Advertisement|Remove ads.

AMC’s Retail Sentiment Bearish As Q2 Report Nears: Movie Magic Fading?

AMC Entertainment Holdings (AMC) is set to unveil its Q2 earnings after market close on Friday. Neither Wall Street nor the stock’s retail investor base seems optimistic about the results.

The company has endured a challenging year, impacted by the 2023 actors' and writers' strikes, which significantly curtailed movie releases.

Consequently, AMC projected a year-over-year revenue decline of 23.50% for Q2. However, the company also hinted at improved profitability, forecasting a narrower-than-expected loss per share.

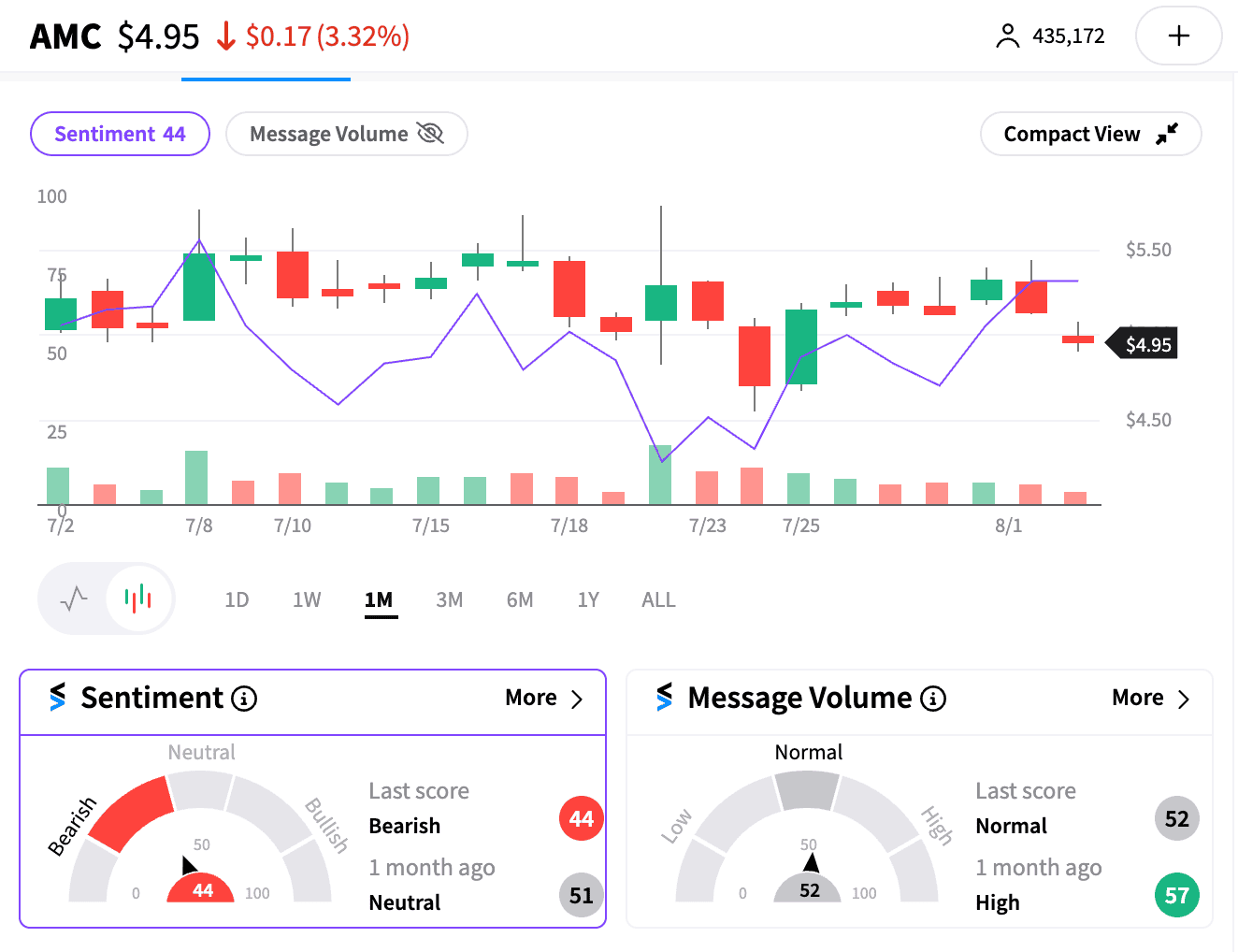

On Stocktwits, retail sentiment for the stock has improved since it released preliminary numbers, but it remains bearish (44/100) hours before earnings results are due.

The recent smashing success of films like "Deadpool & Wolverine" has boosted attendance, and the company's recent debt restructuring deal has injected a degree of optimism.

However, AMC, a known “meme stock” that has experienced a great deal of volatility this year alongside GameStop, has lost nearly 19% of its valuation in 2024.

The decision to release Q2 earnings after market close on a Friday adds an element of uncertainty, and could amplify market reactions due to speculation over the weekend. Retail investors may already be hinting at signs of things to come.

/filters:format(webp)https://news.stocktwits-cdn.com/large_Getty_Images_2212184506_jpg_fda8936683.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/shivani_photo_jpg_dd6e01afa4.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_Novo_Nordisk_jpg_96dd19f953.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/vivekkrishnanphotography_58_jpg_0e45f66a62.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/Getty_Images_1485519874_1_jpg_82b28a6517.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_Bitcoin_Red_OG_jpg_d64521f99a.webp)

/filters:format(webp)https://st-everywhere-cms-prod.s3.us-east-1.amazonaws.com/Prabhjote_DP_67623a9828.jpg)

/filters:format(webp)https://news.stocktwits-cdn.com/large_crowdstrike_resized_jpg_ae45d5de0e.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_Getty_Images_2234227546_jpg_b7fa546ca4.webp)

/filters:format(webp)https://st-everywhere-cms-prod.s3.us-east-1.amazonaws.com/Rounak_Author_Image_7607005b05.png)