Advertisement|Remove ads.

Alphabet Stock Hits Fresh All-Time Highs Today: Raymond James Boosts Price Target To $275

- Alphabet’s Class A shares surged to a record high of $261.68 on Friday.

- Analyst Josh Beck raised the firm’s price target on the shares to $275, citing ad and cloud growth.

- The firm noted that it is "incrementally more bullish" on Google’s search revenue prospects following recent advertising and cloud channel evaluations.

Alphabet, Inc. (GOOG, GOOGL) shares hit fresh all-time highs on Friday on increased optimism ahead of the company’s upcoming third-quarter earnings report.

The firm’s class A stock hit a high of $261.68 on Friday, while the class C shares hit a high of $262.51 at the time of writing.

Raymond James Bats For Growth

On Friday, Raymond James analyst Josh Beck increased the firm’s price target on the stock to $275 from $210 and maintained an ‘Outperform’ rating, according to TheFly.

The firm noted that it is "incrementally more bullish" on Google’s search revenue prospects following recent advertising and cloud channel evaluations. According to Beck, challenges in organic search traffic are prompting advertisers to increase spending on paid search campaigns.

Additionally, integrating Alphabet’s Gemini platform could enhance ad performance, potentially unlocking optimization gains across digital campaigns, he stated.

A recent court ruling largely favored the tech giant in its long-running antitrust battle with the U.S. Department of Justice. The DoJ’s proposal to force Google to divest its Chrome browser and parts of its advertising business was turned down.

Wedbush Securities’ Managing Director Dan Ives had reportedly called the ruling a “massive win” for Google, adding that this removes a “huge overhang” on the stock. He said that this ruling makes the firm more constructive on Google’s Search business in the long term, according to a CNBC report, while setting a new target of $245 for the Alphabet stock.

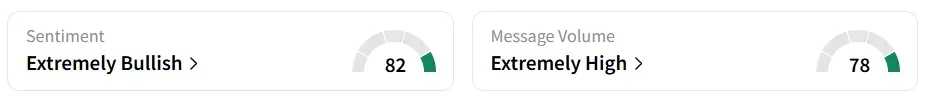

Meanwhile, on Stocktwits, retail sentiment around Alphabet’s Class A stock remained in ‘extremely bullish’ territory amid ‘extremely high’ message volume levels.

The stock saw an 89% increase in user message count over the past month. A bullish Stocktwits user said the shares could hit $370 by the end of 2025.

Google’s Quantum Computing Bet

Google has been drawing investor attention after it announced a new quantum computing algorithm that, when coupled with its Willow chip, can run 13,000 times faster than the world’s fastest supercomputer.

In 2024, Google introduced its quantum processor, Willow, which the company claims addresses a major challenge related to ‘qubits’, quantum computing’s building block.

Alphabet is expected to release its third-quarter (Q3) earnings report on October 29. Analysts expect the company to report earnings per share (EPS) of $2.29 and revenue of $100.01 billion, according to Fiscal AI data.

Alphabet stock has gained 37% in 2025 and over 58% in the last 12 months.

Also See: Why Did NEUP Stock Surge 64% Today?

For updates and corrections, email newsroom[at]stocktwits[dot]com.

/filters:format(webp)https://news.stocktwits-cdn.com/large_Getty_Images_140648412_jpg_05552b4117.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/Anushka_Basu_make_me_smile_in_the_picture_b92832aa_af59_4141_aacc_4180d2241ba8_1_2_png_1086e0ed8c.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_Getty_Images_912727778_jpg_3bd44c57ad.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_Getty_Images_1235943608_jpg_91702ef0ab.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_Getty_Images_167578473_jpg_29255f031f.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_Michael_Burry_jpg_fa0de6ac92.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_winklevoss_1c7de389e0.webp)