Advertisement|Remove ads.

AMC Entertainment Stock Dips After Firm Discloses 50M Share Sale Plan: Retail’s Still Bullish But Disappointment Rampant

Shares of AMC Entertainment Holdings Inc (AMC), the largest theatrical exhibitor in the US, slid over 8% on Friday after the firm disclosed in an SEC filing that it intends to sell 50 million Class A common stock.

Goldman Sachs will act as the sales agent and forward seller.

AMC said it intends to use the net proceeds to strengthen its balance sheet and reinvest in its core business to elevate and differentiate the movie-going experience under its AMC GO Plan, announced in November.

Under the plan, AMC expects to invest between $1 billion and $1.5 billion over the next four to seven years in expanding locations across the U.S. and Europe.

It said investments under the AMC GO Plan include seating, sight, and sound enhancements, including an increase in the number of branded premium large-format screens.

Meanwhile, the company also said it intends to bolster its liquidity and repay, redeem or refinance its existing debt.

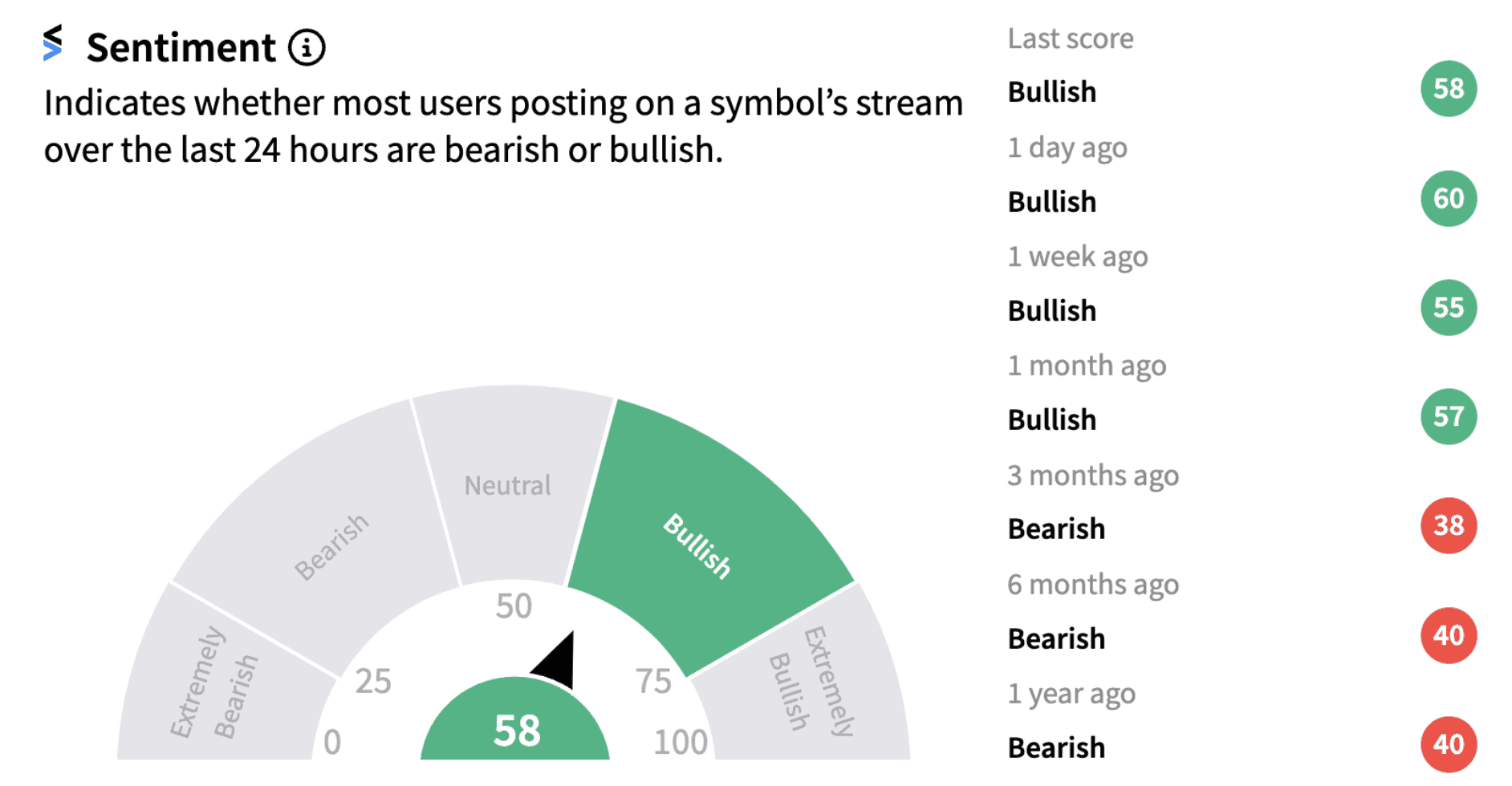

Despite the decline in stock price following the share sale announcement, retail sentiment on Stocktwits continued to trend in the ‘bullish’ territory (58/100), accompanied by ‘extremely high’ message volumes.

Retail chatter on Stocktwits, however, indicated a pessimistic view of the stock, with many users expressing frustration over a potential dilution.

Despite the prevailing pessimism, recent disclosures by the firm on the holiday season attendance were positive.

AMC said that based on attendance at its U.S. theaters, it saw record numbers across pre-Thanksgiving Wednesday, Thanksgiving Day, and Black Friday, resulting in the busiest five-day Thanksgiving holiday period in its 104-year history.

It said moviegoers were drawn to AMC and ODEON by several popular new films, including Moana 2's opening weekend, and strong holdovers from Wicked, Gladiator II, and Red One.

Meanwhile, shares of AMC have lost nearly 23% since the beginning of the year. Going forward, investors will keenly eye the outcome of the firm’s GO Plan.

For updates and corrections, email newsroom[at]stocktwits[dot]com.

/filters:format(webp)https://news.stocktwits-cdn.com/large_Getty_Images_2254648547_jpg_a843db78b6.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/Anushka_Basu_make_me_smile_in_the_picture_b92832aa_af59_4141_aacc_4180d2241ba8_1_2_png_1086e0ed8c.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_Getty_Images_1000648682_jpg_6aa61e3574.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_Getty_Images_2259602028_jpg_5b1a490e64.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_Getty_Images_2259775985_jpg_a06a1e88c3.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_dogecoin_OG_2_jpg_304df31f25.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_vitalik_buterin_OG_jpg_7ac8ea93fe.webp)