate resistance at ₹826.05, followed by a key hurdle at ₹600.25, both critical for sustaining bullish momentum. On the downside, support zones lie at ₹417.90 and ₹393.75.

Meanwhile, Finlight Research highlighted a break above a descending trendline, suggesting a possible shift in price direction.

Still, they cautioned that momentum indicators remain mixed. They advised placing a stop-loss at ₹430, with long-term targets between ₹540 and ₹700.

Sona BLW shares have fallen 19% year-to-date (YTD).

For updates and corrections, email newsroom[at]stocktwits[dot]com.

/filters:format(webp)https://st-everywhere-cms-prod.s3.us-east-1.amazonaws.com/large_eli_lilly_logo_resized_9e8a8a2333.jpg)

/filters:format(webp)https://news.stocktwits-cdn.com/vivekkrishnanphotography_58_jpg_0e45f66a62.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_celsiusholdings_resized_jpg_5617397fa8.webp)

/filters:format(webp)https://st-everywhere-cms-prod.s3.us-east-1.amazonaws.com/Rounak_Author_Image_7607005b05.png)

/filters:format(webp)https://news.stocktwits-cdn.com/large_Ethereum_OG_jpg_d3e6e5843b.webp)

/filters:format(webp)https://st-everywhere-cms-prod.s3.us-east-1.amazonaws.com/Prabhjote_DP_67623a9828.jpg)

/filters:format(webp)https://news.stocktwits-cdn.com/large_Getty_Images_2226817028_jpg_d2fd9156db.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/shivani_photo_jpg_dd6e01afa4.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_elerian_resized_jpg_49303b41ee.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_netflix_paramount_warner_bros_jpg_c959c8a9e4.webp)