Advertisement|Remove ads.

Amazon Stock In Focus Ahead Of Q4 Earnings As Retail Investors Bank On Strong Holiday Sales, Watch For Cloud Updates

Shares of Amazon.com Inc. ($AMZN) rose nearly 0.7% in pre-market trading on Thursday ahead of the retail giant’s fourth-quarter earnings, lifting retail sentiment.

Amazon is among the first major retailers to report earnings and has already reported a record holiday shopping season. Wall Street and investors are keen on learning about the performance of its cloud business segment which has been on the forefront of several artificial intelligence initiatives. Several US tech giants focused on AI have come under pressure in the wake of Chinese startup DeepSeek’s growing popularity in recent weeks.

Wall Street analysts expect the company to post earnings per share of $1.49 on revenues of $187.31 billion, according to Stocktwits data. Amazon reported an EPS beat four times out of the past four quarters. Its revenues missed estimates once in the same four quarters.

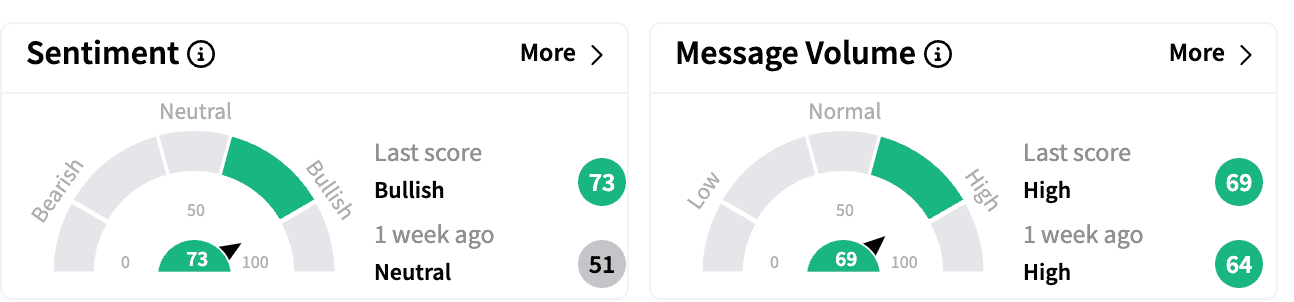

Sentiment on Stocktwits turned ‘bullish’ from ‘neutral’ a week ago. Message volumes have continued to be in the ‘high’ zone.

Earlier this week, Benchmark raised the price target on Amazon.com to $265 from $215 with a ‘Buy’ rating ahead of what it estimates "should be another share-gaining, strong 4Q24 earnings on Thursday after the close," Fly.com reported.

According to the firm, the long-term trajectory for Amazon is strong despite some concern about "extremely elevated sentiment" and significant sell-side enthusiasm around its trajectory for operating income margins, added the report.

Recently, Wedbush also raised the firm's price target to $280 from $260 with an ‘Outperform’ rating ahead of the Q4 report, Fly.com said. The firm cited the retailer’s "strong" holiday season in the U.S. and its continued efficiency gains in its core retail business. Wedbush upped its Q4 operating income estimate to $20.7 billion from $19.9 billion and believes Amazon is poised to outperform expectations again in 2025.

Amazon stock is up 7.6% year-to-date.

For updates and corrections, email newsroom[at]stocktwits[dot]com.

/filters:format(webp)https://news.stocktwits-cdn.com/large_Getty_Images_1813801150_jpg_9e452258fa.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/Anushka_Basu_make_me_smile_in_the_picture_b92832aa_af59_4141_aacc_4180d2241ba8_1_2_png_1086e0ed8c.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_Getty_Images_2190302521_jpg_796f64970e.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_Getty_Images_2194612888_1_jpg_5f7b7f6186.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_Getty_Images_1384896168_jpg_87fab3f04d.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_Getty_Images_2263571605_jpg_f769289486.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_Getty_Images_2233719278_jpg_46dfac21ee.webp)