Advertisement|Remove ads.

Amazon’s New Grocery Strategy Sends CART, DASH, UBER, KR Shares Lower — BofA Calls Plan 'Simpler And Less Costly'

- Amazon announced on Tuesday that it will be shutting down Amazon Go and Amazon Fresh stores, to shift focus to expand more successful formats.

- BofA said that Wall Street had long questioned if Amazon would enter a major investment cycle to support its grocery ambitions, but its latest announcement suggests a shift in its strategy.

- Mizuho said in a note to investors that Amazon’s announcement is raising concerns around competitive intensity, particularly in urban markets, and exerting pressure on grocery stocks.

Bank of America (BAC) said Amazon.com Inc. (AMZN) is making a simpler and less costly shift in its grocery strategy with its latest announcement.

Amazon announced earlier on Tuesday that it will be shutting down Amazon Go and Amazon Fresh stores, and instead shift focus to expand its fast delivery services, increase Whole Foods Market locations, and adjust its physical store footprint.

The bank said that while Amazon will continue to test new store formats, the announcement signals growing confidence in the company’s current strategy and opportunity for category growth, according to TheFly.

Shares of AMZN climbed 2.5% on Tuesday morning. Meanwhile, other grocery stocks were down after the announcement.

Instacart (CART) shares fell over 6% at the time of writing, while Kroger Co. (K) stock was down over 2.5%. DoorDash Inc. (DASH) shares declined almost 1%, Uber Technologies (UBER) fell 0.6%, and Walmart Inc. (WMT) slipped over 0.5%.

Grocery Ambitions

BofA said that Wall Street had long questioned if Amazon would enter a major investment cycle to support its grocery ambitions, but its latest announcement suggests a shift in its strategy.

The firm has a ‘Buy’ rating on Amazon shares with a price target of $286, representing an upside of about 17% from current price levels.

Meanwhile, Mizuho said in a note to investors that Amazon’s grocery strategy shift is raising concerns around competitive intensity, particularly in urban markets, and exerting pressure on grocery stocks.

According to TheFly, the analyst said that Walmart appeared to be most exposed in the near-term, while Costco Wholesale (COST) should see limited impact due to its bulk-focused model and lower dependence on online groceries.

How Did Stocktwits Users React?

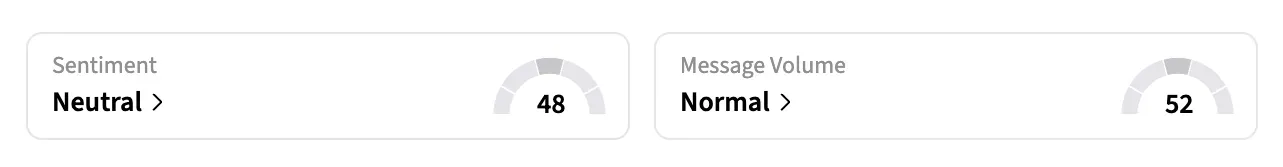

On Stocktwits, retail sentiment around AMZN shares remained in the neutral territory over the past day amid ‘normal’ message volumes.

Shares of AMZN have gained almost 4% in the past year.

For updates and corrections, email newsroom[at]stocktwits[dot]com.

Also Read: What Jim Cramer Thinks Is A Big Part Of Nvidia’s Appeal

/filters:format(webp)https://news.stocktwits-cdn.com/large_Getty_Images_2227347123_jpg_b7a8c29717.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/IMG_4530_jpeg_a09abb56e6.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_immunitybio_jpg_eb6402d336.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/IMG_8805_JPG_6768aaedc3.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_Getty_Images_1236199359_jpg_28b0018e3a.webp)

/filters:format(webp)https://st-everywhere-cms-prod.s3.us-east-1.amazonaws.com/IMG_9209_1_d9c1acde92.jpeg)

/filters:format(webp)https://news.stocktwits-cdn.com/large_Getty_Images_2199401088_jpg_656c1eacd4.webp)

/filters:format(webp)https://st-everywhere-cms-prod.s3.us-east-1.amazonaws.com/large_wall_street_sign_resized_f75f6c0a63.jpg)

/filters:format(webp)https://news.stocktwits-cdn.com/large_tesla_fsd_jpg_e90331e6a6.webp)

/filters:format(webp)https://st-everywhere-cms-prod.s3.us-east-1.amazonaws.com/unnamed_jpg_9dff551b50.webp)