Advertisement. Remove ads.

Amazon Q3 Earnings Preview: Investors Eye AWS, E-commerce Performance

Amazon.com Inc. ($AMZN) shares rose slightly over 1% in midday trading on Wednesday, as the tech giant prepares to report its earnings after the market closes on Thursday.

According to Stocktwits data, Wall Street anticipates Amazon will announce revenue of $157.28 billion and earnings of $1.14 per share.

The stock is under coverage by 51 analysts and brokerages, with 24 rating it a ‘Buy’ and 8 designating it as ‘Outperform.’

On Monday, UBS raised its price target on Amazon from $220 to $223 while maintaining a ‘Buy’ rating on the stock. The brokerage believes that any potential short-term challenges to profit margins from content and initiatives like Project Kuiper are already factored into the stock price.

BMO Capital also sees growth potential, noting that Amazon is optimizing its operations in the second half of 2024 and increasing adoption of its Bedrock platform.

However, BMO cautioned that consumer spending trends could affect results, as strong back-to-school spending may be offset by declines in beauty, electronics, and home goods.

The main focus of the earnings will be Amazon Web Services (AWS), which is the fastest-growing division of Amazon. In the previous quarter, AWS experienced a 19% increase in sales year-over-year, securing a majority 31% share of the market, outpacing Microsoft Azure at 25% and Google Cloud at 11%.

Although Amazon maintains a strong foothold in the cloud market at present, analysts are closely monitoring for indicators of ongoing growth due to fierce competition from these two major players.

The market will also be monitoring the performance of Amazon's core e-commerce business, which represented 82% of the company's total revenue in the last quarter. With rising competition from other online marketplaces and escalating economic uncertainties over the past three months, its growth trajectory will be scrutinized.

Analysts expect the tech giant’s profits to fall compared to the last quarter but rise from a year ago.

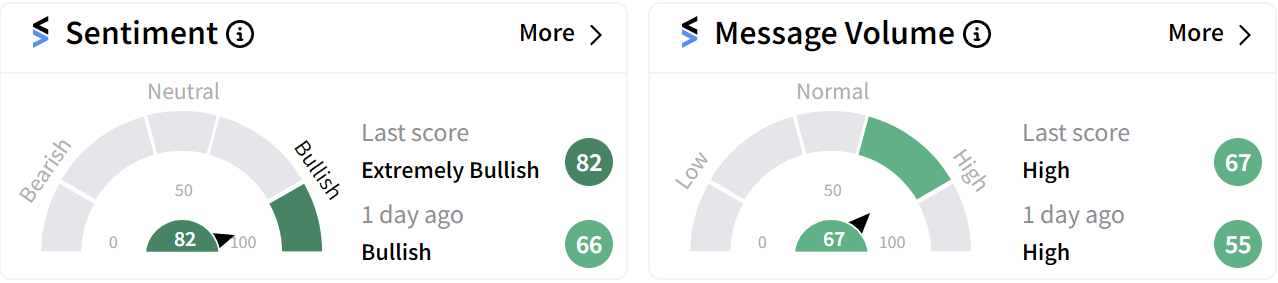

Retail sentiment on Stocktwits has nudged into the ‘extremely bullish’ (82/100) zone with consistently ‘high’ (67/100) message volume in the run-up to its earnings on Thursday.

With the buzz around artificial intelligence (AI) driving stock movements, investors and industry observers will also be looking for updates about the company’s roadmap for future AI initiatives and expected returns.

Amazon has heavily invested in AI research and development, launching a variety of AI-powered features across its product lines, including AWS, Alexa, Amazon Go, and Amazon Prime Video over the last few quarters.

The stock has gained 29% so far in 2024.

For updates and corrections email newsroom@stocktwits.com.

/filters:format(webp)https://news.stocktwits-cdn.com/byd_logo_resized_jpg_dd5d854acb.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/IMG_8805_JPG_6768aaedc3.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_Getty_Images_2218899763_jpg_5d8b51f97d.webp)

/filters:format(webp)https://st-everywhere-cms-prod.s3.us-east-1.amazonaws.com/Sourasis_Bose_Author_Image_939f0c5061.jpg)

/filters:format(webp)https://news.stocktwits-cdn.com/large_Getty_Images_2199468966_1_jpg_2dec686ad6.webp)

/filters:format(webp)https://st-everywhere-cms-prod.s3.us-east-1.amazonaws.com/IMG_9209_1_d9c1acde92.jpeg)

/filters:format(webp)https://news.stocktwits-cdn.com/large_Oracle_jpg_697ba9b96d.webp)

/filters:format(webp)https://st-everywhere-cms-prod.s3.us-east-1.amazonaws.com/shanthi_v2_compressed_98c13b83cf.png)

/filters:format(webp)https://news.stocktwits-cdn.com/large_hims_stock_logo_resized_jpg_5554a2a2c1.webp)

/filters:format(webp)https://images.cnbctv18.com/uploads/2023/12/pharma.jpeg)

/filters:format(webp)https://st-everywhere-cms-prod.s3.us-east-1.amazonaws.com/cnbctv18logo.png)