Advertisement|Remove ads.

Samsara Stock Rises After Hours As Big-Customer Wins Power A Strong Q3 Beat And Higher Outlook

- Revenue and adjusted earnings both came in ahead of analyst expectations.

- Recurring revenue growth accelerated, supported by record net new ARR and customer additions.

- The company lifted its full-year earnings and revenue forecasts and issued stronger fourth-quarter guidance.

Shares of Samsara Inc. (IOT) rose 0.4% after-hours on Thursday after the firm topped Q3 estimates and raised its full-year outlook, helped by its biggest quarter yet for large-customer additions.

The stock closed the regular session up 4.4%.

Q3 Earnings Review

The company reported Q3 revenue of $416 million, ahead of analyst estimates of $399.01 million. Adjusted earnings came in at $0.15 per share, compared with $0.12 expected, marking the company’s first quarter of GAAP profitability.

Samsara closed the quarter with $1.75 billion in annualized recurring revenue (ARR) and added another $105 million in net new ARR, marking a quarterly record.

The firm also lifted its full-year adjusted earnings outlook to the range of $0.50–$0.51, up from $0.45–$0.47, and raised its revenue forecast to $1.595–$1.597 billion from $1.574–$1.578 billion, compared with consensus of $1.58 billion.

For the fourth quarter, Samsara projected revenue of $421–$423 million, compared with analyst expectations of $419.2 million, and forecast adjusted earnings of $0.12–$0.13 per share, in line with the $0.12 consensus.

Growth Drivers

Samsara said it added 219 customers with more than $100,000 in recurring revenue during the quarter, the most it has added in a single period. Another 17 customers crossed the $1 million ARR threshold.

The company said 20% of new annual contract value came from products launched over the past year, including AI Multicam, Asset Maintenance, Asset Tags, Connected Training and Connected Workflows. It cited deployments by a large U.S. mechanical contractor, the State of New York, a global oilfield services provider, a major media corporation and Cadent in the UK.

Stocktwits Traders Expect Big Move After Conference Call

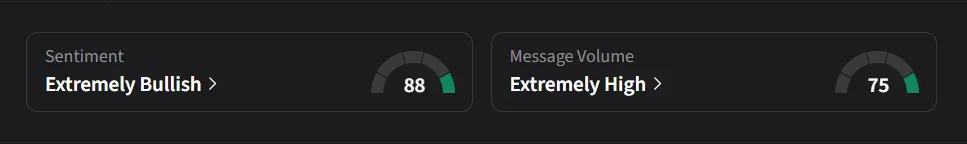

On Stocktwits, retail sentiment for Samsara was ‘extremely bullish’ amid ‘extremely high’ message volume.

One user said the stock often moves after the conference call rather than in after-hours trading, arguing that higher-volume institutional buying typically drives the next day’s reaction.

Another user called the earnings a “a super solid report. Huge steps towards Gaap profitability.”

Samsara’s stock fell nearly 7% so far this year.

For updates and corrections, email newsroom[at]stocktwits[dot]com.

/filters:format(webp)https://news.stocktwits-cdn.com/large_tesla_fsd_jpg_f113fd1ea5.webp)

/filters:format(webp)https://st-everywhere-cms-prod.s3.us-east-1.amazonaws.com/unnamed_jpg_9dff551b50.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_Getty_Images_2212147411_jpg_a8bf4473f2.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_Getty_Images_2230137825_jpg_d14459f501.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/Aashika_Suresh_Profile_Picture_jpg_2acd6f446c.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_brian_armstrong_OG_jpg_3ac8291bf2.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/jaiveer_jpg_280ad67f36.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/Getty_Images_2227994915_jpg_357c625963.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_paramount_skydance_warner_bros_discovery_jpg_709742214d.webp)