Advertisement|Remove ads.

Alphabet Stock In Green After Earnings Top Estimates: Retail Exuberance Continues

Alphabet, Inc. ($GOOG) ($GOOGL) shares climbed over 4% on Wednesday after the company reported third-quarter results that bettered Wall Street’s forecasts.

Mountain View, California-based Alphabet reported quarterly earnings per share of $2.12, up from the $1.55 per share earned a year ago. Revenue rose 15% year-over-year (YoY) to $88.27 billion.

The metrics exceeded the consensus estimates of $1.84 and $86.39 million, respectively.

Google Services, which accounted for roughly 87% of the total revenue, reported 13% revenue growth. Core Search revenue came in at $49.39 billion and YouTube ads fetched $8.92 billion in revenue.

The fastest growth was reported by the Google Cloud business, with revenue climbing 35% to $11.4 billion. The company attributed the strength to accelerated growth in Google Cloud Platform (GCP) across artificial intelligence infrastructure, generative AI solutions and core GGP products.

Operating income of the Google Cloud business skyrocketed 631% to $1.95 billion.

“The momentum across the company is extraordinary. Our commitment to innovation, as well as our long-term focus and investment in AI, are paying off with consumers and partners benefiting from our AI tools,” said Alphabet CEO Sundar Pichai.

The Search business also received a shot in the arm from the company’s new AI features, the company said.

Alphabet-owned video-sharing platform YouTube’s total ads and subscription revenue surpassed $50 billion for the trailing four quarters for the first time ever.

Following the stellar results, Alphabet’s shares snagged a slew of upward price target revisions from Wall Street firms.

Morgan Stanley’s Brian Nowak upped his price target for the stock from $190 to $205, while maintaining an ‘Overweight’ rating. Commenting on the results, the analyst said, “Search showcased durability, YouTube was better than expected and expense discipline shined.”

“GOOGL’s disclosure about multiple emerging products and adoption/engagement/monetization signals should give the market enough confidence in long-term positioning through the Gen AI age,” he added.

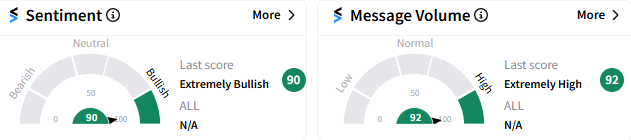

Retail sentiment continued to be “extremely bullish” (90/100), with “extremely high” message volume.

As of 2:55 pm ET, Alphabet’s Class A shares climbed 4.28% to $176.95, retreating from the day’s high of $182, which marked the highest level in over three-and-half months.

For updates and corrections email newsroom@stocktwits.com

/filters:format(webp)https://news.stocktwits-cdn.com/large_WU_Western_Union_dc673aaa7c.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/jaiveer_jpg_280ad67f36.webp)

/filters:format(webp)https://st-everywhere-cms-prod.s3.us-east-1.amazonaws.com/large_Stock_market_Image_public_domain_declining_wc_96197f57d2.jpg)

/filters:format(webp)https://news.stocktwits-cdn.com/vivekkrishnanphotography_58_jpg_0e45f66a62.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_Getty_Images_2149589805_jpg_ceec7778b8.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_Oil_drill_06147e8349.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/Aashika_Suresh_Profile_Picture_jpg_2acd6f446c.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_Coinbase_c429427aa1.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/Anushka_Basu_make_me_smile_in_the_picture_b92832aa_af59_4141_aacc_4180d2241ba8_1_2_png_1086e0ed8c.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_Ford_jpg_186fb0eaa9.webp)

/filters:format(webp)https://st-everywhere-cms-prod.s3.us-east-1.amazonaws.com/unnamed_jpg_9dff551b50.webp)