Advertisement|Remove ads.

Altimmune Reports Better-Than-Feared Q1 Loss, Secures $100M Credit Facility: Retail’s Pleased

Shares of Altimmune, Inc. (ALT) were in the spotlight on Tuesday morning after the company reported a narrower first-quarter (Q1) loss that was better than Wall Street expectations and secured up to $100 million in credit.

Diluted net loss for the three months ended March 31, 2025, was $0.26 per share, compared to a net loss of $0.34 per share in the same period in 2024, and lower than an estimated loss of $0.34 per share, as per Finchat data.

The company ended the March quarter with cash, cash equivalents, and short-term investments totaling $150 million.

Altimmune also entered into a $100 million credit facility with Hercules Capital on Tuesday, with an initial $15 million tranche funded at closing.

The company said that an additional $25 million is available in 2025 at Altimmune’s option, subject to the achievement of certain clinical and financial milestones.

Altimmune said the remaining $60 million will be available beginning in 2026, with $15 million subject to the achievement of certain clinical and financial milestones and up to $45 million available subject to Hercules's approval.

The company said the credit facility significantly increases Altimmune’s financial strength and flexibility.

CEO Vipin K. Garg said the company is approaching a number of important milestones. In the second quarter, the firm expects to announce data from a phase 2 trial of its investigational therapy, Pemvidutide, in treating metabolic dysfunction-associated steatohepatitis (MASH).

Altimmune also intends to commence phase 2 trials to study pemvidutide in Alcohol Use Disorder (AUD) and Alcohol Liver Disease (ALD) in the second and third quarter of this year, respectively.

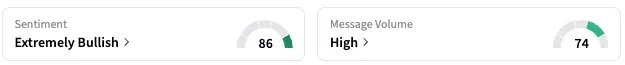

On Stocktwits, retail sentiment around Altimmune jumped from ‘bullish’ to ‘extremely bullish’ territory over the past 24 hours while message volume remained at ‘high’ levels.

ALT stock is down by 21% this year and by over 23% over the past 12 months.

For updates and corrections, email newsroom[at]stocktwits[dot]com.

/filters:format(webp)https://news.stocktwits-cdn.com/large_rolls_royce_jpg_07109534ba.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/IMG_8805_JPG_6768aaedc3.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_winklevoss_1c7de389e0.webp)

/filters:format(webp)https://st-everywhere-cms-prod.s3.us-east-1.amazonaws.com/Prabhjote_DP_67623a9828.jpg)

/filters:format(webp)https://news.stocktwits-cdn.com/large_kraft_heinz_jpg_4db2a61952.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/IMG_4530_jpeg_a09abb56e6.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_immunitybio_stock_jpg_9eab8bde17.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_Getty_Images_2230137825_jpg_d14459f501.webp)

/filters:format(webp)https://st-everywhere-cms-prod.s3.us-east-1.amazonaws.com/IMG_9209_1_d9c1acde92.jpeg)

/filters:format(webp)https://news.stocktwits-cdn.com/large_tom_lee_OG_2_jpg_9ae5c049c3.webp)