Advertisement|Remove ads.

Super Micro Stock Loses Nearly A Third Of Its Market Cap After Auditor EY Resigns: Retail Sentiment Nosedives

Super Micro Computer, Inc. ($SMCI) lost nearly a third of its market capitalization on Wednesday after the company disclosed that its auditor Ernst & Young (EY) has resigned.

In an 8-K form filed with the SEC, the company said EY sent a letter to the members of the Audit Committee of its board on Oct. 24 regarding its resignation as SMCI’s registered public accounting firm.

Super Micro, which manufactures servers to power artificial intelligence applications and processes, said the chair of the audit committee has had discussions with EY about the reasons for the resignation. In July, the accounting firm had raised “concerns about several matters relating to governance, transparency and completeness of communications to EY, and other matters pertaining to the company’s internal control over financial reporting.”

EY, which is among the top four global accounting firms, was engaged on March 15, 2023 by Super Micro. The firm resigned while conducting the first audit on the company’s behalf

SMCI said it has begun the process to identify a successor independent public accounting firm.

The San Jose, California-based company said it does not currently expect the developments to result in any restatements of its quarterly reports for the fiscal year 2024 ending June 30, 2024, or for prior fiscal years.

The development assumes all the more importance against the backdrop of a report published by short seller Hindenburg Research that cited “glaring accounting red flags, evidence of undisclosed related party transactions, sanctions and export control failures, and customer issues.”

Subsequently, the company announced a delay in the filing of its annual report. The Nasdaq issued a delisting notice to the company in late-September for the same.

The company, which got added to the S&P 500 Index in March, has scheduled its earnings for Nov. 5.

As of 1:10 pm ET, Super Micro shares were down 32.71% to $33.06. The stock, which was trading in the high-single-digit dollar range in 2022, trended higher in 2023 when the AI revolution began to take a firm grip. The stock took off in a big way from the middle of the year. The rally’s momentum accelerated in 2024 amid the S&P 500 inclusion and Super Micro stock surged to a high of $122.90 in early March.

Despite Wednesday’s plunge, the stock is still in the green for the year-to-date period.

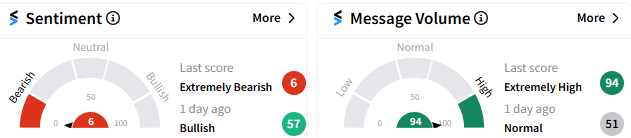

Retail sentiment toward Super Micro stock has hit a rock bottom following the news of EY’s resignation. The sentiment score was at 7/100, suggesting an “extremely bearish” mood, with message volume spiking to “extremely high.”

Messages on Stocktwits platform painted a gloomy outlook for the stock, with some seeing mass exodus out of the stock by pension funds, mutual funds and hedge funds.

For updates and corrections email newsroom@stocktwits.com

/filters:format(webp)https://news.stocktwits-cdn.com/large_Getty_Images_2262606802_1_jpg_86ff244e32.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/IMG_4530_jpeg_a09abb56e6.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/Getty_Images_2250929484_jpg_8206df84ab.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/IMG_8805_JPG_6768aaedc3.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_Getty_Images_2215390052_jpg_84ddd1faac.webp)

/filters:format(webp)https://st-everywhere-cms-prod.s3.us-east-1.amazonaws.com/IMG_9209_1_d9c1acde92.jpeg)

/filters:format(webp)https://news.stocktwits-cdn.com/Getty_Images_2177851484_jpg_b969f68c05.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/Getty_Images_2158238458_jpg_48ab7af27c.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_Rocketlab_resized_jpg_92c1a02a7f.webp)

/filters:format(webp)https://st-everywhere-cms-prod.s3.us-east-1.amazonaws.com/unnamed_jpg_9dff551b50.webp)