Advertisement|Remove ads.

Amazon Narrows Cloud Gap With Microsoft, Google: Stock Soars Toward Best Day In Over 3 Years After Earnings Blowout

- AWS Q3 revenue growth was the highest for the unit in nearly three years.

- Amazon's total revenue in Q3 and its forecast for the current year exceeded expectations.

- The company raises its 2025 capital expenditure estimate to $125 billion and expects it to increase next year.

Amazon.com, Inc. shares surged over 13% in extended trading on Thursday after the tech giant posted robust growth in its cloud business and committed billions more to data center expansion, which investors viewed as proof of the company's unmatched position to capitalize on the AI boom.

Although Amazon Web Services has delivered solid growth in recent quarters, its expansion has lagged rivals such as Microsoft's Azure and Google Cloud, sparking concern among analysts and investors and keeping its stock from breaking out.

AWS Strengths and Why It's Important

Amazon put those fears in the rear-view mirror: AWS's sales rose 20% to $33 billion in the third quarter, beating analysts' $32.42 billion estimate from StreetAccount. The pace of growth was the highest in three years.

"AWS is growing at a pace we haven't seen since 2022," CEO Andy Jassy said in a statement. "We continue to see strong demand in AI and core infrastructure, and we've been focused on accelerating capacity."

That still trails Microsoft Azure's 40% and Google Cloud's 34% growth during the September quarter, but is a significant improvement from its own 17.5% growth rate in the prior three-month period, which made several analysts skeptical.

Jassy added that the power capacity of the AWS data center fleet has doubled since 2022 and is expected to double again by 2027.

AWS contributes just over 15% of Amazon's overall revenue, yet it accounts for about 60% of the company's total operating income.

AI Demand, Investment Show No Signs Of Cooling

Amazon raised its 2025 capital expenditure estimate to $125 billion, up from $118 billion previously, and said the figure is likely to increase next year. Together with similar moves from Meta, Alphabet, and Microsoft, as well as the stellar growth at Azure and Google Cloud last quarter, it is clear that AI demand shows no sign of cooling.

Amazon's stock rose 13.2% in after-market trading following the results. If the move holds in Friday's session, it would be the stock's best performance since February 2022. As of the last close, AMZN stock had gained a mere 1.6% year to date.

What Is Retail's View?

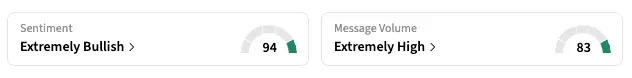

Retail investors cheered Amazon's results, with the ticker trending among the top five symbols late Thursday and sentiment shifting multiple notches higher in the 'extremely bullish' zone (94/100).

"Congratulations for staying the course with $AMZN," a user said, referring to the stock weakness this year, which had frustrated many investors. Notably, after a sharp rally over the past 10 days, many investors cashed out on Thursday (the stock dropped 3.2% in the regular session) just ahead of the results.

"This has been the only lagger MAG7. It's time to catch up," another user said.

Strong Revenue

For the third quarter, Amazon's total sales rose 13% to $180.2 billion, beating an estimate of $177.8 billion compiled by Bloomberg. E-commerce sales rose 10% to $67.4 billion, while advertising sales rose 24% to $17.7 billion.

Amazon projected total net sales of $206 billion to $213 billion for the fourth quarter, the key holiday shopping period, compared with a $208.12 billion estimate from Reuters/LSEG.

For updates and corrections, email newsroom[at]stocktwits[dot]com.

/filters:format(webp)https://news.stocktwits-cdn.com/Getty_Images_2202580632_jpg_9b97227b1a.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/Aashika_Suresh_Profile_Picture_jpg_2acd6f446c.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_ACHR_resized_jpg_25097dbec7.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/jaiveer_jpg_280ad67f36.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_Plug_resized_jpg_82cf2f0bcd.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/astspacemobile_resized_jpg_8a6aa92413.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_Getty_Images_2231279747_jpg_9150b71435.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/Getty_Images_2250929484_jpg_8206df84ab.webp)