Advertisement|Remove ads.

Alphabet Stock Climbs After $4.75B Intersect Buy Signals Power Push For Data Centers

- The deal expands an existing partnership, with joint power and data center projects already under development.

- Intersect will operate independently under CEO Sheldon Kimber while working closely with Google’s infrastructure team.

- Alphabet said the acquisition supports its broader push to scale data center capacity for cloud and AI demand.

Alphabet Inc. (GOOG, GOOGL) shares rose on Monday after the Google parent said it would acquire Intersect for $4.75 billion in cash, plus the assumption of debt, as it moves to secure power and speed up data center development amid surging cloud and AI demand.

At the time of writing, the stock rose 0.4% to $309.96.

The transaction, expected to close in the first half of 2026, builds on an existing relationship between Google and Intersect. Google already holds a minority stake in the company from a previously announced funding round.

Building On Prior Partnership

The acquisition follows a 2024 partnership between Intersect, Google and TPG Rise Climate aimed at delivering gigawatts of renewable power and storage for new U.S. data centers. Intersect said at the time it was targeting about $20 billion in renewable power infrastructure investment by the end of the decade.

The partnership introduced a “power-first” approach to data center development, co-locating data center load with new clean power generation and battery storage to accelerate deployment and reduce strain on the grid. Intersect has already begun financing its first co-located clean energy project, expected to be operational in 2026 and fully completed by 2027.

Alphabet said the Intersect deal includes the company’s team and multiple gigawatts of energy and data center projects that are under development or under construction through its partnership with Google.

Operations And Assets

Intersect will continue to operate as a separate business under its own brand and will be led by founder and CEO Sheldon Kimber, working closely with Google’s technical infrastructure team on joint projects.

Those projects include the companies’ first announced co-located data center and power site under construction in Haskell County.

Alphabet said Intersect’s existing operating assets in Texas and its operating and in-development assets in California are excluded from the transaction and will continue independently with backing from TPG Rise Climate, Climate Adaptive Infrastructure and Greenbelt Capital Partners.

Broader Expansion

The deal adds to Alphabet’s broader push to expand data center capacity globally. Google has outlined large-scale investments in data centers and supporting infrastructure across the U.S., Europe and Asia, alongside efforts to secure reliable power supply through partnerships with utilities and energy developers.

Alphabet has said it expects capital expenditure to be as high as $93 billion in 2025, reflecting the scale of investment required to support cloud computing and AI growth.

How Did Stocktwits Users React?

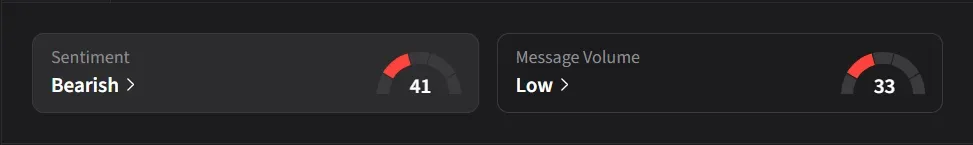

On Stocktwits, retail sentiment for Alphabet was ‘bearish’ amid ‘low’ message volume.

One user said the stock could end the year around $320.

Another user said the $5 billion price tag is small relative to Google’s scale.

Alphabet’s stock has risen 64% so far this year.

For updates and corrections, email newsroom[at]stocktwits[dot]com.

/filters:format(webp)https://news.stocktwits-cdn.com/large_robert_kiyosaki_d28a01cb4b.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/Anushka_Basu_make_me_smile_in_the_picture_b92832aa_af59_4141_aacc_4180d2241ba8_1_2_png_1086e0ed8c.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_Bitcoin_and_Ethereum_2b4356b70a.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_Getty_Images_976546456_jpg_42ddd4a81d.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_Getty_Images_2259655311_jpg_20124bbeb9.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_Donald_Trump_451371e34e.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_Getty_Images_2228736233_jpg_f3ebe80a4c.webp)