Advertisement|Remove ads.

What Jim Cramer Thinks Is A Big Part Of Nvidia’s Appeal

- Cramer said in a post on X that compute was important to go to the next level, and that was Nvidia’s major appeal.

- He added that investors are starting to recognize that Nvidia combines compute, storage, and strong partnerships, even as its partners work on developing their own chips.

- On Monday, Nvidia announced an investment of $2 billion in CoreWeave Inc. (CRWV) to speed up efforts to add over 5 gigawatts (GW) of AI computing capacity by 2030.

CNBC’s Mad Money host and former hedge fund manager Jim Cramer thinks one of the most appealing factors about Nvidia Corp. (NVDA) is its compute business.

In a post on X, Cramer said, “You need COMPUTE to go to the next level and that's a huge part of Nvidia's appeal.”

“I think people are beginning to realize that Nvidia has storage and has compute and has great partners, even if they are all trying to develop their own chips,” the American TV host said in the post.

Nvidia’s Investments

On Monday, Nvidia announced an investment of $2 billion in CoreWeave Inc. (CRWV) to speed up efforts to add over 5 gigawatts (GW) of AI computing capacity by 2030, extending a previous partnership between the two companies.

As part of the deal, Nvidia and Coreweave intend to build AI factories, or data centers, that would employ the chipmaker’s technology, and address the growing demand for AI compute power.

The world’s most valuable company and a big driver of the AI boom, Nvidia has been investing heavily in the industry, including investments in its own customers.

In November last year, Anthropic announced a deal to tap up to one gigawatt of Nvidia-powered compute infrastructure under a $30 billion capacity deal, while Nvidia committed to investing up to $10 billion in the company.

The semiconductor manufacturer also made strategic investments in Elon Musk’s xAI and ChatGPT-maker OpenAI last year.

Cramer’s Other Nvidia Takes

In a separate post, Cramer said on Monday that while the market’s focus appears to be on storage suppliers with shortages, Nvidia is the one driving the need for more storage.

“It's almost as if there is a cabal that says just by the shortage companies not the ones who are creating the need for more storage. The company that is driving the need for more storage in (is) Nvidia,” Cramer said in the post.

After the CoreWeave deal announcement, Cramer said in a post on X that it would be a good day to buy Nvidia stock for those who don’t already own it.

He also clarified in a separate post that while he believed Nvidia stock may not "act" well, the company is doing extremely well, adding that he remains “steadfast that you should own not trade the stock!!!!!”

How Did Stocktwits Users React?

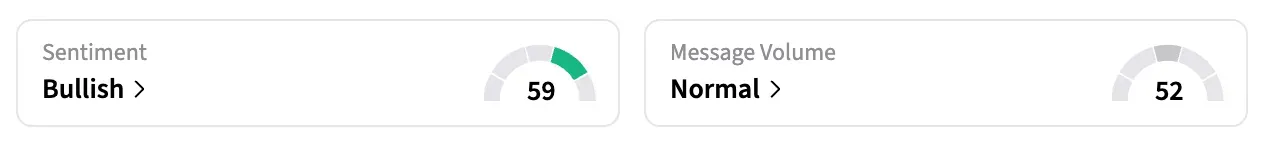

On Stocktwits, retail sentiment around NVDA stock stayed in the ‘bullish’ territory over the past day amid ‘normal’ message volumes.

Shares of NVDA have climbed over 60% in the past year.

For updates and corrections, email newsroom[at]stocktwits[dot]com.

Also Read: CoreWeave Gets Wall Street Upgrade As AI Demand Builds

/filters:format(webp)https://news.stocktwits-cdn.com/large_Opendoor_Technologies_jpg_177252e1f8.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/Aashika_Suresh_Profile_Picture_jpg_2acd6f446c.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_Getty_Images_2246131051_jpg_78a656bc06.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/vivekkrishnanphotography_58_jpg_0e45f66a62.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_lucid_gravity_jpg_173d7fb4ec.webp)

/filters:format(webp)https://st-everywhere-cms-prod.s3.us-east-1.amazonaws.com/unnamed_jpg_9dff551b50.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/Getty_Images_2250240969_jpg_dd9be8c5ea.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/shivani_photo_jpg_dd6e01afa4.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_Trump_jpg_4a30f2c834.webp)

/filters:format(webp)https://st-everywhere-cms-prod.s3.us-east-1.amazonaws.com/Rounak_Author_Image_7607005b05.png)

/filters:format(webp)https://news.stocktwits-cdn.com/large_donald_trump_tariffs_chart_jpg_9309f5e523.webp)