Advertisement|Remove ads.

Amazon’s Extended Prime Day Starts This Week — Analysts Expect Another Bumper Sales Haul

Amazon's Prime Day, its key annual sale event, kicks off in 24 countries on Tuesday, with shoppers keeping their bank cards ready to grab deals on electronics, clothes, and everyday essentials.

The sale will run for four days through June 11, double the duration of the Prime Day event in the last six years. This year's 618 shopping festival, China's largest mid-year shopping festival, also ran for a week longer than its typical one-month span.

In an earlier press release, Amazon said it is offering deals in 35 categories and the lowest prices for products from brands including Sony, Dyson, and Living Proof. Discounts are also available on Amazon's private label electronics, such as Alexa speakers and the Kindle e-readers, as well as groceries, back-to-school essentials, and various Amazon subscription products.

At the sale, Amazon is also heavily promoting its AI tools: shopping assistant Rufus, AI product recommendation tool Interests, and the latest AI-powered Shopping Guides.

Prime Day is one of the most crucial annual events for Amazon. Shoppers spent $14.2 billion in the two-day sale last year, 11% higher than the previous year, according to Adobe Analytics.

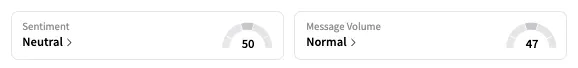

On Stocktwits, the retail sentiment for AMZN shifted to 'neutral' from 'bullish' the previous day. Amazon shares are up 1.8% year-to-date.

JPMorgan predicts a 10% sales increase in this year Prime Day, the investment bank said in a note last week. The 10% increase refers year-over-year growth each day in first-party, third-party, and physical stores relative to Prime Day 2024 during the four-day event.

Meanwhile, analysts remain upbeat about Amazon's recovery in its core markets. Truist expects the company to deliver a stronger-than-expected second quarter, fueled by a resilient North American consumer — largely unaffected by macroeconomic headwinds or tariffs — and supported by favorable foreign exchange gains amid a weakening U.S. dollar.

For updates and corrections, email newsroom[at]stocktwits[dot]com.

/filters:format(webp)https://news.stocktwits-cdn.com/large_ethereum_blue_original_jpg_b6e7cc57f6.webp)

/filters:format(webp)https://st-everywhere-cms-prod.s3.us-east-1.amazonaws.com/Prabhjote_DP_67623a9828.jpg)

/filters:format(webp)https://news.stocktwits-cdn.com/large_Novo_Nordisk_jpg_96dd19f953.webp)

/filters:format(webp)https://st-everywhere-cms-prod.s3.us-east-1.amazonaws.com/Rounak_Author_Image_7607005b05.png)

/filters:format(webp)https://st-everywhere-cms-prod.s3.us-east-1.amazonaws.com/large_microstrategy_michael_saylor_resized_9fd19e69ec.jpg)

/filters:format(webp)https://news.stocktwits-cdn.com/large_Getty_Images_2262651778_jpg_54075aa1d9.webp)

/filters:format(webp)https://st-everywhere-cms-prod.s3.us-east-1.amazonaws.com/IMG_9209_1_d9c1acde92.jpeg)

/filters:format(webp)https://st-everywhere-cms-prod.s3.us-east-1.amazonaws.com/large_ibm_signage_mwc_resized_28f91e1a63.jpg)

/filters:format(webp)https://news.stocktwits-cdn.com/large_circle_stablecoins_original_jpg_b238d12be8.webp)