Advertisement|Remove ads.

Amazon’s Retail Followers Lean Bearish Even As Tech Giant Gets Third-Party Private Label Lawsuit Dismissed

Shares of Amazon.com (AMZN) fell more than 1% on Tuesday, even as the e-commerce giant received a favorable outcome from a Federal Trade Commission case involving third-party sellers, with retail sentiment downbeat.

According to a Reuters report, a U.S. judge dismissed a lawsuit that accused the company of using an algorithm that would make its private-label products appear cheaper than other merchandise.

The court found no "compelling and particularized facts" that Amazon management had covered up any bias towards its own products, said the report.

The suit had also reportedly alleged Amazon concealed the overexpansion of its infrastructure and fulfillment network, which led to its stock plummeting in April 2022 and resulting in its first quarterly loss since 2015, added the report.

The dismissal by the U.S. District Judge John Chun in Seattle “was with prejudice,” preventing the suit to be slapped again, added the report.

Separately, Amazon is suing the U.S. Consumer Product Safety Commission over the agency's mandate that the company recalls potentially hazardous products sold by other sellers on its platform.

According to the government agency, Amazon would need to recall more than 400,000 products, such as faulty carbon monoxide detectors and children's sleepwear that violated federal flammability standards.

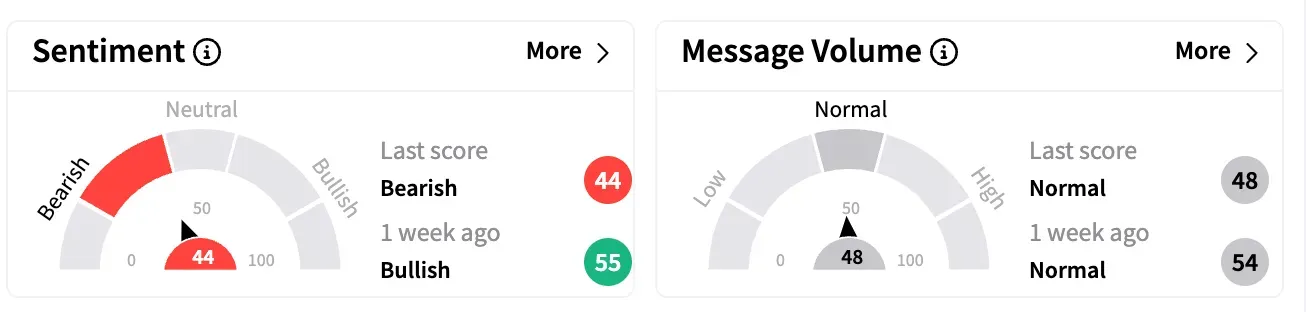

Despite the lawsuit relief, sentiment on Stocktwits ended Tuesday in the bearish zone compared to bullish a week ago. Message volume was in the normal range.

One watcher said the company’s retail business is threatened by tariffs.

However, one bullish watcher suggested the stock was going through short-term pain and would be back at $240 soon.

Amazon stock is down 12% year-to-date.

For updates and corrections, email newsroom[at]stocktwits[dot]com.

/filters:format(webp)https://news.stocktwits-cdn.com/large_Getty_Images_1236271712_jpg_16001d2299.webp)

/filters:format(webp)https://st-everywhere-cms-prod.s3.us-east-1.amazonaws.com/unnamed_jpg_9dff551b50.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_Figma_jpg_4536c33786.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/Aashika_Suresh_Profile_Picture_jpg_2acd6f446c.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_Getty_Images_2219201717_1_jpg_a4257a5acc.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/shivani_photo_jpg_dd6e01afa4.webp)

/filters:format(webp)https://st-everywhere-cms-prod.s3.us-east-1.amazonaws.com/large_Stock_market_Image_public_domain_declining_wc_96197f57d2.jpg)

/filters:format(webp)https://news.stocktwits-cdn.com/vivekkrishnanphotography_58_jpg_0e45f66a62.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_donald_trump_jpg_e07360ccae.webp)

/filters:format(webp)https://st-everywhere-cms-prod.s3.us-east-1.amazonaws.com/Rounak_Author_Image_7607005b05.png)

/filters:format(webp)https://news.stocktwits-cdn.com/large_immunitybio_jpg_eb6402d336.webp)